W.P. Carey (NYSE:WPC) acquired CPA-17, an unlisted real estate company managed by WPC. While we don't argue with the scale effects, the actual numbers suggest that this will have minimal positive impact on funds from operations (FFO). Let us show you the numbers.

WPC's investment management arm has a long history of successful management of unlisted real estate funds. Previously, it had merged CPA-16 into WPC, providing a big boost to FFO, which jumped from $2.78 in 2013 to $4.56 in 2014. Here things look rather different.

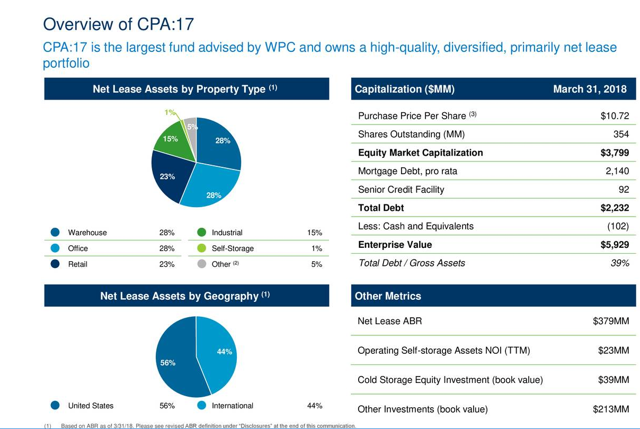

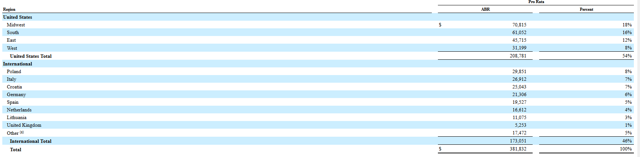

CPA-17 acquisition characteristics

Source: WPC presentation

WPC estimated an approximate 7% cap rate, which, on an enterprise value of $5.929 billion, would translate into approximately NOI of $415 million. That seems about right based on the NOI demonstrated ($402 million) net of other investments.

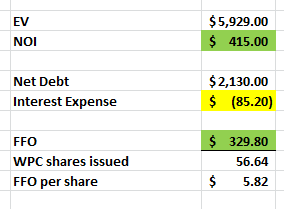

Why this will not be accretive to WPC's FFO

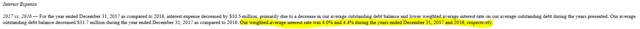

To calculate the addition to the company's FFO, we need the cost of CPA-17's debt and the shares issued by WPC. The latter is easily available, as the exchange ratio has been fixed at 0.16 WPC shares for each CPA-17 share. Hence, 56.64 million WPC shares will be issued. What about the cost on CPA-17's debt? That was not in the press release, but digging into CPA-17's 2017 10-K, we can locate this amount as 4%. CPA-17's Q1-2018 10-Q, which is a bit more recent, does not have an updated amount, but for practical purposes, we would assume the rate is about the same.

Source: CPA 17 10-K

Based on this, we can derive the FFO per share on the newly issued WPC shares.

Source: Author's calculations

The company was expected to make about $5.40/share prior to this, so at first glance, the acquisition does look accretive, as the newly issued shares will generate an FFO of $5.82/share.

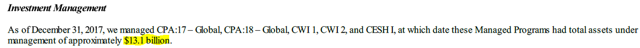

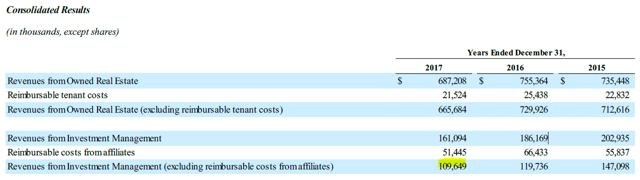

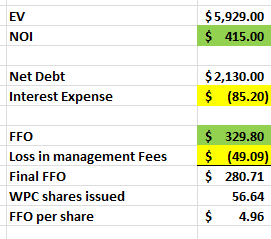

However, this does not account for the loss in investment management revenue from making CPA-17 a part of WPC. WPC generated $109.6 million of net revenues from this division, and considering that the company managed a total of $13.1 billion in real estate, including CPA-17, we expect the hit to this to be substantial.

Even if make a pro rata adjustment (the actual hit should be worse due to reverse economies of scale), FFO on newly issued shares drops to $4.96/share.

WPC will also gain more size, although we are not sure whether going from $11 billion to $17 billion will have much incremental benefits. It is also possible that based on the low rates in Europe and potential rent increases in 2018, the FFO run rate will be a bit higher than what we have modeled (the deal closes in Q4-2018), but we doubt it changes the metrics much. WPC may also be able to pass on some of these lost investment management revenues as costs to net lease tenants. Our best realistic case is thus for the integrated company to have a 5% decline in FFO/share.

Conclusion

Did WPC not get a great deal? The 7% cap rate does seem good, especially considering the large amount of industrial, warehouse and distribution assets. At the same time, the European exposure is not top-tier, with Poland, Italy and Croatia making the top three.

WPC also issued its own equity at a sub-13X FFO multiple, neutralizing any advantage of this deal.

We still love WPC and think this REIT is so much better for dividend investors in the current retail malaise than the overhyped Realty Income (O). Dividend hikes will continue, as WPC has a great portfolio and CPA-17 is probably comparable in quality. But the CPA-17 deal is nothing to get excited about, especially if you actually look at the numbers rather than accepting the hype. It will give no boost to FFO, and likely will subtract a decent amount from it.

For more analysis such as this, alongside real-time alerts to sell insurance (puts) to panicked investors and lottery tickets (calls) to euphoric investors, please consider a subscription to our marketplace service Wheel Of Fortune.

Disclaimer: Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

If you enjoyed this article, please scroll up and click on the "Follow" button next to my name to not miss my future articles. If you did not like this article, please read it again, change your mind and then click on the "Follow" button next to my name to not miss my future articles.