DFAST 2018 Results

DFAST results were released last week for 35 big banks. All banks passed the Fed’s Stress Test. Tables 4.a and C.35 of the Fed’s DFAST document show that Wells Fargo (NYSE:NYSE:WFC) has more than sufficient capital to weather the Fed’s scenarios for a severe downturn in the economy.

CCAR 2018 Results to be Released June 28 at 4:30 p.m.

With DFAST 2018 now public, the next step in the process is for banks to request permission from the Fed to increase dividends and deploy excess capital to buy back shares during the next 12 months.

In the Comprehensive Capital Analysis and Reviews from 2015 to 2017, WFC received Fed permission to increase dividends and buy back shares.

Going into CCAR 2018, Wells is on unprecedented ground. Since the Fed began the Stress Testing exercise in 2015, no bank has experienced the governance, risk management, compliance, and internal control failures currently seen at Wells.

CCAR requires the Fed to conduct two assessments. The Quantitative Assessment is essentially a math exercise. On this basis Wells looks strong given its earnings stream and successful DFAST 2018.

If Wells is to be tripped up by CCAR 2018, it will be because of the Fed's Qualitative Assessment.

Here is how the Fed described the Qualitative Assessment in CCAR 2017:

"The qualitative assessment seeks to ensure that firms have strong practices for assessing their capital needs that are supported by effective identification, measurement, and management of their material risks; strong internal controls; and effective oversight by senior management and boards of directors."

Regulatory Supervision in Dodd-Frank Era

In the Dodd-Frank era of bank supervision, Wells is a CCAR case study of the Fed's ability and willingness to block a quantitatively over-capitalized bank from releasing capital to shareholders if there is inadequate evidence of "effective oversight" and "strong internal controls."

The Fed has a dilemma.

If the Fed allows Wells to increase its dividend and share buyback at a rate comparable to peer banks, it appears toothless in light of Wells' undisputed operational errors. To do so would cause other big banks to question the Fed's commitment to "heightened standards" as described on page 19 of CCAR 2017. Such action would run counter to regulatory rhetoric and guidance issued since the Financial Crisis.

Wells presents a second problem for the Fed that may be even more problematic in today's highly politicized world. If the Fed allows aggressive share buybacks and a greater than $.04 cent increase in the annual dividend, the action will be viewed by certain members of Congress as evidence that bank regulators are not tough on banks.

Investors can be certain that Fed officials have debated the supervisory and public policy implications of Wells' 2018 CCAR request. June 28 looms large for not only Wells, but the Fed.

CCAR 2017 Box 3

Wells' shareholders and potential investors may want to review pages 22 and 23 of CCAR 2017. On these pages the Fed describes the qualitative process the Fed undertakes when reviewing a bank’s request to distribute excess capital to shareholders.

In this section of the CCAR report, the Fed highlights its evaluation of:

1) Governance

2) Risk Management

3) Internal Controls

Across these three categories of safety and soundness, Wells has shown serious deficiencies. My posts of March 27, 2018 and November 20, 2017 enumerate Wells’ operational and compliance failures. In both posts I advised bank investors to avoid WFC shares.

Investors should note three material adverse developments since CCAR 2017 was reviewed by the Fed last year.

- Governance: Six of the bank’s 11 independent directors have been on the board less than two years. Implication: Fed needs further evidence of the skill of the new board.

- Risk Management: Five top risk executives departed in the first quarter of this year. This is unprecedented turnover of a bank Wells' size. The new Chief Risk Officer joined the bank in Q2. Implication: It is too early for the Fed to judge the stature and skill of the new Risk Management team.

- Internal Controls: The Wall Street Journal on January 5, 2018 reported Wells Fargo's "Management" rating which is one of six key metrics from the regulators' highly confidential "CAMELS" ratings. Implication: While internal control breakdowns at Wells are well documented, none is as egregious as the bank’s inability to prevent public disclosure of the bank’s CAMELS rating. This transgression alone could be reason for regulators to not allow Wells to accelerate shareholder payout.

Yet Earnings and Credit Quality Appear Sound

Fortunate for long-time Wells investors, the bank's breakdowns in governance, risk management, and internal controls have occurred while the economy and industry-wide credit quality are sound. Consequently, Wells continues to generate strong earnings. As a result, the bank continues to build capital. For long-term investors in Wells, these are very important considerations for not selling shares regardless of the outcome of CCAR 2018.

CCAR 2018: Four Scenarios

There are four possible scenarios that could play out on June 28.

Scenario 1: >$20 Billion in Dividends and Buybacks

Scenario 1: Dividend raised to $1.60 (from $1.56) and Buybacks =/> $12 billion.

This is the best case for WFC shareholders. According to Merrill Lynch, analyst consensus is for Wells to have CCAR 2018 total payout of $22.8 billion, consistent with Scenario 1.

While consensus considers it likely Wells pays out greater than $20 billion, I consider this scenario unlikely because I expect the Fed to take a strong stand on Wells for qualitative reasons. Probability of Scenario 1 in my opinion is low (call it 10%).

Investors need to read the Fed's letter of February 2, 2018 addressed to the bank's directors. The Fed states in the first line of the letter: "It is incumbent on the directors of WFC to carefully evaluate the firm's risk management capacity and oversee senior management's implementation of an adequate risk management framework."

In this public letter the Fed could not be more clear in its qualitative assessment of the bank's operational failures. Investors who think Wells is in ok shape going into CCAR 2018 may not understand the gravity of the February 2 letter. Operational deficiencies like those noted in the letter will take several years, not months to rectify.

However, if optimistic investors prove correct and the Fed approves Wells releasing more than $20 billion to shareholders, expect WFC’s stock price to outpace peer banks over the next several weeks and as well as the next year.

If Scenario 1 happens, the Fed is indicating Wells has not only adequate capital quantitatively but that it is satisfied with the board's response to the February 2 letter.

Since May 23, Wells shares are down -2.4% compared to the average of 19 peer banks which are down -3.8%. Over the past 90 days Wells shares are up 2.7% compared to the average of peer banks which are down -1.2%. The strong relative performance suggests investors are optimistic about WFC going into CCAR 2018.

My own view is that optimistic WFC investors are miscalculating the Fed's tolerance of the bank's recent problems. CCAR 2018 gives the Fed an opportunity to ensure Wells achieves expected "heightened standards."

Scenario 2: $16-18 Billion in Dividends and Buybacks

Scenario 2: Dividend raised to $1.60 and Buybacks $8-10 billion.

Scenario 2 is more likely in my opinion than Scenario 1. Probability is moderate (call it 50%).

Scenario 2 allows the Fed to send a message about the bank’s operational failures while acknowledging the bank has excess capital. Shareholders should welcome this outcome as it amounts to a wrap on the knuckle for the bank's systemic operational breakdowns.

In Scenario 2 occurs, expect Wells' CCAR 2018 results to lag peer banks, but not so dramatically as to spark a big sell-off. If this scenario transpires, I expect WFC's valuation to continue its downward two-year trend toward industry mean. It likely means peer banks continue to outperform Wells over the next year.

Scenario 3: Dividend Increase Only and No Buybacks Until January 2019

Scenario 3: Dividend to be increased to $1.60 but no new buybacks approved.

Investors should not dismiss Scenario 3. Probability is moderate (call it 45%).

In this scenario the Fed proves it has sharp teeth and that it will punish big banks failing to maintain "heightened standards" of governance, risk management, and internal control practices.

While blocking Wells from announcing any new buybacks, in this scenario the Fed takes a somewhat similar action as it did in 2017 with Capital One (NYSE:COF). In that case, Capital One was required to resubmit its capital plan by year-end. When it did, the Fed approved the plan.

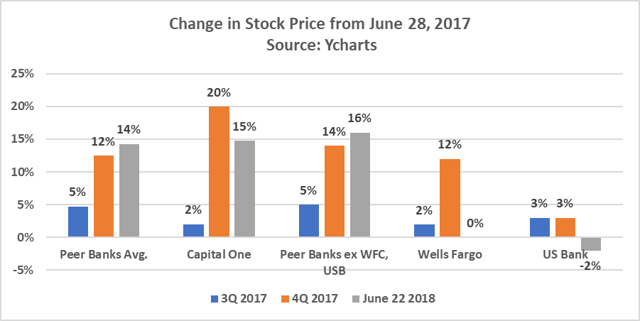

If Scenario 3 occurs, expect WFC’s stock price to underperform compared to peers over the next quarter just as Capital One did last year. See chart 1. However, note that Capital One’s stock price registered an impressive rebound in Q4 2017, presumably in anticipation of the Fed’s approval of the resubmitted capital plan. Quite possibly Wells' shares would respond likewise in 4Q of this year if Scenario 3 is realized.

Chart 1

Scenario 4: No Dividend Increase and No Buybacks Until CCAR 2019

Scenario 4: Dividend flat at $1.56 and no new buybacks authorized.

Scenario 4 is the worst case for Wells investors and also the least likely outcome. (Call it a 5% probability.)

The case for Scenario 4 rests on the February 2, 2018 Fed press release which imposed a "growth restriction" and "requires the firm to improve its governance and risk management processes."

In Scenario 4 the Fed brings down the hammer and requires Wells to evidence material progress in governance, risk management, and internal controls before the bank can accelerate payouts to shareholders.

If Scenario 4 is realized, WFC shares will almost certainly lag peers.

Question: Do WFC Directors Know Something You Don't?

Per page 55 of the bank’s 2018 Proxy, WFC directors, especially among the six members of the bank’s Board Risk Committee, are not large WFC shareholders. Here is the Common Stock ownership of the Board Risk Committee:

- Duke: 5936 shares. Director since 2015 (Board chair)

- Morris: 20 shares. Director since January 2018

- Peetz: 339 shares. Director since February 2017 (Risk Committee chair)

- Pujadas: 2355 shares. Director since September 2017.

- Quigley: 2272 shares. Director since 2013.

- Vautrinol: 100 shares. Director since 2015.

At the stock’s 6/22/2018 closing price of $53.94, the aggregate value of the Risk Committee’s Common Stock ownership is only $595,000. Per www.openinsider.com, none of the WFC Board Risk Committee members have made an open market purchase of WFC shares this year.

WFC director annual compensation in 2017 ranged between a low of $337,000 and a high of $608,000. Stock grants constitute $180,000 of the annual board compensation. The remainder of director compensation is cash. Based on share ownership, Wells' directors appear to be more like employees of the bank, not owners.

The lack of director Common Stock ownership is perplexing and does not convey a positive message to WFC shareholders.

As comparison, consider the open market purchases of JPMorgan Chase (NYSE:JPM) shares by two bank directors who joined the JPM board earlier this year. According to www.openinsider.com, Todd Combs purchased $1.5 million in JPM stock on May 14, 2018 and Mellody Hobson bought $2 million in JPM shares on April 16, 2018.

It is difficult to recommend buying WFC shares when directors own so little. Are they aware of material non-public information that influences their decisions to not buy WFC shares in the open market?

Investors need to monitor WFC insider trading for clues as to when there is an “All Clear” sign to buy. As investors in Huntington (NASDAQ:HBAN) and KeyBank (NYSE:KEY) have learned, one of the best Bank Stock Buy Indicators is the open market purchase of bank shares by all of a bank’s directors.

Invest in WFC?

Scenario 1 is a clear buy signal for WFC as the Fed signals all is well at the bank.

Scenario 2 likely will not help WFC share price relative to peers with strong CCAR results. Existing WFC shareholders should continue to HOLD. Potential investors should invest in banks with better CCAR results.

If Scenario 3 proves true, this path may be the most interesting to speculators in WFC shares. Bold investors may want to consider buying January 2019 WFC calls on weakness in WFC shares over the next several weeks. The rebound in Capital One shares in 4Q last year could bode well for WFC investors.

If Scenario 4 is realized, expect volatility and downward pressure in WFC share prices. Scenario 4 may create a buying opportunity for new WFC shareholders, especially if the stock price dips into the $40s. I expect the new board and risk managers to right the ship over the next couple years. If true, patient investors buying shares in the $40s will be eventually rewarded.

If the board as a group buys WFC shares in the open market, be prepared to follow their lead. If this is to happen, the most likely time would be immediately after the bank announces 2Q earnings on July 13.

I am a buyer of WFC on weakness only if either Scenarios 3 or 4 is realized and directors make material (>$500,000 each) buys.