Previously, I reviewed industry efforts to commercialize therapies targeting the CD47/SIRPa pathway. In the first part of a series intended to profile the companies in this space, I present a company profile for Forty Seven (FTSV). Please reference my original article linked above for more info on the scientific rationale, competitive space, and market opportunities underlying CD47 inhibition.

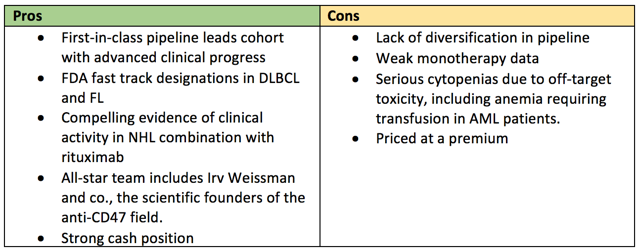

With the most advanced clinical pipeline in CD47 therapies, combined with a healthy balance sheet and a strong foothold in IP, Forty Seven is well positioned to continue their drive towards becoming the first commercial therapy targeting the CD47 pathway. However, substantial risk remains. As their pipeline is almost wholly centered around their lead compound, Hu5F9, they have moved all-in on Forty Seven. With marginal data in ovarian and colorectal cancer, a lot rides on the outcome of new, ongoing combination trials.

Clinical Pipeline:

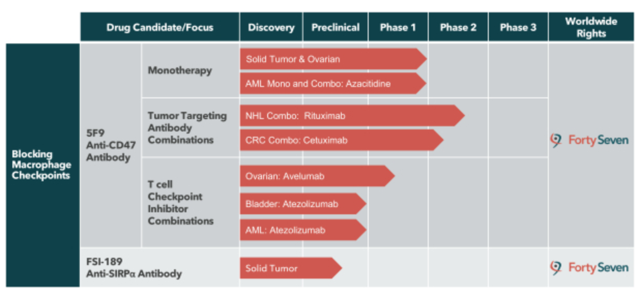

When it comes to targeting CD47, FTSV has the most advanced clinical pipeline, with Phase 2 combination trials in non-Hodgkin's lymphoma (NHL) and colorectal cancer (CRC), along with several additional ongoing Phase 1 monotherapy trials.

For all intents and purposes, FTSV has one compound under development in their pipeline: Hu5F9, a monoclonal antibody targeting CD47. FSI-189, a monoclonal antibody targeting SIRPa on macrophages, carries an interesting premise as it may enable targeting of new indications involved in upregulating the expression of SIRPa, such as renal cell carcinoma or melanoma. However, there is very little info available on FSI-189 and management does not plan on initiating a clinical trial until 2020. However, this compound does give FTSV a marginal emergency cushion in case 5F9 blows up in clinical trials, although a failure of 5F9 will likely mean failure of the CD47-SIRPa pathway.

Key Financials

Following their recent offering the other week, FTSV raised $113 million, for an