Report entitled “Every Day High Prices Guaranteed”

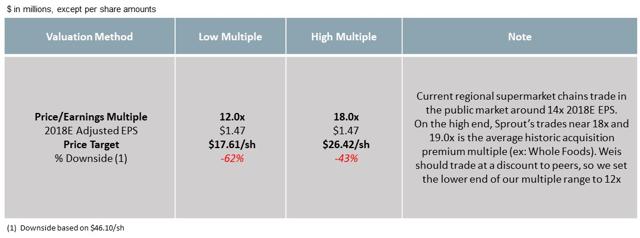

Spruce Point is pleased to release a unique forensic research report on Weis Markets, Inc. (NYSE: NYSE:WMK, "Weis" or "the Company") a northeastern regional supermarket. We believe Weis faces 45%-65% downside risk, or $17.60 to $26.40 per share, as a result of declining organic growth, margin pressures from price discounting, and difficult financial comparisons as a result of aggressive accounting changes that are temporarily inflating operating cash flow.

The complete research report can be found on our website at www.sprucepointcap.com. Spruce Point Capital has a short position in Weis Markets, Inc., and stands to benefit if its share price falls.

As part of this research, Spruce Point attempted to contact Weis Markets’ investor relations but received no response. Please review our full disclaimer at the bottom of this report.

Executive Summary

A Poorly Positioned Supermarket In An Increasingly Competitive Space:

- Not Aligned With Mega-Trends Affecting Supermarkets: We analyze key supermarket mega-trends and find Weis to be poorly positioned, particularly on price where it is increasingly competing against Walmart (WMT), Target (TGT), Costco (COST) along with ultra-low cost grocers Aldi and Lidl

- Proprietary Price Checks Validate Cost Concerns: We conducted price comparisons on a basket of staple food products. Weis’ prices were at a +19.7% premium to peers in 2017 vs. +15.6% premium in 2018. Weis is cutting prices and experiencing margin pressure. Convenience, followed by price, are the two main factors drawing shoppers to the local supermarket according to a recent NGA poll. Weis fares poorly on both.

- Numerous Sanitary, Pest Control Problems and Labeling Issues: An FDA FOIA shows issues with dead mice at Weis’ main distribution warehouse, and over 200 state inspection violations YTD in Pennsylvania. Multiple product recalls logged at the FDA suggest labelling and product control problems. (details below)

Evidence of Financial Strain Uncovered By Spruce Point Forensic Analysis:

- Evidence of Negative Organic Revenue Growth Being Obfuscated: In 2016, Weis turned to growth by acquisitions, acquiring 5 Mars Super Markets, 38 Red Lions, and Nell’s Family Market. In the same period, Weis systematically stopped providing disclosures about same-store sales metrics across product categories. Weis says growth in 2017 was “primarily” by acquisitions. Our analysis suggests that this statement doesn’t disclose the full truth. Absent acquisitions, revenues declined by -0.5% by our calculations . By further excluding fuel sales, core grocery and pharmacy sales declined by -1.1%.

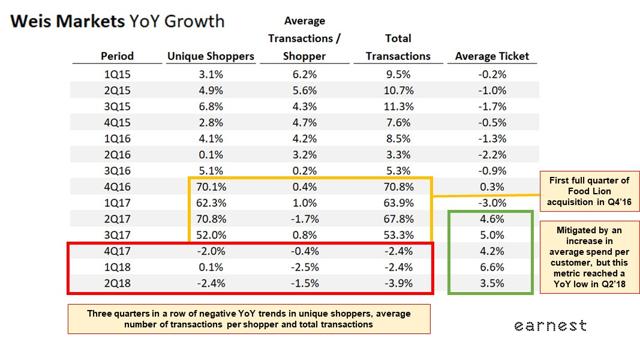

- Big Data Insights Validate Concerns: Spruce Point gleaned insights from Earnest Research on credit card panel data to investigate further. Recent quarterly data show a concerning trend of declines in unique shoppers, total transactions, and average transaction per shopper. Weis has been able to partially offset these declines with growth in average transaction size per customer, but recent data shows this metric slowing too. We also provide compelling evidence to show Weis has poor customer retention relative to grocery peers, and is likely losing customers to low cost leaders such as Aldi.

- Gross And Operating Profit Under Pressure, Now Accounting Changes Made: Gross and operating margins are key performance metrics for supermarkets. In 2017, gross and operating margins tumbled to near an all-time low of 26.7% and 4.6%, respectively. Management blamed it on the weather, but we believe structural and competitive issues are the true underlying cause. Weis has also dramatically reduced operating costs disclosures, despite an SEC comment letter asking for greater cost detail. Spruce Point often finds companies under pressure make accounting changes to mask results. Not surprisingly, in Q1’18 Weis disclosed that it changed its accounting policy for cooperative advertising costs. As a result, it reclassified costs from operating, general and administrative expenses to cost of sales to lower gross margins. This could allow Weis to deflect core margin declines.

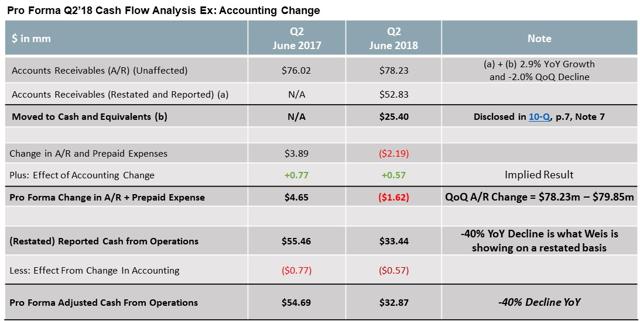

- Aggressive Accounting Change Artificially And Temporarily Inflates Operating Cash Flow: On the surface, Weis’ Q1’18 cash from operations looks impressive with 550% YoY growth. However, we find it moved accounts receivables to cash claiming that funds in transit under 7 days are cash equivalents. Based on our industry research, we disagree and believe its interpretation is very aggressive. Our pro forma analysis suggests that operating cash flow grew 74% YoY, substantially less than 550%. While on the surface impressive, the growth was further aided by depressed results in early 2017 from its acquisitions. We expect future cash flow comparisons to become significantly more difficult. In Q2’18, cash flow declined 40% YoY.

Shareholder Unfriendly Policies And Governance Concerns:

- Insider Buying Ahead of Accounting Change: Our worries about financial accounting gamesmanship are heightened by the fact that the CEO/Chairman purchased stock for the first time ever in Nov 2017 ahead of making the questionable accounting changes in Dec 2017.

- Auditor Turnover: As a cautionary sign, Weis is on its third auditor in just 4 years. E&Y has served as the auditor twice. In its last stint, E&Y was dismissed in 2016 after just 2 years (same year product level SSS metrics were suspended). E&Y’s first time as auditor it chose not to be reappointed.

- No Conference Calls: Weis provides little descriptive details of its earnings in press releases and doesn’t hold conference calls. Furthermore, in our opinion, quarterly Management’s Discussion and Analysis (MD&A) in SEC filings are insufficient to fully understand Weis’ financial performance.

- Insiders seem to be the main beneficiaries: The Weis family controls the Company. Weis has a weak board of just 5 members. This is facilitated by NYSE governance exemptions. For example, despite 2017 being the worst year in recent history, the compensation committee claimed 2017 was a “success” and approved a 10% and 15% salary raise to the CEO and CFO, respectively. Executives also use a corporate jet despite the fact that most supermarkets are within a few hours drive of company headquarters.

- A Deliberate Non-Equity Culture: Weis states bluntly that“The Compensation Committee does not believe that equity-based incentives are a valuable incentive for employees of the Company“. As a result, the entire executive team and Board (ex: Chairman/CEO Weis) own a laughable 17,604 shares (approx. $1m). Furthermore, there are no equity or option programs for rank and file employees to incentivize value creation.

The Most Expensive Supermarket In America Relative To Its Declining Growth Outlook And Poor Positioning, We See 45%-65% Downside Risk:

- Benchmark Analysis Illustrates A Suboptimal Company: We compare key financial metrics relative to other regional chains and find below avg results.

- Recent Financial Performance Unsustainable: The entire “earnings upside” in 2017 came from a one-time tax benefit and recent gimmicks used to optically improve operating cash flow – neither of which are sustainable and will create difficult year-over-year comparisons.

- New Capital “Growth” Plan Appears Deceptive, Won’t Move The Needle: In April 2018, Weis announced a plan to invest $101m in growth, including two new store openings. However, it failed to disclose it is closing three stores! The majority of the $ is for store remodels, supply chain improvements + IT upgrades - sorely needed to remain competitive. In other words, capital is directed toward maintenance and not store growth.

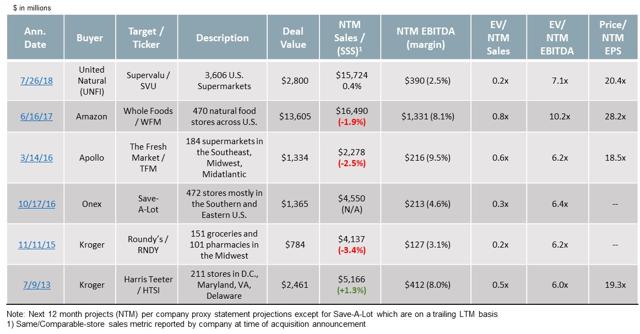

- Trading At Irrational Premium To Recent Takeover Multiples: Our analysis of recent regional supermarket takeout premiums suggest Weis would be fully valued at 0.4x, 6.4x and 19.0x estimated sales, EBITDA and P/E. Weis trades at 0.3x, 7.6x and 32x (our estimates) for a subpar industry player with below average margins. Weis reminds us of Tootsie Roll which was also trading at an irrational premium to its takeover value. Tootsie subsequently declined ~25%.

- Lack of Research Coverage To Say “Sell”: Weis has no analysts that cover its story, but we’ve followed it carefully and believe there’s nothing but downside. We expect margins to continue to contract as Weis is faced with the reality that it must be more price competitive to survive. Valuing Weis at a discount to peers to reflect its weak disclosures and financial profile, poor market position and governance, we estimate 45%-65% downside risk.

Weis Capital Structure and Valuation

Weis Share Price Up Double Digits YTD Despite Negative Organic Growth

Evidence of a Structurally Non-Competitive Regional Supermarket

Supermarket / Food Industry Trend | Challenge / Opportunity | Weis Positioning |

grocery products and succeeding | Consumers value convenience and price. One-stop shopping for basic groceries at places like Walmart, Target and Costco combine both | Weis cannot compete on price for basic food products with the supercenter retailers |

Sourcing and offering hyper-local food | Consumers increasingly want a connection to their food and know where it was made | Above Average With roots in Pennsylvania, Weis does have local products. It is also known for making its own ice cream, processes its meats and milk |

Ability To Connect With Millennials | Millennials will dominate the future of food buying and have grown up in the connected smart phone era. A new research study shows they devote less of their food budget to grocery stores purchases and make fewer trips to the store | Poorly Positioned Limited Twitter (8k), Instagram (3k) presences where most millennials spend time on Social Media |

Pre-Packaged Meals | Amazon now delivers groceries and moved into the physical market with the acquisition of Whole Foods. Pre-packed meal kits (think Plated/Blue Apron) represent a small but fast growing (25%+ p.a.) segment of the food industry | Poorly positioned Competitors like Giant Foods partnering with HelloFresh for instore pick-up. Blue Apron appears at Costco. Weis meal delivery partner Chef’d shuts down |

Instore Drinking and Dining | space for indoor dining | To Be Determined Main competitor Wegman’s has a cafe and offers a variety of gourmet options just like Whole Foods. Weis has a deli with limited sandwich options and just started testing beer-wine cafés in select stores |

Home Delivery | Food shopping has become all about convenience. Consumers expect the ability to use a smart phone to pre-arrange their orders for pick-up at the supermarket location or home delivery | Poorly Positioned Weis offers limited products for purchase online that can be picked up at the store. Its Apple mobile app has a terrible 1.5 stars. It has a limited home delivery partnership with Shipt |

Payment Technologies / Checkout | Industry experts see new payment methods like Apple Pay and Google Wallet to be adopted in supermarkets. Also, some are experimenting with scanning items via mobile phone or hand-held devices | Poorly Positioned Competitors like Amazon and Kroger’s are already rolling out self-scanning technologies. Giant Eagle using Scan Pay & Go |

Weis Markets: An Average Supermarket According To Consumer Reports

Difficult To Compete on Location In The Dense Northeast Region

In the intensely competitive supermarket space, we believe Weis Markets cannot compete on price, location or quality with faster growing and better value supermarkets in the densely populated Northeast corridor. In particular, we note that Wegman’s is a wildly popular and fast growing regional leader that was recently ranked the 2nd best company in all of America to work for behind Salesforce.com (1). Furthermore, the latest ASCI (American Customer Satisfaction Index) survey for supermarkets showed Aldi’s / Wegman’s ranked 3rd. Weis didn’t even merit consideration or analysis. (2)

Source: Company websites, comments from Glassdoor

Source: Company websites, comments from Glassdoor

Wegman’s Fortune Ranking ASCI 2017 report

Spruce Point’s Price Comparison Study Shows Prices 15% to 20% Higher Than Peers

According to a recent survey by Nielsen on behalf of the National Grocers Association, convenience, followed by price, are the two biggest factors drawing shoppers into the local grocery. We conducted a non-scientific study of Weis’ prices relative to peers. We find that its prices are on average 15%-20% higher. Weis’ prices decreased 8% relative to peers between mid-year 2017 and 2018. As a result, we expect Weis’ gross margins to be pressured in 2018. We relied on Pennlive’s price study for 2017 prices, and then took similar items to price them in 2018 to calculate our YoY price changes.

Objective of Study

To determine how price competitive Weis Markets are for a staple of food products relative to industry peers

Basket of Items Measured

Dairy: Eggs and Milk

Grains: Hamburger Buns, Cereal

Beverages: Orange Juice

Condiments: Ketchup and Baked Beans

Meat/Poultry: Ground Meat and Chicken Breasts

Locations Sampled

Southeast Pennsylvania, July 2017(2) and 2018

Competitors Analyzed

Mass Retailers: Walmart

Local Supermarkets: Giants

Low Cost: Aldi’s

Upscale Local: Wegman’s

Weis claims hardship in tracking prices or products sold, but we’ve done the work:

“Although the Company experienced retail inflation and deflation in various commodities for the years presented, management cannot accurately measure the full impact of inflation or deflation on retail pricing due to changes in the types of merchandise sold between periods, shifts in customer buying patterns and the fluctuation of competitive factors.” (10-Q, p. 12, May 10, 2018)

Below is a sample of the products we price checked:

Our analysis reveals that Weis has been 15% to 20% higher in prices than Peers. There is evidence Weis has lowered prices in the last twelve months

Insights From Big Data Also Suggest Struggles

Spruce Point sourced big data insights provided by Earnest Research, a data platform that creates consumer insight products for institutional investors derived from credit- and debit-card transaction data across 6 million anonymous, US-based consumers. Earnest’s data on ~42,000 Weis Markets customers shows that over the past three quarters, unique shoppers, average transactions per shopper and total transactions have declined YoY. Weis has mitigated these negative trends with an increase in average ticket price per shopper. However, in 2Q18 it posted the lowest YoY growth in recent quarters (3.5%).

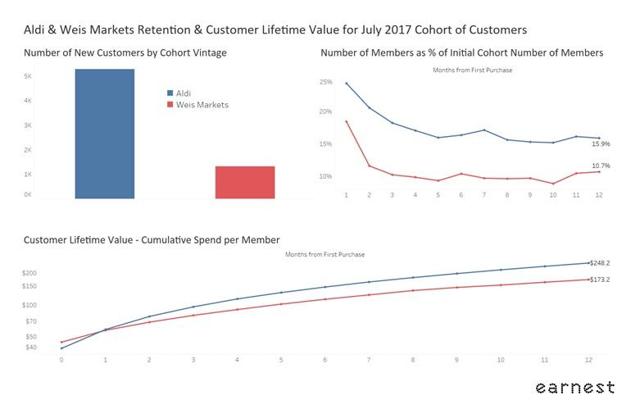

Aldi and Lidl continue to gain Weis customers. Earnest Research data shows 36.2% of Weis customers transacted at an Aldi in the 12 months prior to July 2018, up from 30.4% in July 2017 and 8.0% vs 0.8% at Lidl over the same period (n = ~42,000 Weis customers observed since July 2016).

Aldi drives superior retention of its customers. Below, an Earnest Research cohort analysis of new Weis and Aldi shoppers in July 2017 shows 15.9% of Aldi customers continued to shop at Aldi after 12 months versus 10.7% at Weis. Additionally, new Aldi customers are more valuable than new Weis customers. Within this cohort, on average, Aldi customers spent $75 more than Weis customers over 12 months ($248.20 at Aldi vs $173.20 at Weis).

Quality Control / Labeling and Pest Contamination Issues From FDA Recalls and Freedom of Information Request

A Forensic Look At Weis’ Financials And Accounting Suggest Strain

Weis provides limited commentary in press releases and its SEC Filings. What it does suggest is that business is fine. The Board even declared 2017 a year of “financial and operational success”; Spruce Point’s forensic analysis suggests otherwise.

Spruce Point believes there is no greater evidence of Weis’ financial struggles than the fact it has systematically stopped disclosing product level comparable store sales metrics. The greatest change in disclosure practices happened between 2016-2017 when its auditor was also changed.

Weis gives a potentially misleading view of its underlying sales performance in 2017. The Company says it attributes it sales growth “primarily” to acquisitions, but based on our analysis, all of its sales growth (and more) was attributable to acquisitions. In fact, our analysis suggests total sales declined organically in 2017 by -0.5% and core food and pharmacy sales declined by -1.1%.

Weis’ 2017 MD&A Discussion of Sales Performance Appears Misleading:

“The Company attributes the increased net sales primarily to the acquisition of 44 locations in the second half of 2016.” Source: 2017 10-K, p.13

By removing the sales contributions from acquisitions disclosed by Weis, we find that core grocery and pharmacy sales declined 1.1%

More Evidence To Suggest Q2’18 SSS Pressures

Weis’ negative SSS print in Q2’18 caught our attention because it blamed the results partly on Easter and the Fourth of July. We investigated the Company’s historical reliance on these holidays. While frequently citing Easter as impacting Q1/Q2 results, we found that that the last time Weis even mentioned the Fourth of July as material to results was 17 years ago in 2001. Looking carefully, we find that management inflated its comps in Q2 by acting as if $12.5m of lost July 4th sales occurred in Q2’18.

“The Company’s second quarter sales were adversely affected by holiday shifts on Easter and Fourth of July. The 2018 Easter sales week fell on the last week of the first quarter and the slow selling week afterwards fell in the second quarter this year. While comparatively last year, both holiday selling weeks fell in the second quarter. Additionally, the Fourth of July fell later in the week after the second quarter ended. Management estimates the incremental holiday sales impact was approximately $12.5 million and included it in the second quarter 2018 comparable store sales.”

Source: 2017 10-Q, p.9

The Last Time Weis Even Mentioned 4th of July In An SEC Filing 17 Years Ago:

“The decrease in inventories in this year is attributable to how the Fourth of July holiday shipping period fell this fiscal year compared to last year.”

Source: Aug 2001 10-Q, p.7

Weis is also giving less disclosures about its operating costs drivers. In Oct 2015, after questioning by the SEC in a Comment Letter, it agreed to provide more cost disclosures. Fast forward two years later, and Weis is back to giving minimal cost disclosure.

Unusual Timing For Two Recent Accounting Changes

Spruce Point has consistently warned to pay close attention to gross margins when evaluating a company’s financial health. It is a particularly important metric for analyzing supermarkets. Weis recently disclosed an accounting change at year end 2017 related to advertising credits that historically inflated gross margins. We pro forma adjust its results to better reflect reality. It is possible that Weis made this change to deflect underlying gross margin pressure and explain it away with the accounting change. Oddly enough, the only purchase ever made by Chairman/CEO Weis was in Nov 2017 ahead of the revision. (Source: insider purchase)

Per the 10-Q filed May 2018: “As of December 31, 2017, the Company changed its policy for advertising costs to expense advertising costs as incurred, net of vendor paid cooperative advertising credits, in Cost of sales… Management deems the policy change to record net advertising costs in Cost of sales instead of Operating, general and administrative expenses better represents Cost of sales inclusive of direct product costs (net of discounts and allowances), distribution center and transportation costs, manufacturing facility operations and advertising costs that are primarily funded by vendor cooperative advertising credits and occur in the same period the product is sold.”

Pro Forma Adjusted Gross Margins:

Weis also made a recent accounting change to accounts receivables to consider funds-in-process under a week as cash equivalents. By making this change, it will reduce its accounts receivable outstanding, artificially enhance its operating cash flow, and make its cash conversion cycle appear better. Weis’ MD&A discussion is also misleading as it does not call out the accounting change was a factor contributing to the $43m increase.

Per the 10-Q filed May 2018: “As of December 31, 2017, the Company changed its policy for cash and cash equivalents to include all credit card, debit card and electronic benefits transfer transactions that process in less than seven days in the amount of $31.4 million and $26.6 million as of March 31, 2018 and December 30, 2017, respectively. Management deems the classification of the amounts due from third-party financial institutions to be more appropriately reported in cash and cash equivalents due to certainty and timely settlement in less than seven days. The amounts have been reclassified from accounts receivable to cash and cash equivalents as of December 30, 2017 in the amount of $26.6 million to conform to the presentation of the Consolidated Balance Sheets as of March 31, 2018.”

The MD&A Discussion Does Not Reveal The Impact To Cash Flow: “Cash flows from operating activities increased $43.0 million in the first 13 weeks of 2018 compared to the first 13 weeks of 2017. Higher profits, lower inventories and lower management incentive payouts accounted for the increase in cash provided.”

Industry practice would suggest funds-in-transit for at best a few days, and not an entire week, is more appropriate

Company | Disclosure About Funds In Transit |

Company changed its policy for cash and cash equivalents to include all credit card, debit card and electronic benefits transfer transactions that process in less than seven days | |

Accounts receivable are shown net of related allowances and consist primarily of credit card receivables, vendor receivables, customer purchases, and occupancy-related receivables | |

Deposits in-transit generally represent funds deposited to the Company’s bank accounts at the end of the year related to sales, a majority of which were paid for with debit cards, credit cards and checks, to which the Company does not have immediate access but settle within a few days of the sales transaction. | |

Deposits in transit include sales through the end of the period, the majority of which were paid with credit and debit cards and settle within a few days of the sales transactions | |

Included in cash and cash equivalents are proceeds due from credit and debit card transactions, which typically settle within five business days |

Spruce Point believes part of what has driven Weis’ share price is the belief that its operating cash flow grew 550% YoY in Q1’18. However, by pro forma adjusting results for its aggressive accounting change to accelerate accounts receivables as cash, and a one-time long-term incentive payment to associates (cash flow drag) from Q1’17, we estimate the growth rate was 74%. Furthermore, we believe the Q1’17 cash flow was artificially depressed by three acquisitions made in Q3/Q4 2016. In Q2’18, cash flow declined 40%. We expect the cash flow comparisons going forward will be increasingly difficult to show growth.

With all of our analysis in mind, it’s worth noting that Weis is on its third auditor in the last four years. It also appears unusual to us that E&Y has served as its auditor twice, with the first time declining to be reappointed.

Auditor | Appointed | Dismissed | Note |

RSM | July 2016 | Current | |

Ernst and Young | Feb 2014 | Second stint with Ernst and Young as auditor ended in just 2yrs | |

Grant Thornton | Sept 2004 | ||

Ernst and Young | Jan 1996 | E&Y notified the Company that they did not wish to submit a proposal for the 2005 audit engagement and had also decided to resign as auditors for fiscal year 2004 effective immediately. |

Shareholder Unfriendly Policies and Governance Concerns

The Weis family controls 65% of the stock. Weis has a weak board of just 5 members. This is facilitated by NYSE governance exemptions For example, even when financial performance was at a multi-year low in 2017, executives did just great at the expense of shareholders.

Weis’ Compensation Committee Sees 2017 A Success Despite Negative Organic Growth

“Based on consideration of the criteria discussed above and the overall financial and operational success of the Company in 2017, the Compensation Committee made the decision to provide a salary merit increase, ranging from 4% to 14.9%, to the Named Executive Officers”“The Compensation Committee approved a 10.4% increase in base salary for the Chairman, President and Chief Executive Officer, Mr. Jonathan H. Weis in fiscal 2017”“ The Compensation Committee approved a 14.9%, 5.9.% and 4% increase in base salary for the Senior Vice President, Chief Financial Officer and Treasurer, Mr. Scott F. Frost, the Senior Vice President of Operations, Mr. David W. Gose II, and the Senior Vice President of Real Estate and Development, Mr. Harold G. Graber, respectively, in fiscal 2017”

Perks For A Company Where All Its Assets Are Within A Few Hours Drive of Its Headquarters

“For security purposes, Named Officers may use the Company aircraft for business and for limited personal travel.” Spruce Point requests that Weis tell its shareholders the last security threat received by a Weis supermarket executive, and if shareholders were reimbursed for personal travel

Despite Tough Times, Related-Party Dealing With The Chairman/CEO

“On January 16, 2018, the Company purchased a parcel of land from Central Properties, Inc., a company in which Jonathan H. Weis and his immediate family members have a material beneficial ownership. The purchase price of $1.1 million was approved by the Company’s Executive Committee in accordance with Company policy and regulatory guidelines, and reviewed and approved by the Board of Directors in accordance with the Company’s Code of Business Conduct and Ethics, the Code of Ethics for CEO and CFO, the Audit Committee Charter and the Company’s Related Party Transaction policy.”

Sources: Weis Proxy Statement, pp. 10, 14, 20

Among The Worst Return On Capital In The Industry

Weis’ executives have a cash incentive plan linked to “Modified Return on Invested Capital” (MROIC)”. It uses a non-standard definition that applies a 20x multiple to rental expense to calculate invested capital. (1) Nevertheless, if we take Weis MROIC definition at face value, and compare it with national and regional supermarket peers, we find it has among the worst MROIC in the industry.

Weis missed its target MROIC in 2017 by 2%. The threshold, target and maximum hurdles for MROIC in fiscal 2017 were equal to a result of 9.29%, 9.48% and 9.96%, respectively. Yet, recall the compensation committee gave executives a base salary pay raise saying performance was great

Kroger’s proxy statement (p. 29) references 8x rent expense multiple and it is a commonly accepted practice by credit rating agencies such as Moody’s to cap the multiple at 10x

Limited Employees and Management Alignment With Outside Shareholders

Weis states bluntly the following:“The Compensation Committee does not believe that equity-based incentives are a valuable incentive for employees of the Company“ (Source: Weis Proxy Statement) As a result, the entire executive team and Board (ex: Chairman/CEO Weis) own a minuscule 17,604 shares (approximately $1m). Furthermore, there are no equity or option incentive programs for any of Weis’ 23,000 full and part-time employees to incentivize value creation

Poor Capital Allocation Policies

Weis has a flexible capital structure with $93m of net cash, an underutilized revolver, and free cash flow. Yet it pays just a modest 2% dividend, and last raised the dividend 1c per quarter 7 years ago The Company hasn’t repurchased stock of any materiality in almost 18yrs, even during periods when its stock remained depressed

Valuation Downside Case

Weis does not hold conference calls, investor days, or have any traditional sell-side research coverage. Spruce Point has attempted to model its earnings given poor industry trends and net store closures in 2018. Given the high fixed costs of running a supermarket and high operating leverage, Weis revenue declines translate into significant earnings contraction

(1) Nottingham opening press release

(2) Weis opens a store in Randolph, NJ at the location of a failed A&P supermarket (source). Store opened July 19th

(3) Weis closed 43,000 sqft Oakland Mills June 1 st (Source: Baltimore Sun), closing 9,480 sqft Marshalls Creek Sept 1 st (Source: Pocono Record), and 52,000 sqft Selinsgrove Aug 10th (Sources: 1, 2). Note that the report says Selinsgrove was to close in October, but actually closed in August according to sources

We use Glassdoor reviews as a sentiment indicator. Only 31% of reviewers currently have a positive business outlook for Weis

Source: Glassdoor

Gross profit and square footage are key measures when evaluating a supermarket. Weis ranks below average on these measures relative to regional peers. We use these subpar operating metrics to anchor our below market valuation multiples.

Despite Suboptimal Performance Metrics, Weis Trades At A Premium Valuation To Peers

We use supermarket trading peers Kroger (KR), Ahold (OTCQX:ADRNY), Loblaw (OTCPK:LBLCF), Sprout (SFM), Village Supermarkets (VLGEA) and Ingles Market (IMKTA). Excluding SuperValu which is being acquired, and high growth organic market Sprouts, we find that supermarkets are trading around 14x P/E, whereas Weis trades closer to 32x (our estimated EPS)

1) Supervalu’s SSS metric is for its retail operation. Ahold Delhaize is weighted average of Ahold USA and Delhaize America. All other SSS are excluding fuel sales for an apples-to-apples comparison with Weis

Source: Bloomberg and Wall St Consensus Estimates, Spruce Point Research For Weis Markets

Comparable Acquisitions Further Support Weis Overvaluation

The acquisition of Whole Foods by Amazon (AMZN) (and entry into the Pharmacy market) has sent shockwaves in the supermarket industry. While not a representative valuation comparison for Weis, we analyzed recent regional acquisitions and find the average Sales, EBITDA and P/E multiple to be 0.3x, 6.4x, and 19.0x, respectively. In particular, the recent acquisition of Supervalu (SVU) is a very recent and visible valuation benchmark. However, Weis’ 4.8% EBITDA margin is below the deal peer average of 5.2% and we also believe organic sales are declining low single digits, which will drive EBITDA margin closer to 4.4%. Given suboptimal financial performance, poor disclosures and governance, Weis should trade at a discount to recent M&A valuation benchmarks.

There is no way to justify Weis’ current valuation in the context of its struggling financial performance, aggressive accounting changes inflating recent performance, declining disclosures, and terrible governance practices. Using a combination of current public valuations for supermarkets and historical acquisition multiples in the sector, it is easy to justify approximately 45% to 65% downside risk.

Summary of the Bear Case on Weis Markets

Disclaimer

This research presentation expresses our research opinions. You should assume that as of the publication date of any presentation, report or letter, Spruce Point Capital Management LLC (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our subscribers and clients has a short position in all stocks (and are long/short combinations of puts and calls on the stock) covered herein, including without limitation Weis Markets Inc. (“WMK”), and therefore stand to realize significant gains in the event that the price of its stock declines. Following publication of any presentation, report or letter, we intend to continue transacting in the securities covered therein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation. All expressions of opinion are subject to change without notice, and Spruce Point Capital Management does not undertake to update this report or any information contained herein. Spruce Point Capital Management, subscribers and/or consultants shall have no obligation to inform any investor or viewer of this report about their historical, current, and future trading activities.

This research presentation expresses our research opinions, which we have based upon interpretation of certain facts and observations, all of which are based upon publicly available information, and all of which are set out in this research presentation. Any investment involves substantial risks, including complete loss of capital. Any forecasts or estimates are for illustrative purpose only and should not be taken as limitations of the maximum possible loss or gain. Any information contained in this report may include forward looking statements, expectations, pro forma analyses, estimates, and projections. You should assume these types of statements, expectations, pro forma analyses, estimates, and projections may turn out to be incorrect for reasons beyond Spruce Point Capital Management LLC’s control. This is not investment or accounting advice nor should it be construed as such. Use of Spruce Point Capital Management LLC’s research is at your own risk. You should do your own research and due diligence, with assistance from professional financial, legal and tax experts, before making any investment decision with respect to securities covered herein. All figures assumed to be in US Dollars, unless specified otherwise.

To the best of our ability and belief, as of the date hereof, all information contained herein is accurate and reliable and does not omit to state material facts necessary to make the statements herein not misleading, and all information has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer, or to any other person or entity that was breached by the transmission of information to Spruce Point Capital Management LLC. However, Spruce Point Capital Management LLC recognizes that there may be non-public information in the possession of WMK or other insiders of WMK that has not been publicly disclosed by WMK. Therefore, such information contained herein is presented “as is,” without warranty of any kind – whether express or implied. Spruce Point Capital Management LLC makes no other representations, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use.

This report’s estimated fundamental value only represents a best efforts estimate of the potential fundamental valuation of a specific security, and is not expressed as, or implied as, assessments of the quality of a security, a summary of past performance, or an actionable investment strategy for an investor. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Spruce Point Capital Management LLC is not registered as an investment advisor, broker/dealer, or accounting firm.

All rights reserved. This document may not be reproduced or disseminated in whole or in part without the prior written consent of Spruce Point Capital Management LLC.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.