In the last entry of this series, we took a look at top ideas from Opaleye Management, one of the best performing funds we've come across so far that´s been growing its AUM at an impressive rate.

Going forward, I hope to continue to delve into the portfolios of successful hedge funds predominantly in the biotech sector, trying to place ourselves in the mindset of the managers and analysts. We do so humbly, knowing that we don't have access to their research or thought processes (and keeping in mind that positions are constantly changing) - nevertheless, it is an interesting exercise that I hope readers find useful.

Today's Fund: Perceptive Advisors

Founded: 1999

Manager: Joseph Edelman

Strategy: Long/short

Relevant Reading Material: Forbes Article (highly recommended and several takeaways that readers are encouraged to apply to their own trading)

Market Value: Over $3.5 billion

Top 10 Holdings %: 49.57%

Turnover %: 51.82%

Time Held Top 20 holdings: 5.50 quarters

Performance 4/16- 2/18: 79.19%

Figure 1: Performance compared to S&P Total Return Index (source: Whale Wisdom)

Figure 1: Performance compared to S&P Total Return Index (source: Whale Wisdom)

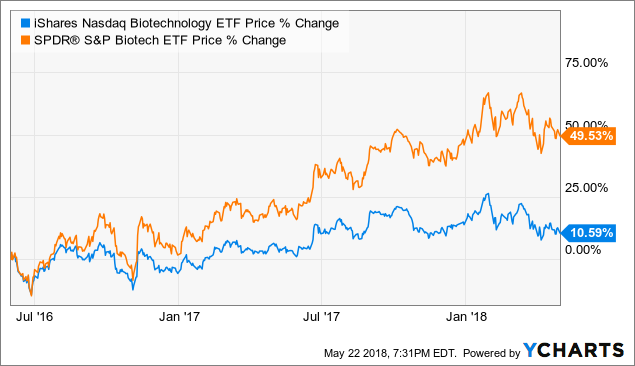

IBB data by

IBB data byTop 5 Weighted Biotech Positions:

#1: Neurocrine Biosciences (NBIX) @ 11.06% of portfolio

NBIX data by

NBIX data byPossible 1 Sentence Thesis: INGREZZA sales should continue to impress (has a leg up over Teva's (TEVA) Austedo and could do over $2 billion in peak sales), while the market opportunity in Tourette's and opportunity for elagolix appear largely ignored. The stock is also a very attractive M&A target with downside limited by a so far successful INGREZZA launch that appears to be strengthening and a run-up into T-Force GOLD results by year-end.

Opinion: The thesis above is actually the same one from the Core Biotech Series. I continue to consider the stock a long term holding with INGREZZA sales to pave the way forward and Tourette´s providing significant optionality. A revenue beat for the first quarter was welcome news.

#2: Amicus Therapeutics (FOLD) @ 8.43% of portfolio

FOLD data by

FOLD data byPossible 1 Sentence Thesis: The firm has one of the best management teams (especially CEO John Crowley) of the companies on my radar, a near term regulatory update for their Pompe program could move the stock significantly in the event of accelerated approval pathway, the Galafold launch (and possible approval in the US) are also upside drivers and after their February secondary offering they have a comfortable cash position.

Opinion: We had this one prior as an ROTY holding and in the near to medium term I still like their chances. However, longer term competition from gene therapies (such as Audentes Therapeutics´ Pompe program) is something to look out for. In their presentation at Cowen Crowley talked about the possibility of in-licensing a gene therapy candidate or doing a partnership with a gene therapy platform, which would be a very welcome development.

Readers with the spare time should check out prior commentary by Crowley and listen to prior presentations as I feel that the biotech sector would be better off if other corporate executives emulated his style of staying grounded and avoiding over-promising. A key upcoming catalyst is regulatory feedback from the EMA late in Q2 and from the FDA in Q3 for their Pompe program.

#3: Global Blood Therapeutics (GBT) @ 6.74% of portfolio

Possible 1 Sentence Thesis: $2 billion or more of potential peak sales for voxelotor is being increasingly figured into the stock price and upcoming results for the pivotal HOPE part A readout appear somewhat derisked (some argue a 3x sales multiple or $6 billion valuation is merited). As a revaluation story this one likely has further upside ahead

Opinion: I don´t mind revealing that the above is borrowed from our thesis in ROTY. Additional analysis and our gameplan as well as that of other readers can be found inside the service as well as in our Chat log using the search feature.

#4: Zogenix (ZGNX) @ 4.45% of portfolio

ZGNX data by

ZGNX data byPossible 1 Sentence Thesis: In February, ZX008 received the coveted Breakthrough Therapy Designation from the FDA for the treatment of seizures associated with Dravet syndrome, the drug looks like it has a leg up over Epidiolex in terms of efficacy and data from the second Phase 3 study in the second quarter could provide additional near-term upside.

Opinion: This one was our first binary winner for ROTY and longer term I imagine they will continue to do well. In the educational resource section of the service, there is a Winners/Losers section with key takeaways from both my good selections and those where we didn´t do so well.

Initial due diligence would suggest there is sufficient room for both Epidiolex and ZX008, with the former having perhaps a superior safety profile. Regulatory submissions (EU and USA) won't take place until Q4 so this one could see muted action in the meantime (after Q2 data). It´s worth noting that Ra Capital Management has been adding to this one (as has DAFNA Capital) and it´s a new position for Scopia Capital and Broadfin. Institutional clustering is a green flag I look for.

#5: Alnylam Pharmaceuticals (ALNY) @ 4.27% of portfolio

ALNY data by

ALNY data byPossible 1 Sentence Thesis: Weakness in the stock resulting from Pfizer´s (PFE) positive data for competitor drug candidate tafamidis in TTR-CM appears to be providing a buying opportunity, as there is likely room on the playing field for both assets- they also have a strong cash balance of $1.6 billion and several catalysts coming in the medium term including FDA approval for patisiran (potential peak sales of over $1 billion) and topline phase 3 interim analysis for givosiran followed by an NDA filing.

Opinion: With a few catalysts coming up and a strong pipeline, I believe this one is worth a look on the dip. By 2021 they could have 4 drugs on the market not to mention their partnered programs. This optimism doesn´t even include their back up clinical programs, with management guiding for at least one new CTN in 2018 and advancement of their ESC+ platform programs (starting with ALN-AAT02 program for Alpha-1 antitrypsin deficiency-associated liver disease).

Commentary on Top Weighted Positions: Edelman is known for sizing his bets according to his outlook and needs, so investors might want to take special heed of the top three positions. It looks like he´s taking a calculated bet on Global Blood Therapeutics with significant upside exposure while not overdoing it (perhaps due to single asset risk). This is definitely a fund for which I recommend readers keep track of their quarterly filings.

3 New Positions of Note:

Alexion Pharmaceuticals (ALXN) @ 2.72% of portfolio

ALXN data by

ALXN data byPossible 1 Sentence Thesis: Soliris is their primary source of revenue but management is wisely taking steps to diversify their drug portfolio as seen with the recent acquisition of Wilson Therapeutics- positive phase 3 data (and trends in superiority across all endpoints) for ALXN1210 also bodes well considering it is supposed to replace Soliris and extend IP into the late 2020's.

Opinion: Shares reacted favorably to first quarter earnings with revenues up by 7% and non-GAAP earnings per share rising 22%. A strong launch for Soliris in patients with AchR antibody-positive generalized myasthenia gravis was encouraging and management continues to prove their intention of building up the pipeline with the acquisition of Wilson Therapeutics.

2017 financial peformance was solid with over $3.5 billion in revenue (15% growth)- Strensiq and Kanuma growth continue to ramp up as well. I still don´t find the stock particularly attractive, but it does seem that they have enough going on to provide a floor to the stock price. It´s worth noting that the stock accounts for over 8% of the Baker Brothers´ portfolio.

Ascendis Pharma (ASND) @ 1.8% of portfolio

ASND data by

ASND data byPossible 1 Sentence Thesis: While there is high binary risk with their lead program TransCon hGH, original data gives reason for optimism and other assets such as TransCon PTH give hope that this platform story will continue to deliver for years to come with many potential applications for this unique technology.

Opinion: Readers and ROTY subscribers have done well playing the run-up to phase 3 data on this one, entering it shortly after Versartis' (NASDAQ:VSAR) failed phase 3 study. Their lead candidate is a potential blockbuster and the amount of potential applications for their technology is very exciting to me - after their February equity offering they have a revamped cash position and clear runway to head higher prior to phase 3 data. It´s worth noting that DAFNA Capital has been adding to the position and that it accounts for over 21% of Ra Capital´s portfolio.

Solid Biosciences (SLDB) @ 0.82% of portfolio

SLDB data by

SLDB data byPossible 1 Sentence Thesis: Weakness following the clinical hold could potentially be a buying opportunity, management hopes to respond to issues raised by the FDA soon and recent news of a DMD patient regaining some strength and function in his muscles following treatment bodes well.

Opinion: I´m mainly fond of this one because their clinical hold on safety concerns brought down the gene therapy sector, letting us take advantage of the temporary pessimism and weakness in the space to add to key holdings in ROTY and in the Core Biotech model account. It´s impressive that the stock has staged such a comeback from falling below $8. Part of this could be due in part to the fact that a story has been getting attention, namely that a 14 year old boy with Duchenne muscular dystrophy has been improving on the company´s lead drug candidate. Institutional clustering here also suggests there is more here than meets the eye. Keep in mind that the patient for whom a serious adverse event was reported has recovered with laboratory parameters improved or returned to normal.

3 Noteworthy Positions To Which They Are Adding:

DBV Technologies (DBVT) @ 1.35% of portfolio

DBVT data by

DBVT data byPossible 1 Sentence Thesis: The company recently shored up their balance sheet with a successful secondary offering, and while Viaskin Peanut may have ¨failed¨ its pivotal study their BLA to be filed in the second half of the year could be green lighted by the FDA (and ultimately see commercial success) due to its low risk and solid safety profile.

Opinion: I always thought of this one as the inferior option to Aimmune Therapeutics (AIMT)(still do), but perhaps there is more here than meets the eye. If the patch has decent efficacy while safety and tolerability are superior, I've read commentary from doctors in the field that Viaskin Peanut could still be the first treatment option of choice (that´s the argument anyway). It might be better to wait for the FDA to accept their BLA (2nd half of the year) and then play the resulting regulatory run-up.

Iovance Biotherapeutics (IOVA) @ 2.91% of portfolio

IOVA data by

IOVA data byPossible 1 Sentence Thesis: Tumor infiltrating lymphocytes (TILs) have several potential advantages over competition (including greater potency, broad utility in several solid tumor settings, lower COGS, enhanced modulation of PD-1/CTLA-4), the manufacturing process continues to be shortened, they have a strong cash position after January´s secondary offering and are looking to give CAR-T participants a run for their money (in part due to possible safety advantages).

Opinion: I keep kicking myself whenever I see this one as it crossed my radar in the $7 range and I passed it over. An investment here is a bet on the potential of tumor infiltrating lymphocytes (TILs) including the possibility for providing a safer alternative to CAR-T. The recent pullback appears attractive and updates for ongoing studies (head and neck, melanoma, cervical cancer) later in the year (or in 2019) could result in a rebound. It´s worth noting that Orbimed owns a 4.5% stake as well.

La Jolla Pharmaceutical (LJPC) @ 3.59% of portfolio

LJPC data by

LJPC data byPossible 1 Sentence Thesis: After March´s secondary offering they have a strong cash position, a favorable label could help them penetrate the market for vasodilatory/septic shock ($500 million peak sales or more) and LJPC-401 is being evaluated in patients with hereditary hemochromatosis (a compelling opportunity).

Opinion: While analyst consensus is split, I am leaning toward the bearish camp that the drug launch could be rocky and revenue opportunity overstated. On the other hand, LJPC-401 has a clear commercial opportunity and I suspect is the primary reason the fund has established its position (strong proof of concept data already provides significant derisking). Recent closing of a $125 million royalty deal is an incremental positive as well.

Bonus Section: Five 13G/13D Filings Of Note

With many of these bigger biotech funds, it's especially important to look into their recent 13G/13D filings (required when they buy up more than 5% of a company's shares).

For example, Baker Brothers' holdings in Idera Pharmaceuticals (IDRA) makes up less than 1% of their portfolio - however, it accounts for 18% of the company's shares and thus is quite significant.

#1 Aldeyra Therapeutics (ALDX) - owns over 16% (SEC Filing)

ALDX data by

ALDX data byThoughts: You can see our full thesis and gameplan for this one inside the ROTY service in the latest edition as well as prior update pieces and commentary in Live Chat using the search feature. Perceptive actually has significant positions in over 6 ROTY holdings & Contenders, which while unintentional it´s nice to have another green flag knowing that Edelman and company see similar potential in them.

#2 Dova Pharmaceuticals (DOVA) - owns over 7% (SEC Filing)

DOVA data by

DOVA data byThoughts: I recently looked at this one after a ROTY member requested it, but after digging decided to hold off until later in the year. I´m glad they got approval for Doptelet for the treatment of thrombocytopenia adult patients who have CLD, but keep in mind they´ll be submitted an sNDA for the treatment of patients with immune thrombocytopenic purpura later in the year. I´d look for signs that management is executing on launch efforts and this one has strong potential for being a Core Biotech candidate.

#3 Corium International (CORI) - owns over 16% (SEC Filing)

CORI data by

CORI data byThoughts: Their NDA submission for Corplex Donepezil (US peak sales could exceed $500 million alone due to advantages over injectible drugs such as improved compliance and reduction of side effects) is expected to take place in the first quarter of 2019, March´s convertible offering helped extend their cash runway and pay off debt but the current decline potentially reflects skepticism in light of no partnership being inked yet. A Complete Response Letter for their partner Agile Therapeutics (OTC:AGRX) might also be weighing on shares.

#4 Motus GI Holdings (OTC:MOTS) - owns over 18% (SEC Filing)

MOTS data by

MOTS data byThoughts: This February IPO´s Pure-Vu system could be an ideal solution for use before colonoscopy exams and is addressing a large market opportunity (15 million procedures performed per year) and overcoming obstacles of insufficient bowel prep rior to the procedure (can lead to poor outcomes and increased healthcare costs). They´ve already received European CE mark approval and are currently introducing the system on a pilot basis in the U.S. market with plans for a broader commercial launch in 2019. Ongoing post-approval studies should help demonstrate the Pure-Vu system´s value proposition as well. I believe this is a good one to dig deeper into late in 2018 for possible entry (so hold me to it).

#5 Avadel Pharmaceuticals (AVDL) - owns around 6% (SEC Filing)

AVDL data by

AVDL data byThoughts: This was a former ROTY Contender that we got out of rather quickly when it became apparent that timelines were being postponed. Keep a close eye on NOCTIVA launch efforts (could do up to $750 million in peak sales) and updates for their new drug application filing for FT 218 new drug (current commentary makes it very unclear but the drug candidate could have safety and compliance advantages over blockbuster treatment Xyrem). First quarter revenue came in above guidance, they have a strong cash balance following the convertible offering and recently they reduced shares outstanding by 12% (a positive development).

Conclusion/Final Thoughts:

As you can see, this is by no means a comprehensive piece and just covers a few of the fund's positions that stuck out to me or to which they were heavily adding.

I hope you found the above article useful. I look forward to reading your feedback in the comments section, including which stocks mentioned above that you own or also find attractive (along with your thesis and plan if you'd like to share with the Seeking Alpha community). Another interesting question to debate is which institutional investor we will choose next!

Disclaimer: Commentary presented is not individualized investment advice. Opinions offered here are not personalized recommendations. Readers are expected to do their own due diligence or consult an investment professional if needed prior to making trades. Strategies discussed should not be mistaken for recommendations, and past performance may not be indicative of future results. Although I do my best to present factual research, I do not in any way guarantee the accuracy of the information I post. I reserve the right to make investment decisions on behalf of myself and affiliates regarding any security without notification except where it is required by law. Keep in mind that any opinion or position disclosed on this platform is subject to change at any moment as the thesis evolves. Investing in common stock can result in partial or total loss of capital. In other words, readers are expected to form their own trading plan, do their own research and take responsibility for their own actions. If they are not able or willing to do so, better to buy index funds or find a thoroughly vetted fee-only financial advisor to handle your account.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.