Earlier in August, I asked myself whether "winter was over" for Texas-based retailer J.C. Penney (JCP). After all, the company had reported terrible results in 1Q18, in part attributed to a late start to the warm season that had theoretically pushed spring sales forward into the second quarter. I believe, however, that J.C. Penney was unequivocal in hinting that last quarter's troubles were much more rooted and severe instead, as 2Q18 earnings looked as discouraging as ever for the traditional department store chain. Credit: LA Times

Credit: LA Times

To be more specific, revenues of $2.83 billion missed consensus by the widest margin of the past five quarters, nearly 8% lower YOY. As bad as the sales contraction may have seemed, 2Q17 was the first quarter marked by numerous store closures, suggesting that total revenues should stabilize a bit going forward.

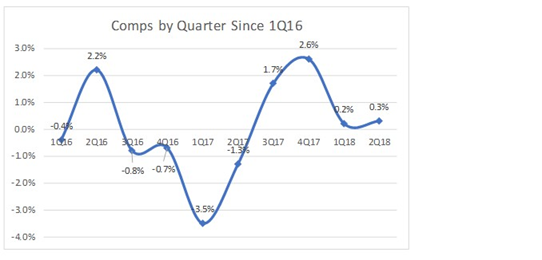

Less encouraging were comps of only +0.3%, which I find surprisingly low considering the expected timing shift caused by the delayed spring season. As the chart below illustrates, J.C. Penney's modest 2017 holiday quarter recovery off depressed late 2016 levels seems to have been short-lived. From the evidence gathered, it looks like J.C. Penney is still struggling to get its inventories in order, and the flushing of merchandising seems to have been at the core of pricing pressures that impacted not only comps but also profitability.

Source: DM Martins Research, using data from company reports

Source: DM Martins Research, using data from company reports

Speaking of profitability, gross margin of 33.7% fell well below last year's 35.3%, likely a consequence of heavy discounting. Such a trend goes against what more capable peers have been able to produce lately -- Macy's (M), for example, delivered YOY gross margin expansion of nearly one percentage point in 2Q18. At least GAAP opex pulled back a welcome 5%, not quite as much as revenues but already showing

Note from the author: If you have enjoyed this article, follow me by clicking the orange "Follow" button next to the header, making sure that the "Get email alerts" box remains checked. And to dig deeper into how I have built a risk-diversified portfolio designed and back-tested to generate market-like returns with lower risk, join my Storm-Resistant Growth group. Take advantage of the 14-day free trial, read all the content written to date and get immediate access to the community.