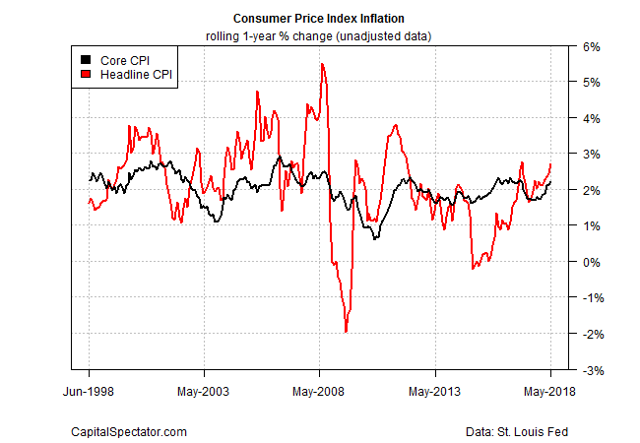

Thursday's report on consumer inflation for June is expected to show that the recent firming trend will roll on. Analysts are looking for the year-over-year rate in headline prices to tick up to the fastest pace in over six years. It's easy to overstate the rebound in pricing pressure, which appears dramatic after flirting with a mild degree of deflation as recently as 2015. But the rise from a low base still leaves inflation at a moderate rate relative to history. Nonetheless, the numbers clearly show that reflation is in progress - a trend that will increasingly ratchet up pressure on the Federal Reserve to tighten monetary policy.

Short of a new recession, or at least a dramatic slowdown in economic activity (neither of which appears imminent), it's reasonable to assume that the reflationary regime underway will persist for the foreseeable future. Economists are projecting that annual increase in the consumer price index (CPI) for June will edge higher for a fifth straight month. Econoday.com's consensus forecast for Thursday's release (July 12) sees the unadjusted headline measure of CPI inching up to a 2.9% year-over-year gain, the most since February 2012. That's still moderate, although the key takeaway is that the revival of inflation to just under 3% marks a conspicuous change from 2015, when headline inflation was essentially flat.

The more reliable core measure of CPI, which strips out food and energy, is rising at a softer pace - up 2.2% for the year through May. But the larger point is that reflation is alive and kicking in this corner too.

Recent surveys align with the firming up of inflation to a roughly 3% pace at the headline level. The New York Fed on Monday, for instance, released its monthly poll of consumers on prices and found that "median inflation