Buckle (NYSE: BKE) reported comparable store sales and net revenues for the month (and first quarter) which exceeded market expectations. However, performance remained less than ideal as both metrics continued to decline and the recent trend of incremental improvements deteriorated as a result. Nonetheless, we expect the company’s outperformance of sales expectations will allow the company to exceed current annual earnings projections, which appear somewhat low and continue to incorporate higher erosion in revenues. The significant increase in share valuation over the last nine months, however, reflects much of the potential for rising earnings estimates.

Comparable Store Sales Performance

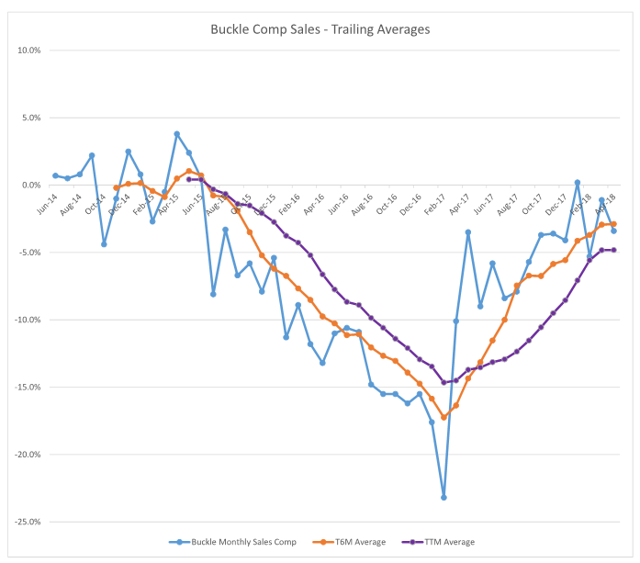

The decline in monthly comparable store sales performance for April didn’t reflect a continuation of the company’s performance over the balance of the first quarter. The decline was, in fact, enough to flatten the trailing average trend, as reflected in the following chart:

Source: Buckle Financial Reports

The apparent loss of momentum on the trailing average comparable store sales metrics is somewhat concerning as it was one of the factors that supported our view that the company was turning around the core business. A flattening of the trend doesn’t change that perspective – stabilization is the first step – but we’d have preferred to see a continuation of the momentum into mildly positive comparable store sales through the summer and into the critical fall period. We’re less inclined to believe the company can achieve those results – in fact, our projection for the balance of the year is for net revenues to decline between 1% and 3%.

Clearly, Buckle has made significant progress over the last year, but still has significant work ahead to remake the business into a growth engine.

Earnings

We continue to believe that current consensus earnings estimates represent an overly pessimistic view of comparable store sales performance and net revenue performance over the coming year. Indeed, our internal projections suggest net income of $2.00-$2.10 per share which incorporates ongoing revenue weakness. The higher end of our estimate range assumes the possibility of positive comparable store performance at the tail end of the year. In either case, our analysis suggests the company’s sensitivity to revenue changes is relatively mild while significant earnings outperformance would require a meaningful improvement in either (or both of) gross or operating margins.

The company will soon report first-quarter earnings (scheduled for May 25) and a positive outcome exceeding current estimates could provide an additional boost to the shares. The company does not provide forward earnings guidance so the focus should be on gross and operating margins to assess the company’s incremental improvement in performance. The gross margin improvement in the prior quarter drove the company’s ability to exceed quarterly estimates, at least partially based on entering the holiday season with a much more favorable ratio of inventory to revenues versus prior years, and this trend should continue for the current quarter. Clearly, sentiment has recently turned in favor of the company given the rise in the share price during the month; it will be interesting to see whether this shift in sentiment is reflected by a decline in the short interest.

The Longer Term

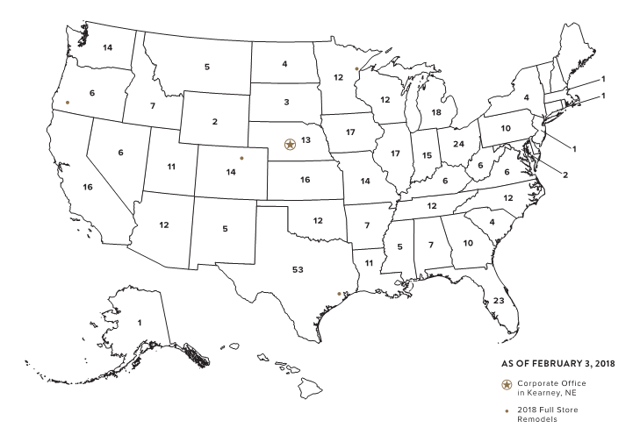

Buckle still has growth opportunities on a national scale as the brand remains one concentrated in selected regions of the United States. The conventional wisdom on retailers is that physical store locations are an anachronism, but this is only partially true; for companies such as Buckle, which continue to be underrepresented in large markets such as California, well selected store locations provide an opportunity to introduce and showcase the brand to new potential customers.

Source:

Buckle Annual Report (2017)The model is different than retailing in the past where stores were treated akin to warehouses and evaluated on how many people fell outside a specified range of a company’s store locations. Instead, retailing going forward will, in our view, be much more closely aligned with the style of Lululemon Athletica (NASDAQ: LULU) or Gap’s (NYSE: GPS) Athleta where stores are located in selected locations (versus a mass market approach) and represent an opportunity to touch and feel – and experience – a brand while supporting a growing online presence versus pure online shopping. We also find it interesting that both Athleta and Lululemon offer free in-store hemming, a feature which has long been on offer at Buckle, but the company tends to undersell at its locations. In a retail environment where customization and personalization hold more cache than in the past, this should be a front-and-center opportunity.

In addition, assuming no further erosion in profitability, the company will be in a good position to continue to distribute the majority of its earnings to shareholders through annual special dividends to supplement the already robust regular dividend. The effective annual dividend yield, including projected special dividends, may well remain in the range of 6%-7%.

Our Position

In general, we avoid trading our portfolios for short-term gains since we typically expect the valuation gaps we identify to close incrementally over a period of years rather than quickly over a period of months. However, in instances where share price appreciation closes a significant portion of an intrinsic valuation gap over a short term of time, we do consider trimming positions in order to reallocate funds to more compelling opportunities.

The appreciation in Buckle’s share price over the last several months has significantly closed the intrinsic valuation gap we identified last year. Indeed, after reaching an intraday low of $12.42 on August 17, 2017, a patently ridiculous valuation for a profitable company with significant excess cash, no debt, and high insider ownership, the company’s shares have more than doubled since that time. We were a little early in our investment in the company and didn’t fully capture the low point, but nonetheless have recorded a significant gain.

We’ve not developed a detailed valuation of the company’s shares, but historical experience suggests that, based on forward earnings of around $2.00 per share, the upper end of the valuation range is probably around $30 per share. The company’s price-to-earnings ratio has long held within a rather tight range of 10-15 and even at its peak in 2014, after a strong run of rising revenues and profits, didn’t exceed that range. In this vein, while we believe the company does have long-term growth opportunities, we don’t see significant additional valuation potential in the intermediate term barring an unexpected reversal in comparable store sales or marked acceleration in profitability.

We’ve therefore trimmed our holdings over the last week despite the company’s ongoing positives.

Conclusion

Buckle has managed to substantially stabilize the business over the last several quarters after a significant decline in comparable store sales and revenues. The current earnings projections for the company are likely low and revenue outperformance should support higher revised earnings estimates. However, the potential for a sudden return to significant earnings growth is remote and the company’s shares currently trade towards the upper part of the historical valuation range. The rise in share value over the last several months has significantly closed the prior valuation gap and, in our view, limits future appreciation potential despite the likelihood of large ongoing special dividends.

Buckle remains a solid choice for long-term income and growth, but better opportunities are available.