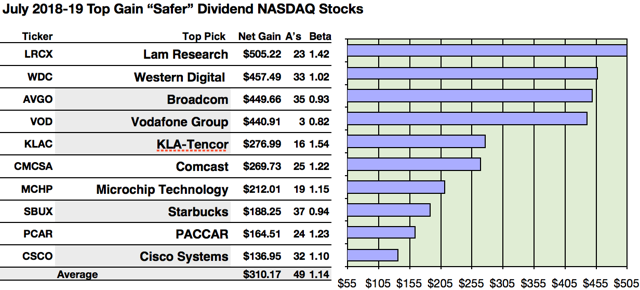

Actionable Conclusions (1-10): Brokers Estimated Top Ten NASDAQ "Safer" Dividend Stocks to Net 13.7% to 50.5% Gains By July 2019

Five of the ten top yield "safer" Dividend NASDAQ stocks (with name backgrounds tinted grey in the list above) were found among the top ten gainers for the coming year based on analyst one-year target prices. Thus the yield strategy for this group as graded by analyst estimates for June proved 50% accurate.

Projections based on estimated dividends from $1000 invested in the thirty highest yielding stocks and their aggregate one-year analyst median target prices, as reported by YCharts, created the 2018-19 data points. Note: one-year target prices by lone analysts were not applied. Ten probable profit-generating trades projected to July 12, 2019, were:

Lam Research (LRCX) netted $505.22, based on a median target price estimate from twenty-three analysts plus dividends less broker fees. The Beta number showed this estimate subject to volatility 42% more than the market as a whole.

Western Digital (WDC) netted $457.49, based on a median target price set by thirty-three analysts plus estimated dividends less broker fees. The Beta number showed this estimate subject to volatility 2% more than the market as a whole.

Broadcom (AVGO) netted $449.66, based on dividends plus a target price estimate from thirty-five analysts, minus broker fees. The Beta number showed this estimate subject to volatility 7% less than the market as a whole.

Vodafone Group (VOD) netted $440.91, based on a mean target estimate from three analysts plus dividends less broker fees. The Beta number showed this estimate subject to volatility 18% less than the market as a whole.

KLA-Tencor (KLAC) netted $276.99, based on dividends plus a median target price estimate from sixteen analysts less broker fees. The Beta number showed this estimate subject to volatility 54% more than the market

Three of these "Safer" Dividend NASDAQ 100 dividend pups qualified as valuable catches! Look for where they might reside among the 52 Dogs of the Week (DOTW)I and others among 52 DOTWII now accumulating returns on The Dividend Dog Catcher premium site. Also, Dogs of the Week III (Safari to Sweet Success) portfolio launched September 8. Click here to subscribe or get more information.

Make investing gains again. Catch your underdog on Facebook!

At 8:45 AM nearly every NYSE trading day on Facebook/Dividend Dog Catcher, Fredrik Arnold does a quick live video summary of one of five stocks for the week contending for a place in his Safari To Sweet Success portfolio.

Go to Facebook/Dividend Dog Catcher 8:45 AM most trade days and watch, comment and share. Of course the recent archive videos are there to review anytime.

Yet always remember: Root for the Underdog.