Welcome to the weekly oil storage report edition of Oil Markets Daily!

Note: Starting June 1, HFI Research will be limiting the number of public articles we publish. Weekly oil storage reports will continue, but all storage estimates - including next week's estimate - will be reserved for HFI Research subscribers. On June 1, we will also be increasing the subscription fee for HFI Research. For more info about the service, see here.

Highlights

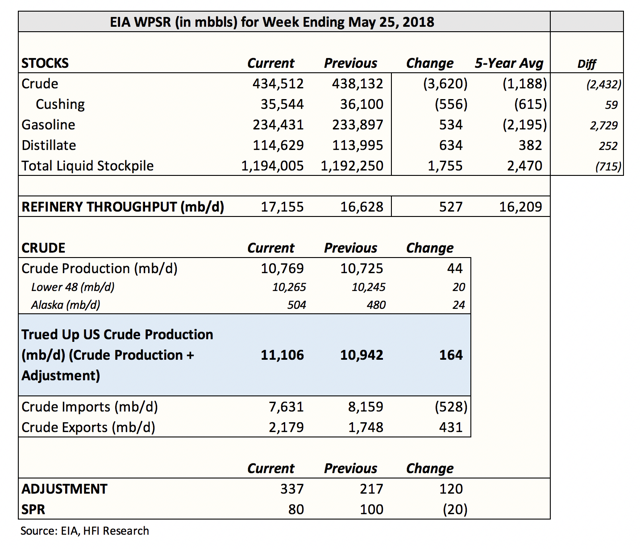

EIA reported a crude storage draw of 3.62 million bbls versus our forecast of a 4.2 million bbl draw. The draw was higher than the five-year average, all thanks to a large jump in refinery throughput (+527k b/d w-o-w).

EIA reported that U.S. crude imports decreased 528k b/d (in line with third-party estimates), and exports increased by 431k b/d w-o-w (higher than third-party estimates). The adjustment factor jumped by 120k b/d w-o-w to +337k b/d, which in our view is largely explained by the overstated exports.

Today was also the release of the EIA 914 March U.S. monthly oil production figure, and the monthly is closely tracking the weekly. For the month of March, the average adjustment factor was +304k b/d, while the tracking error average for U.S. crude exports was overstated by +202k b/d. In our view, this confirms what we've seen in the recent weekly data, which is that EIA's crude exports have been overstated, resulting in the adjustment factor to be consistently positive. This is not attributed to understated production.

Turning to the product side, the build in gasoline storage of +534k bbls was bearish compared to the five-year average draw of 2.195 million bbls. Exports were down, and higher refinery throughput explained the minor build. Distillate storage also saw a build of +643k bbls, which was slightly higher than the five-year average of +382k bbls. Overall, total liquid stockpile came in lower

If you have found our oil market articles to be insightful, we know you will find our premium service even more valuable to you. We have been one of the few research firms to have nailed the oil market fundamentals, and if you have questions, we have answers. See here for more info.

Starting June 1, we will be increasing the subscription prices for our premium service. The monthly subscription price will increase from $100/month to $150/month, and the annual subscription price will increase from $800/year to $900/year. If you join before then, you will be able to lock in the old rate. We hope to see you join the HFI Research community today!