I’ve been following the Seadrill (NYSE:SDRL) restructuring story for many months. Ironically, the company’s emergence from Chapter 11 corresponded with my vacation, but now I had the time to reflect on both what happened with the “previous Seadrill” and also think about the “new Seadrill”.

At the day of emergence from Chapter 11, the company has provided just a few data points. However, they are important for further discussion, so I’ll list them one by one (all numbers presented as of the Effective Date of emergence from bankruptcy):

- Cash position = $2.1 billion;

- Secured bank debt = $5.7 billion, first maturity in 2022;

- New secured notes = $880 million, first maturity in 2025;

- Backlog = $2.3 billion (excluding SeaMex and Seadrill Partners);

- Common shares issues = 100 million;

- Next earnings report = November 2018.

With this in mind, let’s begin the discussion.

A short trip to the past – does valuation actually work?

During Seadrill’s restructuring, I’ve written a number of articles on the topic as the case was complicated and there was a lot of information to digest. The cornerstone article was published on October 11, 2017, and titled “Seadrill: Price Target 5 Cents, 85% Downside”. I argued that under the conditions of October 2017, new Seadrill would start trading at about $1.2 billion market capitalization, which implied huge downside from the levels of early October 2017. So, how did this play out? Seadrill is now trading at a $1.9 billion market capitalization, way below the levels ($3.3 billion - $4.7 billion) indicated by Seadrill’s advisor, Houlihan Lokey (I’ve discussed Houlihan Lokey’s numbers here). Why is it so, is the market too hard on Seadrill? I don’t think so.

Back in October 2017, Brent oil (BNO) was in the $55 - $60 range. Now, oil trades in the $70 - $80 area, an increase of 30%. This is a significant development, and it had a serious positive effect on drillers’ valuation. Let’s take the market leader by capitalization and backlog as a reference point. Back in October 2017, Transocean was a $4 billion company. Now it’s a $6 billion company, an increase of 50%. Roughly the same happened to Seadrill: the shares should have reflected the true value close to $1.2 billion back in October 2017 (in reality, they did not, and implied a completely different capitalization up until the last day), and now the capitalization increased at a rate similar to Transocean’s.

There is one thing I’d like to reiterate about the lessons of the past. The chart above is typical for a bankrupt/restructuring company. The market rarely takes all the information into account until the company emerges from bankruptcy with a new stock, which often results in a very significant deterioration of the already beaten shares. The reasons for this phenomenon are limited availability of shares to short, high borrowing fees, high margin requirements for short selling, irrational behavior by long-time holders of the stock, speculative support without fundamental reasons from short-term gamblers etc. Many investors, especially those who can’t sit day after day glued to the screen, should consider avoiding this type of situations completely.

Now, back to the present times.

Where does Seadrill stand today?

Let’s start with the discussion of the restructuring results for the company. Typically, a restructuring is an attempt to give a fresh start to the company which was previously burdened by debt. Often, it comes with much pain or a complete wipeout of common shareholders. In Seadrill’s case, we’ve seen a lot of pain for common equity which was reduced to a measly 1.9% stake in “new Seadrill” but not much deleveraging. I find it a rather strange exercise in deleveraging when the company exits bankruptcy with $6.6 billion of debt. We can also talk about net debt, but it does not sweeten the picture much as net debt is $4.5 billion, twice as much as the company’s backlog!

In my opinion, the company is not in a great financial shape due to significant debt burden. Basically, the company reduced bond debt and received some breathing space until 2022 on bank debt by turning shareholders’ 100% stake in “old Seadrill” into a 1.9% in “new Seadrill”. While any recovery for common equity in Seadrill’s case would have been a gift from higher-priority stakeholders, the result of this trade for the business itself is not impressive at all.

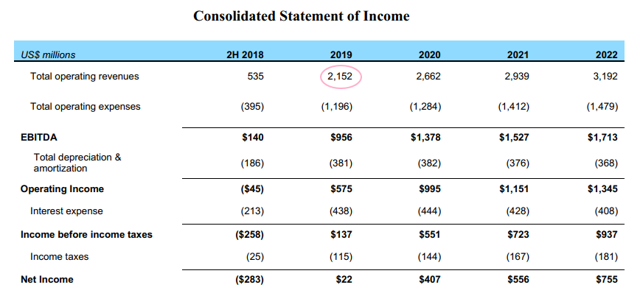

I’d also like to remind that Seadrill’s business plan, presented in disclosure statement (docket 1002), was based on aggressive assumptions. The following table from the disclosure statement highlights it perfectly:

According to financial projections presented in Exhibit G of the disclosure statement, revenues in 2019 should be double the run-rate of revenues of the second half of 2018. How is that possible? Currently, I do not see how these projections may come true in 2019 given today’s market dynamics. The market is rebounding, but the rebound is slow outside the North Sea, and dayrates remain under significant pressure. While there is obviously no concern for Seadrill financial position for the next few years due to significant cash cushion and maturity holidays, the debt will now always be a factor in evaluation of the company.

Now let’s get to valuation. Currently, the value of the fleet directly owned by Seadrill is estimated to be about $5.6 billion (data from Bassoe Offshore). Seadrill owns interests in Seadrill Partners’ (SDLP), but they are a collateral for a loan that materially exceeds their value so there’s no point in counting them. Seadrill’s stake in Seadrill Partners units is worth about $150 million at current prices. Also, Seadrill exited bankruptcy with a 50% stake in SeaMex and a 50% stake in Seabras Sapura. As of December 31, the book value for Seabras Sapura ownership was $353 million while the book value for SeaMex ownership was $102 million. However, we have already learned during this market downturn that book values may be hugely inflated, so I’d take these numbers with a big grain of salt. A great example is the book evaluation of the company’s interests in Seadrill Partners (direct ownership interests, subordinated units, IDRs), which is listed as $1 billion.

The good news is that for the practical evaluation of Seadrill capitalization we do not need to have a precise valuation for the company’s interests in Seabras Sapura and SeaMex as they are immaterial for the big picture. For the numbers we can be sure of, Seadrill should have at least $5.8 billion in fleet and interests in other companies at today’s asset prices. With $2.1 billion in cash and, likely, about $1 billion for the value of the backlog, Seadrill should have about $8.9 billion of assets against $6.6 billion of debt, leading to an estimated $2.3 billion of market capitalization.

What we see today in the market is a capitalization of $1.9 billion, which, given the complexity of the case and many assumptions regarding the value of the fleet (especially the value of the cold stacked fleet) is roughly equal to the estimated capitalization. The market is never precise in the valuation of any company (and neither are analyst valuations which are based on a number of assumptions), so investors and traders should search for major dislocations for a successful investment or trade. In Seadrill’s case, I don’t see such an opportunity right now. The stock might have some upside along with the price of oil if oil goes back to $80, but I don’t see sufficient internal upside drivers in Seadrill right now. The stock is trading more or less where it should be trading. Also, I’d expect some cautiousness from the investment public following the difficult history of the stock.

Now that Seadrill has finally completed its restructuring, the company’s management will be free to focus on the company’s operations. Despite challenges, Seadrill remains a major player with a modern fleet. This month, Seadrill has reportedly found work for its jack-up West Tucana, which will be drilling in Qatar for 440 days. I think that investors will hear more news from Seadrill on the contract front as restructuring is now behind the company.

In my opinion, both the company and its shares remain highly interesting to follow, but I do not see a big opportunity in Seadrill right now.

If you like my work, don't forget to click on the big orange "Follow" button at the top of the screen and hit the "Like" button at the bottom of this article.