In this investment essay, we will discuss Standard Diversified Opportunities (SDI), a publicly listed and diversified holding company with a current market capitalization of ca. $275 million.

SDI is a holding company and permanent investment vehicle of private equity investor Standard General, with excellent investment track record and serves as a platform to facilitate long-term value creation. Its current portfolio of Other Tobacco Products (OTP), billboard and insurance business is run by high-caliber management team with outstanding record of capital allocation. The company has good, long-term compounding prospects with capacity to grow from internally generated capital in the form of free cash flow and insurance float. The stock has good margin of safety at current levels and trades at a discount to its net asset value (based on sum-of-the-parts) as Turning Point Brands' (TPB) current market price is not reflected in the current price of SDI.

I got this idea when I was looking for off-the-radar, high-quality companies trading at attractive valuations. Turning Point Brands was one such branded consumer goods company whose investment thesis was posted by Maran Capital Management in their third-quarter 2017 newsletter. Though the TPB stock price is up ca. 1.4x over the past one year, investors can buy the company cheap indirectly through SDI which holds ca. 51% stake in TPB. The company's current portfolio consists of three major assets spread across three different industries with favorable growth prospects and run by superior management teams. In the first part of the write-up, we will discuss the investment merits of these assets.

#1) 51.2% stake in OTP manufacturer Turning Point Brands

#2) Standard Outdoor - Outdoor billboard advertising

#3) Pillar General - Auto, Property & Casualty insurer acquired in January 2018

#1) Turning Point Brands

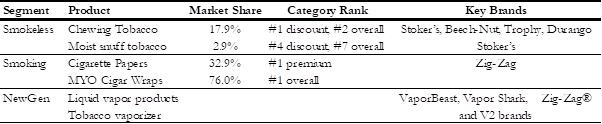

Turning Point Brands is one of the leading independent providers of OTP, where SDI holds a ca. 51% stake. TPB had sales of $285.8 million in 2017 and does not sell cigarettes. It has managed to build a leading portfolio of brands with broad customer appeal, and its key brands, Stoker's, Zig-Zag and VaporBeast, account for ca. 84% of 2017 gross sales.

Source: 2017 TPB 10-K

Asset-light business with superior capital returns and stable FCF: Turning Point has adopted a lean, asset-light manufacturing and sourcing model with low capex needs and utilizes outsourced supplier relationships. This arrangement provides marketplace flexibility and helped generate superior returns on capital. Further it helped generate stable free cash flows (FCF) given limited annual capital reinvestment needs of not more than $1 to $2 million.

Oligopolistic industry with stable unit growth: The other tobacco product market has an oligopoly industry structure with no irrational pricing behavior. Management estimates the OTP industry to have generated ca. $11 billion in manufacturer revenue in 2017. While cigarettes have been experiencing declining sales over the past decade, the OTP industry is demonstrating increased consumer appeal with low- to mid-single-digit consumer unit growth. Maran Capital Management in their third-quarter 2017 newsletter stated that:

"While the industry has pricing power that should provide a tailwind over time, penetration is a key component of the growth story. Stoker's moist snuff has 2.5% market share overall, but 6.8% share in stores in which it is being sold. The company notes that in-store share is highly correlated to the number of sales calls a store receives per year. TPB has added salespeople over the last two year to drive this penetration; they have incurred the upfront costs without yet seeing the benefits. Stoker's moist snuff is among the fastest growing brands in its segment. It is worth noting that Stoker's moist snuff has 2.5% share, which compares to Stoker's chew share of 16% - there is potentially a lot of runway to grow the Stoker's moist snuff brand organically."

Large runway for growth through acquisitions: TPB has a large runway to grow though accretive acquisitions at very attractive valuations. The OTP industry remains highly fragmented with more than 300 players at the low end, and rising regulatory burden is likely to force many of these smaller competitors to consider strategic alternatives. The small absolute size of these potential acquisitions likely leaves them off the radar screens of the majors. TPB is thus in an enviable position of seeking acquisitions in a market with little bidding competition on the one hand and "forced" sellers on the other.

Source: 2018 Annual Shareholder Meeting

Deleveraging post 2016 IPO along with strong FCF makes it well poised to carry out acquisitions: The company raised $54 million in an IPO, which was used to retire its high-yield debt, and it led to lower interest payment and rising FCF that can be deployed in value accretive acquisitions.

Source: TPB September 2018 Gateway Conference Presentation

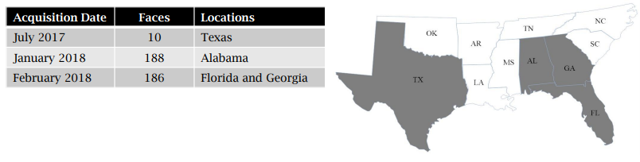

Since its 2016 IPO, TPB completed the following three deals:

Source: www.businesswire.com

These five Wind River brands had a market share of ca. 2% and available in only 25% of the market, which shows potential to sell these products to a larger universe of chewing tobacco outlets. VaporBeast is an e-commerce platform and sales organization mainly serving the evolving non-traditional channels of retail distribution. Vapor Supply is a leading B2B e-commerce marketing and distribution platform servicing vapor stores. It also markets proprietary e-liquids (DripCo brand), operates eight company-owned stores in the Oklahoma market area, and owns the eCig.com domain, which will be used to educate consumers on the growing dynamics of electronic cigarette space.

Excellent management team, strong sponsor backing, and aligned interests: The company is run by industry veterans Thomas F. Helms and Lawrence Wexler (own ca. 4.8% stake) who have prior stints at major tobacco companies. Thomas F. Helms founded the company in 1988 by acquiring certain loose leaf assets of Lorillard Wexler has been the CEO since June 2009. We believe interests are solidly aligned given that ca. 65% of CEO's 2017 compensation was variable and significant stake held by Standard General.

The other two assets are small and were acquired at the start of 2018.

#2) Standard Outdoor

Standard Outdoor is an out-of-home advertising business, which owns and operates 384 billboard faces located across Alabama, Florida, Georgia and Texas. According to the 10-Q filings, SDI had acquired ca. 174 billboard structures since June 2017 for a consideration of ca. $17 million. Management believes there is an attractive opportunity in this industry, which consists of three large nationwide players, a few medium-sized regional companies, and hundreds of independent sign owners.

Source: SDI Company Presentation

Simple business model: The business model is very simple; SDI generally owns the billboard structures, holds the permits for displaying, and leases the underlying sites. Its billboard structures are on properties it leases for 10 to 99 years with renewal or extension options, while its contracts with advertisers are typically short-term (one month to one year). The billboards aren't overly costly to run and maintenance is usually less than half of the total capital expenditure.

Industry characterized by high barriers to entry due to permitting restrictions: While traditional advertising models are vulnerable to competition from new supply, billboards aren't such an easy build, thanks to a 1965 law that limited new construction along federal highways and grandfathered existing inventory. Out of Home Advertising (OOH) is an attention-grabbing, non-invasive way of reaching consumers, and new technologies like mobile tracking and data make it more relevant. OOH advertising is connecting with consumers where they are, in the places they live, work, and play, and not disrupting what they're trying to do. As consumers become more desensitized to digital ads, OOH becomes a powerful option when done right. Similar to OTP products, out-of-home advertising business offers attractive industry fundamentals and growth opportunities, while other traditional advertising businesses are on a decline. According to Magna and Rapport, OOH is the only traditional medium that has been growing ad sales over the last 10 years and its revenue is predicted to rise by 3% to 4% per year in the next five years to reach US$33 billion by 2021 (vs. $29 billion now).

Value creation strategy: The company aims to create value by acquiring high-quality outdoor advertising assets with upside potential from strategic sales efforts and establishing regional operational hubs for managing these. It also aims to aggressively pursue growth through "tuck-in" acquisitions, new site development and digital conversion. Its key area of focus would be on markets dominated by local ad sales and establish relationships through direct market participation in these communities

#3) Pillar General

Pillar General is SDI's wholly owned, insurance holding company that acquired Interboro Holdings (parent company of Maidstone Insurance) for $2.5 million. Maidstone Insurance is an automobile, property and casualty insurer licensed to write business in 24 states with ca. 11,500 policies in-force and strong brand recognition in the New York market. Maidstone sources policies through a network of independently licensed and appointed agents and brokers and not market its products directly to consumers.

The Maidstone acquisition would be the first step in the planned build-out of its insurance platform, which came up with a float of ca. $50 million. SDI further invested ca. $10 million to bolster its capital position and plans to extend its products to homeowner insurance. The company is keenly focused on profitable underwriting in markets where there is a disconnect between pricing and risk, while simultaneously investing capital and reserves on its balance sheet to maximize returns.

It plans to adopt a two-pronged strategy to accumulate "safe" risk on both sides of the balance sheet: i) risk that can be underwritten with a margin of safety and ii) has potential to generate long-term capital appreciation.

Now let us come to the investment thesis and discuss the reasons to own the stock.

#1) Access to best-in-class private equity sponsor with excellent investment track record and no extra management fee:

Standard General owns 89% of SDI and is a New York-based investment firm that mainly manages event-driven opportunity funds. The fund was started in 2007 by two young stars of investment giant Och-Ziff Capital Management - Soohyung Kim and Nicholas Singer - with a $100 million seed capital from Reservoir Capital Group. It has managed to carve out a niche in the special situation space and has stellar long-term investment track record. The fund managed to come out of the 2008 global financial crisis unscathed. Though it was down ca. 6% in 2008, it avoided more severe losses, largely helped by its bearish bets against the stocks and bonds of companies in finance, gambling and media. After the market bottomed, the fund reversed course and placed large bets on the success of gambling and media stocks.

SDI is the permanent investment vehicle of Standard General and aims to create a diverse portfolio of scalable businesses by acquiring companies with sustainable cash flows and top-quality management teams. It targets businesses with an enterprise value of $40 to $400 million and is industry agnostic with a focus on: i) situations with "social issues", ii) distressed opportunities, iii) legacy holdings of private equity/asset managers, and iv) generational businesses.

#2) Scope to generate capital internally from strong cash-generating business and insurance float

TPB's business generated free cash flow (excluding interest) in the range of ca. $49 to $ 58 million over the past three years. While the billboard business has still not reached the scale and size to generate meaningful FCF, it can use excess cash from TPB for its own investments.

Insurance float would also emerge as one of its key sources of additional investable funds. It should be noted that property and casualty insurance generates a larger amount of float, and in extreme cases, such as those arising from certain workers' compensation accidents, payments can stretch over many decades. A key event worth mentioning here is SDI is moving its office to Maidstone's former headquarters, pointing to the strategic importance of its insurance platform.

#3) Margin of safety as TPB's current market price is not reflected in the current price of SDI

Based on the sum-of-the-parts analysis framework provided in the company presentation and updating it for the recent share price movements, we believe that the stock has a good margin of safety at the current levels.

Source: SDI Company Presentation

At TPB's current market price of $ 43.57, SDI's 51% stake is valued at $ 415.8 million, which is ca. 66% premium to SDI's current price.

In conclusion, SDI is a cheap way to play TPB and invest alongside a reputed private equity sponsor without paying management fee or carry.

Key risks to our investment thesis

SDI faces the following risks in terms of operating the portfolio companies and running the fund:

#1) Poor capital allocation decisions and pricey acquisitions.

#2) Failure to integrate the acquisitions and inability to scale up its billboard and insurance business.

#3) Rising competition in OTP products business.

The other major risk is the market failing to recognize the valuation mismatch due to its small capitalization and lack of sell-side coverage with price discount staying for long. Also, the low stock liquidity and trading volume could lead to higher price volatility.