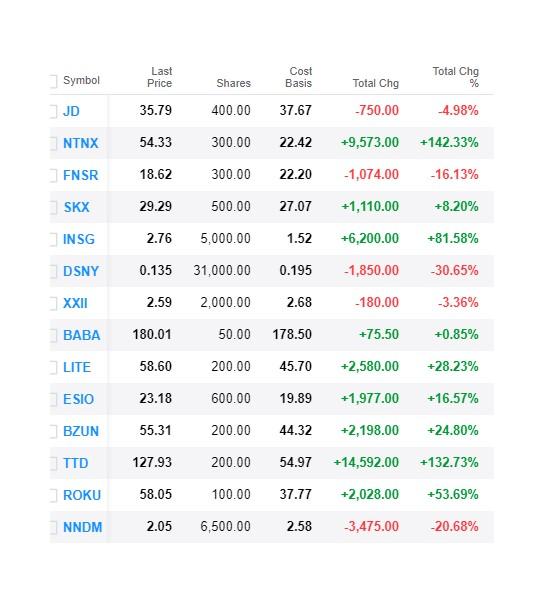

We bought 200 shares in online ad platform The Trade Desk (NASDAQ:TTD) for the SHU portfolio on March 1 for $54.77. Needless to say, we're happy - less than half a year later, and the shares have more than doubled and are already our second-best performers (SHU portfolio after market close August 10, 2018):

It's actually not all that hard to see why The Trade Desk shares have been such a good buy:

But it is a little curious that they've taken off so strongly only recently, as revenue growth is actually slowing down a bit, although parts are growing very fast (Q2CC):

In Audio, one of the best values in programmatic today, it grew by just under 200%, mobile video grew 156%, and as Jeff mentioned, Connected TV spend more than doubled from the previous quarter.

The stock price has taken off impressively:

Competitive advantage

We highly recommend reading this article from SA contributor Saga Partners, which explains the market in much more detail and shows how The Trade Desk is positioned, which they compare to Bloomberg in the securities business, as it provides agencies a platform for them to analyze data and value inventory.

Basically, the company is enjoying economies of scale as well as network effects, which provides it with considerable protection, as the barriers to entry are substantial as a result. Some elements of its competitive advantage are as follows:

- Ad exchanges prefer dealing with bigger DSPs (and SSPs or Supply Side Platforms) because that's more efficient.

- SSPs prefer to send their impressions to DSPs that are more likely to win the auction, i.e., the bigger, more established DSPs like The Trade Desk.

- Ad agencies prefer to use one (or a few at most) DSP to run their campaign, and obviously, this favors the bigger, more established ones.

- The company doesn't try to be a demand- and supply-side platform at the same time, creating potential conflicts of interests.

- Bigger DSPs accumulate more data, hence their value proposition improves.

- The company isn't greedy with take rates like some other platforms (during the Q2CC, management spoke of the importance of a consumer surplus, the value for the customer over and above the price they pay).

- Their omnichannel and cross-device performance measurement is top-notch.

- Their ability to tie online ad exposure to offline sales results.

- The Trade Desk is independent, not tied to any large media companies (like DoubleClick with Google (GOOG, GOOGL) and AppNexus with AT&T (T)) which have a natural inclination to favor their related parties on the sell side.

- The Trade Desk isn't a walled garden like Google and Facebook (FB), and isn't associated with one. A walled garden doesn't allow data comparison between its inventory and inventory outside its walled garden, it does not provide the data to even help value its inventory. TTD's CEO predicts that this will ultimately produce the demise of walled gardens, as price discovery is only possible outside them, and this will put economic pressure on the walled gardens. The jury is still out.

All this produces stickiness (the client retention rate is over 95%) and barriers to entry for competition. Here is what management said about omnichannel (Q2CC):

Our key performance metrics across multiple channels regularly outperformed other platforms they used. For example, viewability came in consistently 15% to 20% higher than all other platforms while maintaining comparable cost efficiency.

There seems to be a kernel of truth in this (Q2CC):

In Q2, we continued to see marketers advertise across more channels than ever before, which include mobile, video, connected TV, audio, native, and display. In Q2, our customers using at least six of these channels increased by 156% versus the same quarter a year ago.

And the same is apparently happening with cross-device measurement (Q2CC):

By activating all four Identity Alliance cost device partners through our platform, the agency was able to drive a 20% increase in new customer bookings. These are significantly better results for that advertiser. Every dollar spent on cross-device data easily paid for itself, resulting in an average 31% increase in ROI across the four cross-device partners.

New platform

The Trade Desk came up with a new platform ("The Next Wave"), and the biggest overhaul in the company's history is already producing wins, according to management. The company spent 40% of its engineering resources in the last year on its development, and it consists of three parts (from Q2CC):

- Megagon - A data-focused user experience that enables media buyers to see precisely how their bidding strategies affect their opportunities to win impressions.

- Planner - An innovative tool that enables media planners to generate a range of campaign scenarios and validate them against data-driven insights.

- Koa - The artificial intelligence that drives it all, backed by data from the company's entire bid stream.

There are already a number of clients that have moved to the new platform, and the company expects to have moved everybody by the end of the year. It seems to be very well received, you can read more about The Next Wave here, and reviews here and here. Planner seems to be generating value (Q2CC):

So by not only making the media buying process of data driven, we've also gone a little bit upstream to make the planning process data driven... Early results for those using Predictive Clearing indicate CPMs are being reduced by up to 20%. That’s a huge value! That is amazing consumer surplus.

Growth

The company is benefiting from a number of tailwinds:

- The shift to programmatic advertising

- The shift from linear TV to OTT (or CTV, as it's called here)

- Increased emphasis on privacy and data protection

- A renovated platform

- Merging of content and distribution

- International growth (international sales being just 15% of revenue, but was growing at 85% in Q2).

Apart from a number of secular tailwinds, another reason for the better-than-expected results in H1 of 2018 was the signing up of big clients (advertising clients like ad agencies and brands) in H2 of last year. It takes these bigger clients time to ramp up.

What's more, management argued that the company had a similar trend of wins in Q2, so we can expect the growth to continue for some time.

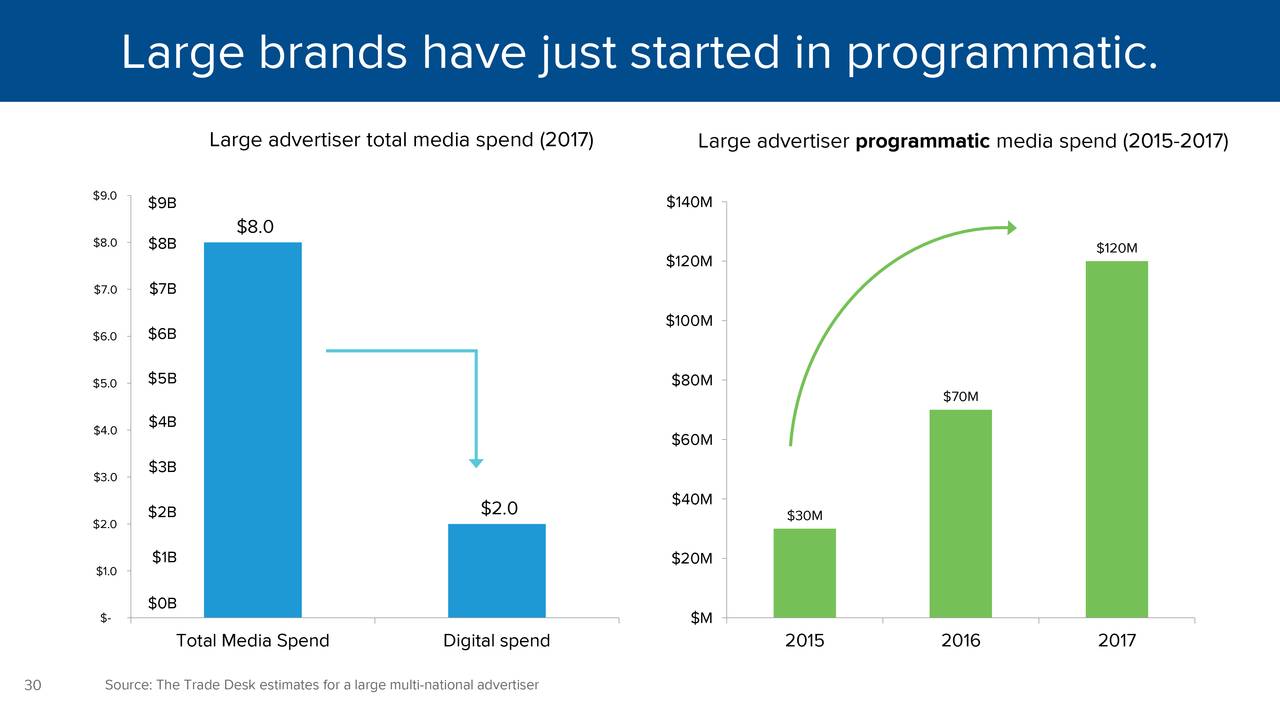

Programmatic

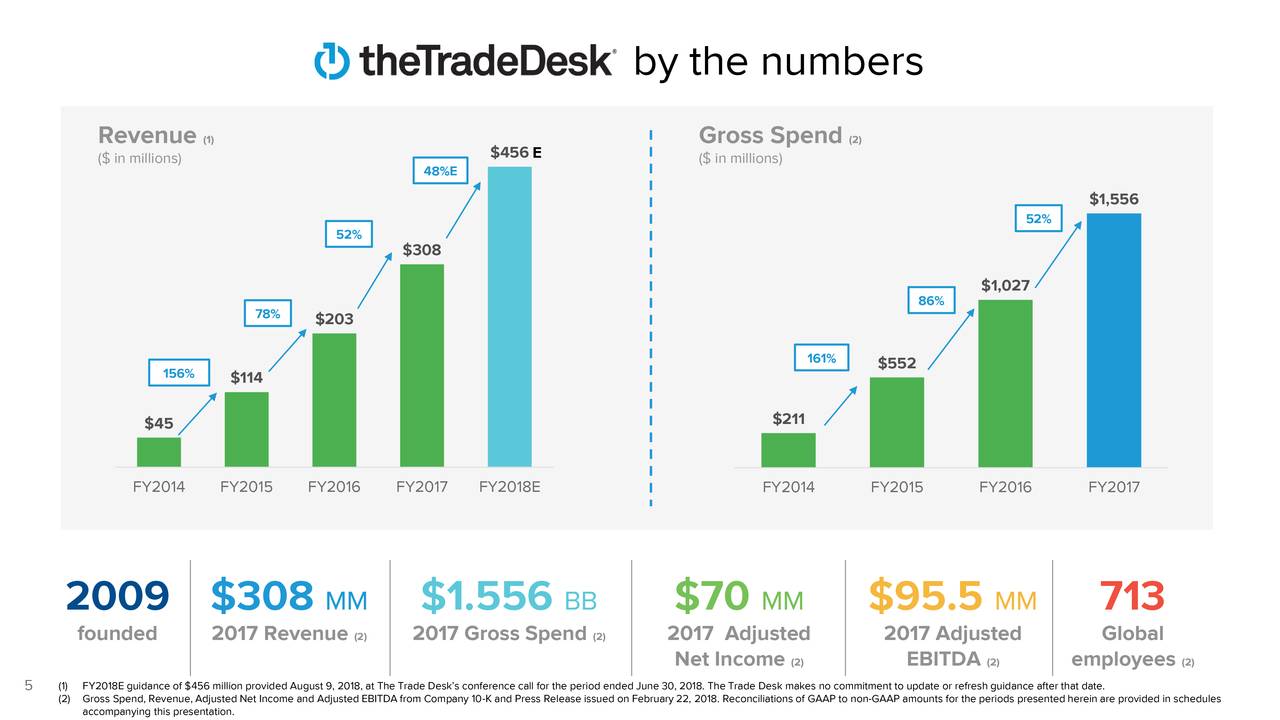

The biggest tailwinds for The Trade Desk come from the shift towards data-driven automatic digital advertising, or programmatic advertising. From the earnings deck:

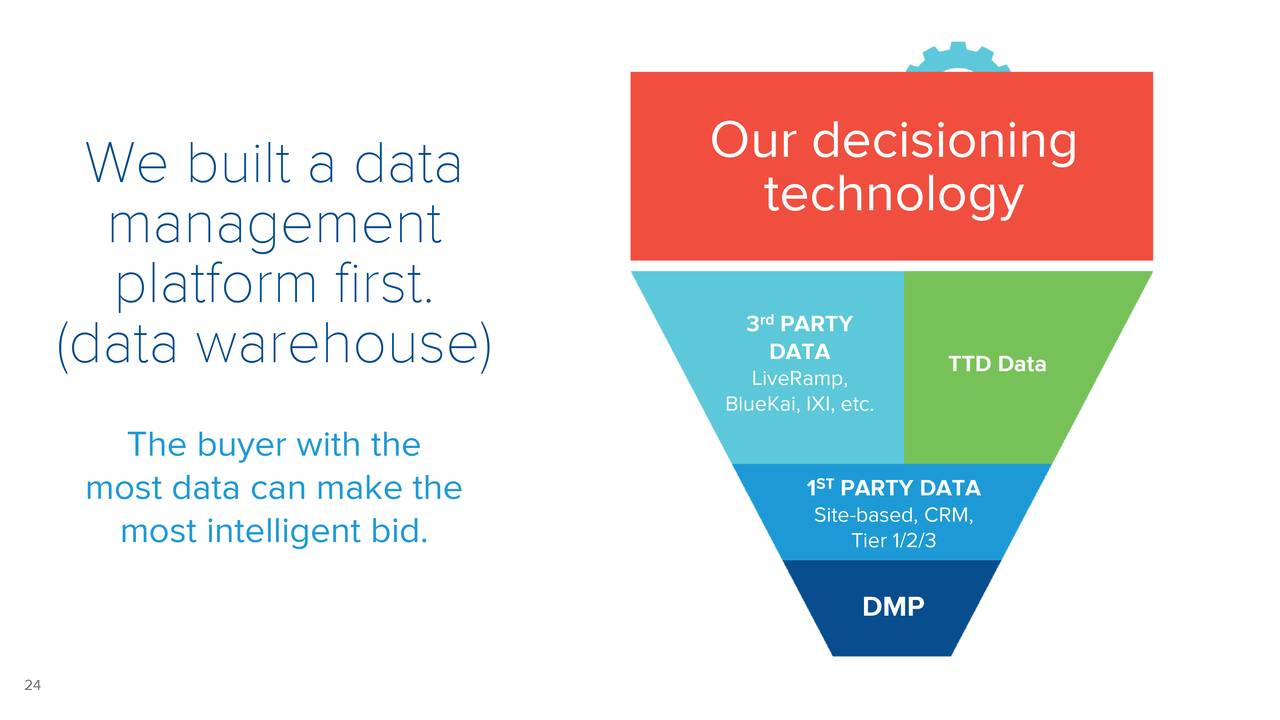

The company makes this simple for its clients (ad agencies and brands) with the DSP (Demand Side Platform), which bids automatically on ad exchanges for strategic placement of ads driven by data.

The reason for this shift is simple - it's more effective, as data-driven ads can be much better targeted. Programmatic is growing at 21% a year, but The Trade Desk is growing much faster than that (54% in Q2 y/y).

Management is especially optimistic that the company's new platform, The Next Wave, will be instrumental in taking market share in the fastest-growing segment in advertising, which is Programmatic (which is just 2% of the entire ad market).

CTV

While serving multiple channels (simultaneously, as multi-channel campaigns are another one of its strengths), the most important channel for the company is CTV. Here is management during the Q2CC:

Last quarter, we shared the most bullish number that I think we’ve ever shared as a public company. Q1 2018 CTV spend increased by over 21x over Q1 2017. This quarter I'm excited to report that Connected TV more than doubled from last quarter.

Mergers

Mergers, like the ones between AT&T (T) and Time Warner, and Disney (DIS) and Fox (FOXA) are accelerating the move towards CTV. But this shift fragments content distribution, which is playing in the hands of The Trade Desk.

At first it might seem odd that mergers lead to more fragmentation, but this is driving more content owners to open their own streaming channels and platforms. Management noted that there are probably more than 20 ways to watch ESPN, for instance. The Trade Desk benefits from this fragmentation, as management explains (Q2CC):

This is driving the increase in the number of content owners who are providing their inventory directly to us. Content owners can eliminate many steps in the distribution channels and monetize their ad inventory more directly and effectively. Our objectivity from not owning media ourselves makes The Trade Desk one of the most important partners to these TV content owners... TV distribution is more fragmented than ever as content owners in desperate need of ad revenues increasingly try to go direct to consumers. Internet TV - especially ad-funded Internet TV is all up for grabs.

We have seen the latter with Roku, for instance, but The Trade Desk is also benefiting from this a great deal, given the veritable explosion in CTV revenue.

Data protection

The proposition is pretty simple:

The buyer with the most data can make the most intelligent bid. There are a host of third parties which provide data, but many advertisers were looking at companies like Facebook and Google as repositories of the best data.

However, there has been a bit of a snag. First came the Cambridge Analytica scandal, then a new EU regulation for data and privacy protection.

Google reacted to this by not sharing the DoubleClick IDs with third parties, as that can be combined with personal data and potentially be exploited in malignant ways (think of Cambridge Analytica here).

As DoubleClick has about 75% of the global ad serving market, this is rather important, and it removes the DoubleClick ID as a comparative reporting tool (Q2CC):

The ID makes it possible for marketers to compare YouTube, Google and DBM performance to the other parts of their media plan. Taking this away weakens the value proposition of YouTube, Google and DBM.

The Trade Desk's platform does not use data that can be related to people (addresses, emails, phone numbers, social security numbers, etc.). From the Q2CC:

We don't store that, we don't use that, we don't ask for it, we don’t have search engine and we don't have a social networking site where we asked all these personal questions. We have no way to identify a user personally.

It's anonymous, and this now turns out to be an advantage (Q2CC):

Because The Traders Desk does not transact in directly identifiable consumer data and because we don't own a search engine we can provide a unified open ID that enables advertisers to compare every destination on their media plan to every other destination objectively. Agencies and brands see this and it is why impart we are winning spend... The choice for marketers could not be clear. Choose an objective partner with transparent reporting or choose higher walls where the publisher largely does the measurement.

Management argues it has already seen some benefit of this in Q2. And while the likes of Google are not sharing their IDs anymore, The Trade Desk says (Q2CC):

We have over 100 data and other value-added service partners in our platform, and while large competitors have stopped sharing their IDs and do not offer solutions for offline sales attribution, we provide advertisers a better path to understand how their marketing spend drives overall revenue growth for their companies.

Guidance

From the Q2CC:

For Q3 of 2018, we are expecting revenue of $116 million, an adjusted EBITDA of $33 million. And for the full year 2018, we now expect revenue to be at least $456 million, which approximates to 48% growth year-over-year, and the corresponding adjusted EBITDA to be $140 million or nearly 31% percent of revenue.

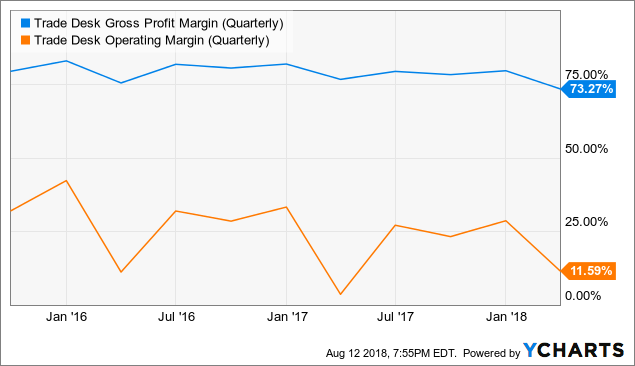

Margins

TTD Gross Profit Margin (Quarterly) data by YCharts

TTD Gross Profit Margin (Quarterly) data by YCharts

The figure doesn't yet include the Q2 margins, but we don't think it's all that important at the moment, as the company is still investing for the ample growth opportunities it is facing.

For instance, operating expenses grew from $53 million in Q2 2017 to $86 million in Q2 2018, a 62% growth rate, which is above revenue growth (54%). As a result, we think that cash flows are more important, because if the company would be bleeding cash, that is likely to dampen returns for shareholders down the line.

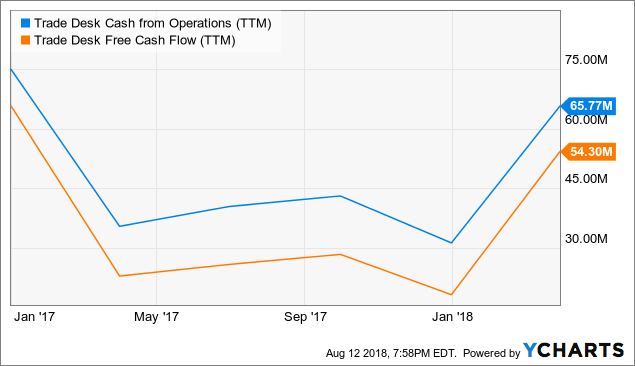

Cash

TTD Cash from Operations (TTM) data by YCharts

TTD Cash from Operations (TTM) data by YCharts

Again the latest quarter isn't included, but this is a reassuring graph nevertheless. More reassuring, from the Q2CC:

Net cash provided by operating activities was about $1 million for Q2 and our trailing twelve months of operating cash flow and free cash flow were $56 million and $42 million, respectively. We have zero debt on our balance sheet and our cash position exiting the quarter was $142 million.

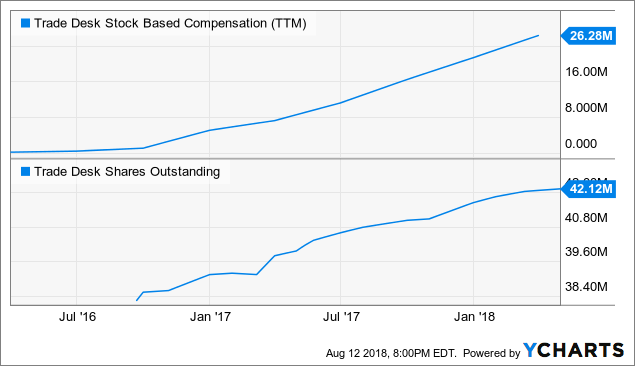

So no cash bleed despite the investment in growth. Quite the contrary, in fact. On the other hand, there is a little worm eating just a tad at shareholder returns down the line, which is share-based compensation and the dilution this causes:

TTD Stock Based Compensation (TTM) data by YCharts

TTD Stock Based Compensation (TTM) data by YCharts

The dilution is a little steeper than we had expected.

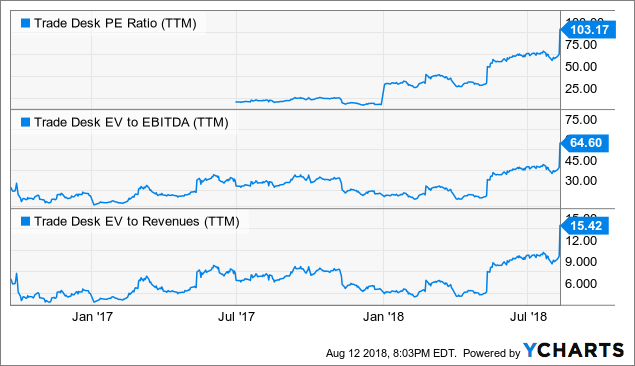

Valuation

TTD PE Ratio (TTM) data by YCharts

TTD PE Ratio (TTM) data by YCharts

There is no hiding from the fact that valuation is steep and double what it was just four months ago. Analysts expect EPS at $1.98 this year, rising to $2.41 in 2019.

Conclusion

The company is set to profit from a number of tailwinds, most notably the rise in programmatic ad and CTV. Smart management has entrenched the company in the middle of these, and it also benefits from scale economies, network effects. There are further beneficial developments, like an increasing concern about data privacy and a host of mergers fragmenting the CTV market landscape.

However, the shares are now rather expensive. While we're not terribly concerned, especially about the earnings multiple, this does give the company little room for error.

Despite the high valuation, we nevertheless see the tailwinds as continuing unabated for quite some time to come, so we are not selling a single share from the SHU portfolio and still see considerable upside, even if not quite at the torrent pace of the last three months.