Besides Warren Buffett, John Malone is one of the featured CEOs in William Thorndike’s great book, "The Outsiders: Eight Unconventional CEOs & Their Radically Rational Blueprint For Success".

Thorndike describes how John Malone at the start of his career - while he was at McKinsey - got more and more intrigued by the cable television business. Three things in particular caught his attention:

- highly predictable, utility-like revenues;

- favorable tax characteristics; and

- the fact that it was growing like a weed.

Prudent cable operators could successfully shelter their cash flow from taxes by using debt to build new systems and by aggressively depreciating the costs of construction. These substantial depreciation charges reduced taxable income as did the interest expense on the debt, with the result that well-run cable companies rarely showed net income, and as a result, rarely paid taxes, despite very healthy cash flows.

Related to this central idea was Malone’s realization that maximizing earnings per share, the Holy Grail for most public companies at that time, was inconsistent with the pursuit of scale in the nascent cable television industry. To Malone, higher net income meant higher taxes, and he believed that the best strategy for a cable company was to use all available tools to minimize reported earnings and taxes, and fund internal growth and acquisitions with pretax cash flow.

Terms and concepts such as EBITDA (earnings before interest, taxes, depreciation, and amortization) were first introduced into the business lexicon by Malone.

In deciding how to deploy capital, Malone made choices that were starkly different from those of his peers. He never paid dividends (or even considered them) and rarely paid down debt. He was parsimonious with capital expenditures, aggressive in regard to acquisitions, and opportunistic with stock repurchases.

He was also, however, a value buyer, and he quickly developed a simple rule that became the cornerstone of the company’s acquisition program: only purchase companies if the price translated into a maximum multiple of five times cash flow after the easily quantifiable benefits from programming discounts and overhead elimination had been realized.

Malone, alone among the CEOs of major public cable companies, was also an opportunistic buyer of his own stock during periodic market downturns.

Telenet

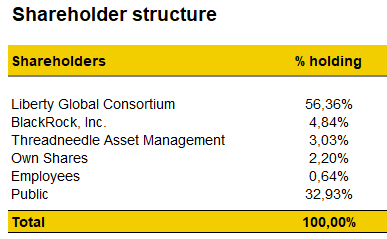

John Malone’s Liberty Global (LBTYA) is the majority shareholder (56.4%) in the Belgian cable operator Telenet (TLGHF, OTC:TLGHY). It will not surprise you that Telenet has highly predictable revenues, favorable tax and strong growth characteristics. Telenet has also no recurring dividend policy and a lot of debt. Telenet does buy back its own shares and currently owns 2.2%.

Exhibit 1: Telenet shareholder structure

Source: Telenet-website

Malone’s Liberty Global also tried an opportunistic buyback. In 2012, Liberty Global launched an offer for the shares in Telenet it did not already own at 35 EUR per share.

Financial advisor Lazard, appointed by Telenet’s independent directors to evaluate the bid in accordance with Belgian law, said that Telenet was worth between 37 and 42 EUR per share. Liberty Global was not prepared to raise its price for Telenet because it believed it made a fair offer. The offer failed.

Telenet has its primary listing on Euronext Brussels where it’s trading with TNET as its ticker symbol. The current share price is 40.24 EUR (which equals $46.9).

Shareholder activism

Although John Malone is not a big fan of dividend payments, in 2013, Telenet paid out an extraordinary dividend of 7.9 EUR per share. This coincided with the takeover by Liberty Global of UK cable operator Virgin Media. A coincidence or not?

Telenet is generating high cash flows and this brought the debt levels below normal Telenet (and Liberty Global) standards.

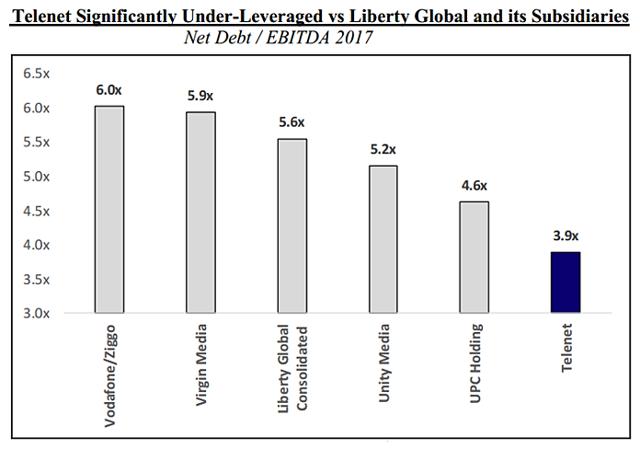

Exhibit 2: Leverage

Source: Lucerne Capital Management

This led many Telenet shareholders to expect a big dividend and there was a big disappointment when Telenet decided not to pay any dividend. This led to a drop in the share price and to shareholder activism by hedge fund Lucerne Capital Management.

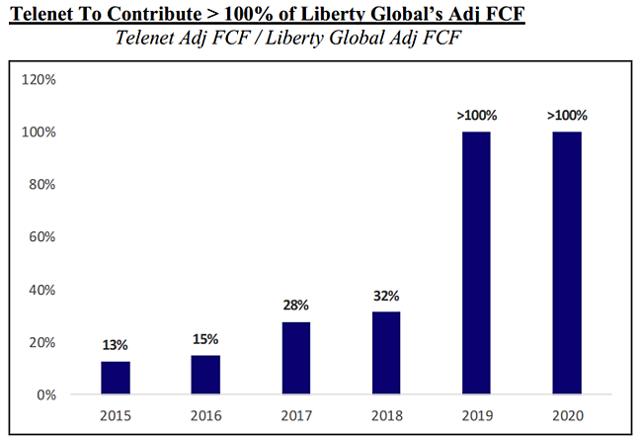

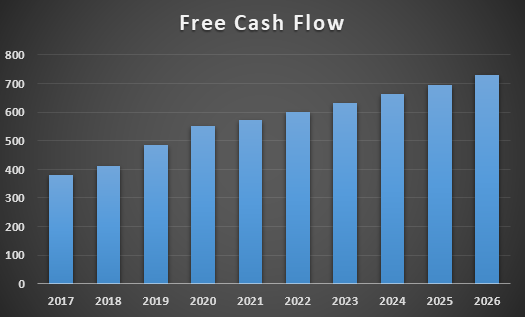

In 2017, Telenet contributed 28% to Liberty Global’s adjusted FCF; however, Lucerne Capital Management expects this to grow to >100% by 2019 following the completion of Liberty Global’s disposals to Vodafone (VOD).

Exhibit 3: Telenet’s cash flow generation

Source: Lucerne Capital Management

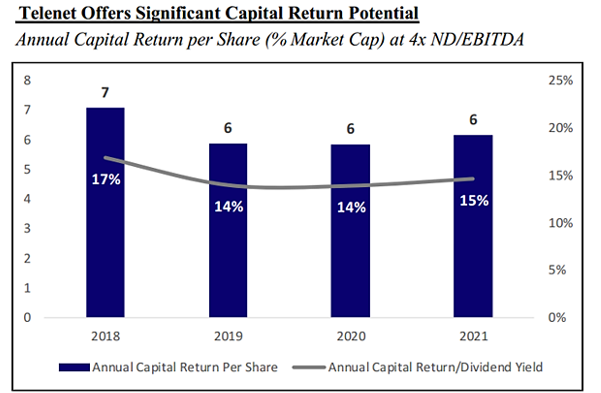

Given Telenet’s strong cash flow generation and assuming a ratio of net debt to EBITDA of 4, there is ample room for returning cash to shareholders, according to Lucerne Capital Management.

Exhibit 4: Capital return potential

Source: Lucerne Capital Management

Refusing to return cash to the shareholders shows the Telenet Board of directors only acts in the sole interest of, and potentially on the instructions by, Liberty Global, according to Lucerne Capital Management.

Valuation

The refusal to pay out a big dividend was not the only reason for the share price drop. Due to the competitive forces in the Belgian market, Telenet was not able to implement its yearly increase of the subscription prices. On top of that came the declaration of Telecom Minister De Croo that he wanted to open the Belgian market for a fourth player in order to increase the competition and to lower the prices for consumers.

Exhibit 5: Telenet price chart

There are elections coming up in Belgium and Minister De Croo wants to please his voters with his proposal. I do not expect that there will be a fourth player entering the Belgian market. In other European countries, there is a tendency to move from four to three players, rather than the other way around.

In the meantime, Telenet did announce the implementation of the yearly increase of its prices. This is very important because there isn’t much growth in the Belgian market, although expansion into the southern part of Belgium is still a possible growth venue.

So two of the three reasons for the share price drop are tackled, and for the third one (the refusal to pay a (big) dividend), I would like to point to the so-called Miller-Modigliani dividend irrelevance theory. This theory states that investors do not need to concern themselves with a company's dividend policy since they have the option to sell a portion of their portfolio of equities if they want cash.

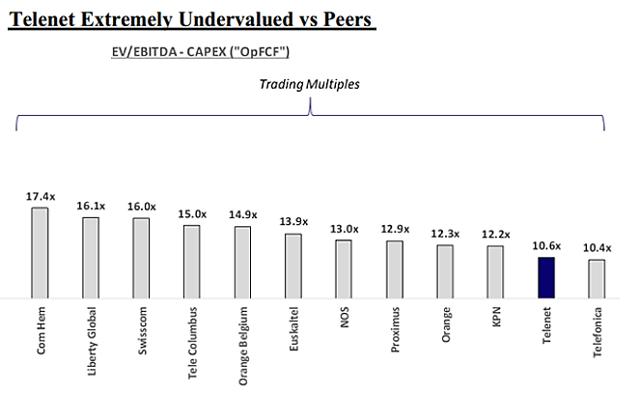

The bottom line is simple: the share price drop is too big and leaves Telenet undervalued compared to its peers.

Exhibit 6: Valuation

Source: Lucerne Capital Management

Telenet publishes on its website very detailed consensus estimates (until 2021) from analysts following the company. Based on the median projections, we expect Telenet to generate free cash flows of 411 million EUR and 484 million EUR for this and next year, respectively.

Exhibit 7: Free cash flow projections

Source: Telenet website and own projections

We set our DCF-based price target at 55 EUR ($64), which gives an upside potential of almost 40% and implies a forward PE of 17.

Conclusion

The current weakness in Telenet’s share price evokes shareholder activism and represents a buying opportunity. The reasons for the share price drop are not really valid, and if this continues, we do not exclude that John Malone may once again become an opportunistic buyer of his own stock.

Please click the "Follow" tab at the top of this article, if you like my articles. If you would like to receive real-time alerts on future articles and updates, make sure that the "Get E-mail Alerts" box (below the "Follow" tab) remains checked.

This article provides opinions and information, but does not contain recommendations or personal investment advice to any specific person for any particular purpose. The information provided is for educational purposes only and does not constitute a recommendation of the suitability of any investment strategy for a particular investor.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.