Michaels Companies (MIK) reported Q2 results not long ago, sending shares into yet another free fall. After listening in on the company's earnings call, we believe that the headwinds in the arts & crafts ("A&C") space are secular and underemphasized by management.

Source: Forbes

Even then, management is pursuing various strategies and initiatives - some of which seem attractive, with considerable potential in driving sales, traffic, and value in the long run. Combined with a heavily discounted valuation, from what we deem to be an overly pessimistic market sentiment, we see value in Michaels shares.

Q2 Analysis

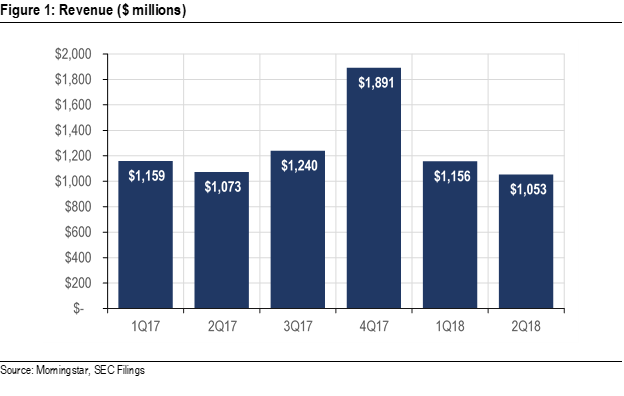

Revenue in the quarter came in at ~$1.05 billion, falling short of the analyst consensus by roughly $10 million. Compared to the same quarter in the previous year, revenue declined by $19 million or 1.9% y/y. Drivers here included an increase in average ticket size, outweighed by a decrease in transaction volume.

Additionally, comparable store sales declined by 40 basis points y/y. Management notes the impact of the 13-week quarter in FY17; when comparing 2Q17 and 2Q18 on a 13-week quarter basis, comparable store sales would have grown by 30 basis points.

In the quarter, the primary driver in revenue decline was the closing of 94 Aaron Brothers stores, which impacted sales to the tune of $27 million. This was offset by $8 million from operations, which in turn was from 21 net new Michaels stores opened in 2Q17. On a broader level, management highlights the stagnant industry which is seeing no growth in total sales, stressing that the issue is industry-wide, not company-specific.

An interesting topic management brought up - one that has been in the headlines quite frequently - is tariffs. We typically think of tariffs as impacting a company's costs, although Michaels' management notes how they believe it may affect consumer spending, and in turn, their revenue. The connection makes