Welcome to the latest edition of the Energy Recap. This week, we wanted to point readers to the most recent version of Seeking Alpha's Multimedia Weekly Digest, which features some great discussion on the rising price of oil and its effects on gold miners/inflation, geoeconomics, and energy stocks in general. You can check out the article and listen to its podcasts/view its videos by clicking here.

And here's some food for thought from the oil price discussion in a quote by Janus Henderson Investors:

Until recently, energy stocks have failed to keep pace with the surging price of crude. Now Lead Energy Analyst Noah Barrett sees potential for well-managed, upstream and midstream companies to benefit from the highest spot prices for Brent and West Texas Intermediate oil in almost four years.

Saudi Arabia and Russia are showing no signs of breaking with coordinated production cuts, and while U.S. output is rising quickly, the risk is it will miss to the downside. Therefore, there is a greater probability that crude prices will reach $90 a barrel than fall back below $60, while the spread between Brent and West Texas Intermediate is likely to remain wider.

The outlook is positive for energy stocks relative to the broader market through 2018 and beyond, as analysts raise their price decks for oil, leading to upward revisions in earnings estimates, higher price targets and making the sector more appealing to generalist investors.

As much as 80% of incremental U.S. production is concentrated in the Permian Basin, leading to bottlenecks that favor high-quality exploration and production companies, and midstream operators in the region that allocate capital responsibly and set budgets well below the spot price of oil.

Please leave us your thoughts about the podcast discussions or anything else energy-related in the comments section below.

Energy Articles of Note

"The Play Between Energy, Economy And Technological Change" By Jennifer Warren

"Blueknight Energy Partners: First The Pain, Then The Gain" By Long Player

"Oil Is Still Going To $80" By Kirk Spano

Energy Sector Bankruptcies for the Week Ended June 1, 2018

Here's a list of the most recent bankruptcy announcements in the energy sector:

- None.

Feel free to add any that we might have missed in the comments section below.

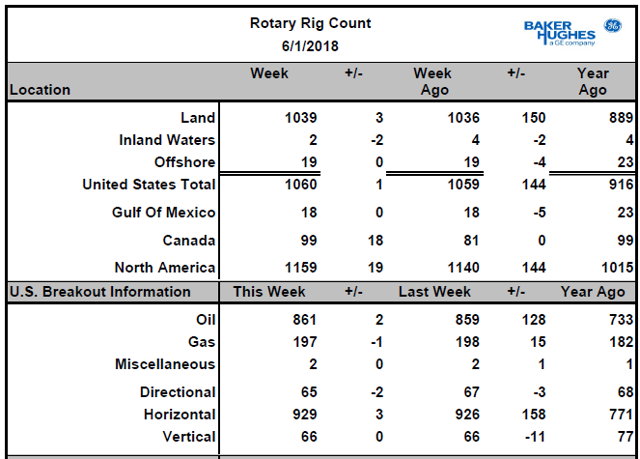

U.S. Oil Rig Count

As per Baker Hughes, the number of active U.S. oil drilling rigs rose slightly this week.

Weekly Natural Gas Storage Report and Summary

Natural Gas Rig Count

Oil Production

As always, we encourage you to submit your own article by clicking here, if you haven't already done so.