I first warned about Exxon and Chevron being market laggards on December 29th, 2016 in an article titled "Oil Majors Not The Place For Rising Oil." In that article I pointed out that Exxon (XOM) and Chevron (CVX) would trail most U.S. E&Ps focused on shale. While Chevron has held-up fairly well, Exxon has been a terrible laggard. I believe Chevron will follow Exxon soon.

I first warned about Exxon and Chevron being market laggards on December 29th, 2016 in an article titled "Oil Majors Not The Place For Rising Oil." In that article I pointed out that Exxon (XOM) and Chevron (CVX) would trail most U.S. E&Ps focused on shale. While Chevron has held-up fairly well, Exxon has been a terrible laggard. I believe Chevron will follow Exxon soon.

My thesis revolves around the reality that we are at the beginning of the end of the oil age which I first discussed back in 2015 on MarketWatch. Since then I've expanded on the idea on Seeking Alpha:

Tony Seba, EVs, Solar And $25 Oil

The New 'Golden Age' For Oil Stocks Is About To Begin

For investors concerned with total return during what is likely the last great secular oil bull market, I strongly recommend swapping Exxon and Chevron shares for more focused competitors with fewer financial, operational and legal hurdles. Here are just a few of the hurdles facing these majors.

The End of the Oil Age

For companies like Exxon and Chevron, a dramatic reduction in oil demand would obviously be detrimental. It is even more complex than that as the companies try to transition to what comes next while maximizing returns now.

The end of the oil age is a simple concept whereby gasoline and diesel powered vehicles, which account for about 70% of oil demand, give way to electric vehicles. The uncertainty to this scenario is time frame.

Estimates for peak oil demand range from Tony Seba's aggressive paradigm shifting EV adoption rates reducing oil demand by the early 2020s, to various oil producers suggesting peak oil demand will happen in about ten years, as the Royal Dutch Shell (RDS.A) CEO said, to BP (BP

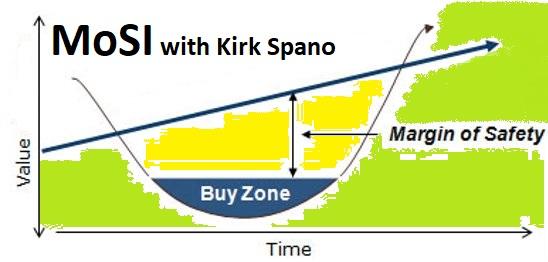

July 31st is the LAST DAY to get Margin of Safety Investing at the first year founders rate of $365 per year vs the regular price of $499.

Take a Free Trial today to lock in your opportunity to receive ideas about investing in energy,the coming "smart everything" world, as well as, many other value priced growth and dividend opportunities.

Learn from top ranked analyst, winner of MarketWatch's inaugural "Next Great Investing Columnist" competition and fee-only advisor Kirk Spano, to help build a portfolio that withstands risks and benefits from a changing world.