One Liberty Properties, Inc. (NYSE:OLP) is an interesting REIT income vehicle in the small-cap category. The real estate investment trust has put together a portfolio of commercial properties that produce more than enough cash to fund a generous dividend for shareholders. One Liberty Properties has a moderately low AFFO-payout ratio, suggesting that the company can maintain and grow its current dividend payout. Shares are not totally cheap, but also not overvalued yet, in my opinion. An investment in One Liberty Properties at today's price point yields 6.3 percent.

One Liberty Properties - Portfolio Snapshot

One Liberty Properties is a fast-growing commercial property REIT with an investment focus on retail and industrial properties. One Liberty Properties' real estate portfolio includes about 120 properties representing 10.9 million square feet. The REIT's lease portfolio throws off ~$71 million a year in rental income.

Here's a portfolio snapshot.

Source: One Liberty Properties Investor Presentation

Source: One Liberty Properties Investor Presentation

Industrial properties account for the lion's share of One Liberty Properties' contractual rental income: 37.3 percent. Retail properties come in second, making up 24.6 percent of annual rental income.

Here's a breakdown by property type.

Source: One Liberty Properties

One Liberty Properties is geographically diversified, having a presence in 30 U.S. states. Texas remains the REIT's most important market, consolidating more than eleven percent of contractual rental income.

Here are One Liberty Properties' five most important states in terms of rental income contribution.

Source: One Liberty Properties

Source: One Liberty Properties

One Liberty Properties' occupancy rate - a key indicator of the REIT's portfolio quality - consistently remained in the high 90-percent range in the last ten years.

Source: One Liberty Properties

Source: One Liberty Properties

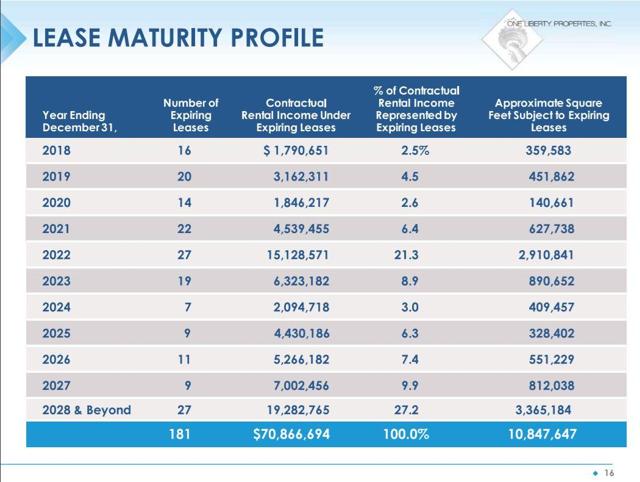

One Liberty Properties has a well-laddered lease maturity schedule. Only a limited number of leases expire in the next couple of years, giving the REIT plenty of time to roll over existing leases. The majority of One Liberty Properties' leases expire only after 2021.

Source: One Liberty Properties

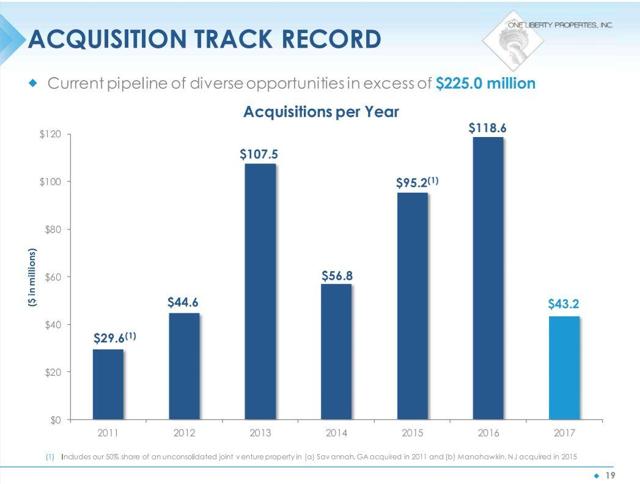

Acquisition-Centered Growth Strategy

One Liberty Properties regularly acquires new properties to add to its existing real estate portfolio. Since 2011, the REIT has spent an average of ~$71 million per year on property acquisitions.

Source: One Liberty Properties

Source: One Liberty Properties

On the back of One Liberty Properties' acquisition activity, rental income increased ~59 percent since 2012.

Source: One Liberty Properties

Source: One Liberty Properties

Dividend Coverage And Dividend Growth

One Liberty Properties has had stable dividend coverage in the last ten quarters, suggesting a moderately high degree of dividend safety. The real estate investment trust earned $0.52/share, on average, in adjusted funds from operations while it paid out only $0.43/share, on average. The AFFO-payout ratio over the last ten quarters averaged ~84 percent, leaving room on the table for a dividend hike.

Here are One Liberty Properties' major dividend coverage stats.

One Liberty Properties is a promising investment for DGI investors as the REIT has grown its dividend payout over time.

Source: One Liberty Properties

Source: One Liberty Properties

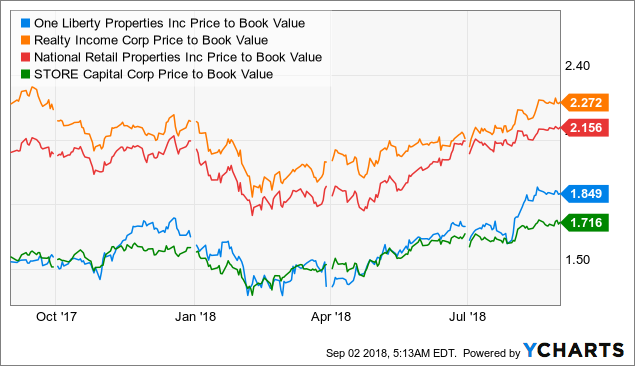

Valuation

Income investors currently pay ~13.3x Q2 2018 run-rate adjusted funds from operations in order to access the REIT's dividend stream, which I think is neither cheap nor overpriced. One Liberty Properties retains upside potential as its scales its real estate business through acquisitions and grows FFO going forward.

And here's how One Liberty Properties compares against its larger REIT rivals in the sector in terms of price-to-book ratio.

OLP Price to Book Value data by YCharts

OLP Price to Book Value data by YCharts

Risk Factors Investors Need To Consider

An investment in One Liberty Properties exposes investors to a bunch of risks:

- The U.S. economy could slide into a recession which could pressure on the REIT's dividend coverage stats as occupancy rates are likely to drop.

- U.S. commercial property values could fall and adversely affect the REIT's investment proposition.

- The trade dispute between the U.S. and China could heat up again, negatively affecting investor sentiment.

Your Takeaway

One Liberty Properties is a promising income vehicle for investors that desire a high dividend yield but would also like to see dividend growth. One Liberty Properties has an increasingly diversified property portfolio (geographic diversification increases as the REIT adds new properties through acquisitions), and the dividend has a moderately high degree of dividend safety. Importantly, One Liberty Properties is actively growing its dividend payout, which will appeal to DGI investors. Shares are not cheap and not overpriced yet. Buy for income and capital appreciation.

If you like to read more of my articles, and like to be kept up to date with the companies I cover, I kindly ask you that you scroll to the top of this page and click 'follow'. I am largely investing in dividend paying stocks, but also venture out occasionally and cover special situations that offer appealing reward-to-risk ratios and have potential for significant capital appreciation. Above all, my immediate investment goal is to achieve financial independence.