In the quest for selecting the best REITs to own, I am constantly scanning the universe to find companies that can move the needle based upon their scale advantage and cost of capital advantage. Just last week I wrote an article explaining:

“Although they are not entirely exclusive (scale and cost of capital), REITs that generate the best long-term performance have typically demonstrated that they must capitalize on both (scale and cost of capital) to become the greatest moat-worthy REITs.”

The problem of course is that many of the so-called “blue chips” are not cheap, and in fact, most are expensive. Investors typically turn to the highest quality names first, and that’s why I spend a lot of my time looking for the REITs that fly under the radar.

That’s precisely what I am doing today, and the reason that I decided to peel back the onion of RLJ Lodging Trust (NYSE:RLJ).

As my loyal readers know, I have been screening the Lodging REIT sector feverishly, hoping to uncover another gem like Ryman Hospitality (RHP), up 27% year-to-date. Last week, I introduced a new name, CorePoint Lodging (CPLG), and I also decided to check in on Chatham Lodging (CLDT), with this article.

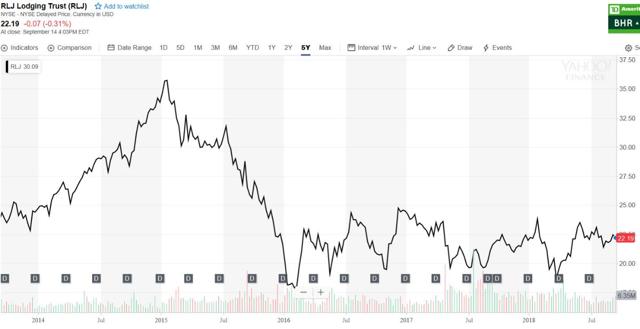

It’s been a while since I published an article on RLJ, over three years, and what impressed me the most with this REIT was the robust dividend growth history. However, since my last article (2015), RLJ has not grown its dividend and Mr. Market hasn’t been impressed.

But as I said, I’m looking for diamonds in the rough, and perhaps RLJ could become a prime-time player.

A few notable updates (since my last article): it’s been over a year since the company acquired FelCor Lodging Trust, making RLJ the fourth largest lodging REIT, and more recently, RLJ appointed Leslie Hale as the company’s CEO (was CFO and COO and has been with the company for 13 years).

So let’s get down to business and determine if there’s value in RLJ, or as Warren Buffett explains, “Your premium brand had better be delivering something special, or it's not going to get the business”

RLJ Invests In Premium-Branded Hotels

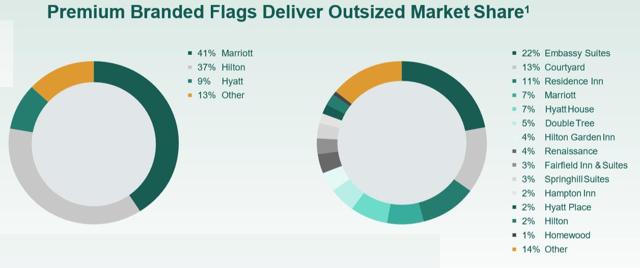

RLJ owns a ~$7 billion diversified portfolio that’s comprised of high-quality, high-margin, premium-branded hotels that generate superior RevPAR and outsized market share. Marriott, Hilton, and Hyatt brands account for ~90% of RLJ’s Hotel EBITDA.

1. 2017 pro-forma statistic for the 155 hotels owned as of May 31, 2018.

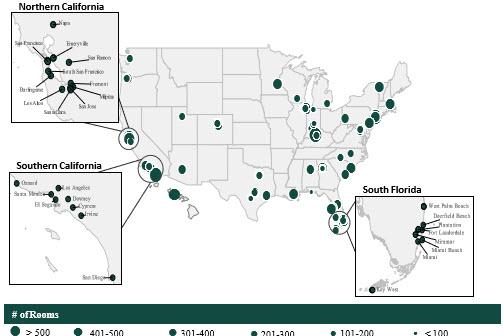

RLJ owns 154 properties that consist of 30,005 hotel rooms with almost $600M in Hotel EBITDA across 26 states.

As noted, RLJ acquired FelCor last year and the combined company continues to execute on its stated strategy post FelCor merger; it has outperformed peers:

Scale advantage is critical to REIT success and RLJ has demonstrated significant cost savings through corporate and operational synergies:

RLJ continues to execute its disposition strategy, having sold almost $300 million FelCor hotels at a weighted average multiple of 15.2x. The company expects incremental proceeds of $200-$400 million from the second round of asset sales in 2018. The company is on target to sell five remaining non-core FelCor hotels by Q1-19 and the portfolio EBITDA margins should improve by 90 bps and RevPAR index by 62 bps as a result.

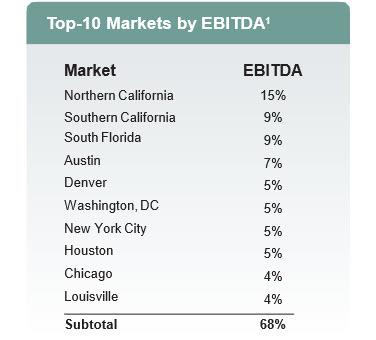

RLJ has enhanced its portfolio by strengthening its presence in long-term high growth markets, improving diversification by entering several new markets and refining the business mix. RLJ’s top 10 markets account for 68% of EBITDA and no individual hotel accounts for more than 2.4% of Hotel EBITDA (as of 12-31-17).

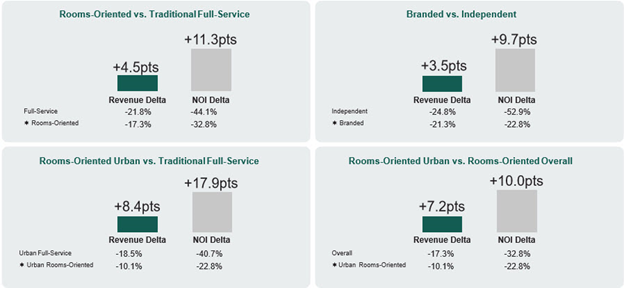

Rooms-oriented hotels in urban markets and premium brands have lower volatility and outperform in challenging economic environments, as illustrated below:

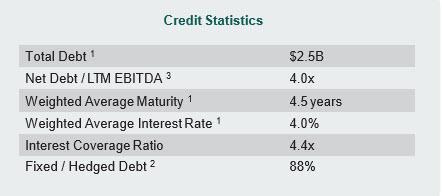

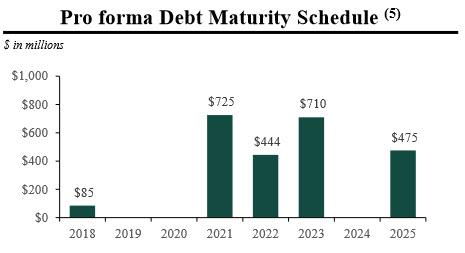

The Balance Sheet

RLJ ended Q2-18 in a strong position with nearly $400 million in unrestricted cash, $2.5 billion of debt outstanding and a net debt-to-EBITDA ratio of 3.9x. Using asset sales proceeds, RLJ paid down $100 million of debt subsequent to the quarter and further strengthened the balance sheet.

Through Q2-18, RLJ reduced debt by $375 million, which represents 75% of its stated objective of reducing debt by $500 million in 2018. RLJ’s liquidity position remains strong, with ample capacity to support various capital deployment priorities and cover the dividend.

RLJ’s renovations remain on schedule and on budget and the company “expects renovations to have approximately 100 basis points of impact on 2018 RevPAR growth”.

The company said it was “on target to achieve balance sheet objectives” and is “only $125 million away from achieving its stated goal of paying down $500,000 of debt and has already achieved its targeted net debt-to-EBITDA ratio of 4x.”

The Latest Earnings Results

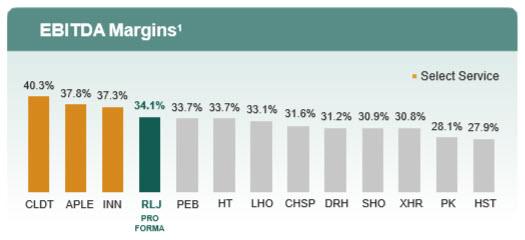

RLJ’s portfolio generated solid EBITDA margins of 35% during Q2-18 that translated into robust corporate financial results: Adjusted EBITDA of approximately of $160 million and adjusted FFO of approximately $128 million, or $0.73 on a per share basis for the quarter.

The company posted solid RevPAR growth of 1.3% in Q2-18 influenced by the timing of holidays, with April benefiting from the Easter shift, which led to strong RevPAR growth of 3.7% in the month followed by largely flat results in May due to the impact of the tropical Storm Alberto, which hampered demand over the Memorial Day weekend. June then benefited from the Fourth of July falling on a Wednesday, which resulted in positive RevPAR growth of 0.5%.

RevPAR guidance was unchanged and Hotel EBITDA is expected to be between $555 million to $586 million. Adjusted EBITDA is expected to be between $519 million to $550 million. RLJ expects Hotel EBITDA to be approximately 25.25% to 25.75% of the full-year Hotel EBITDA.

This Premium Brand Should Shine

Premium brands generate superior RevPAR, outsized market share and higher margins through superior distribution networks and loyalty base:

RLJ has extensive experience in re-development, creating value through complex renovations and conversions, and the premium flags within the primary brand platforms and segments generate outsized Rev PAR index.

Marriott, Hilton and Hyatt brands account for nearly 90% of RLJ’s EBITDA, all top ranked flags per JD Power (over 75% of EBITDA with brands that rank within the top 5 of the JD Power 2017 North American Hotel Guest Satisfaction rankings).

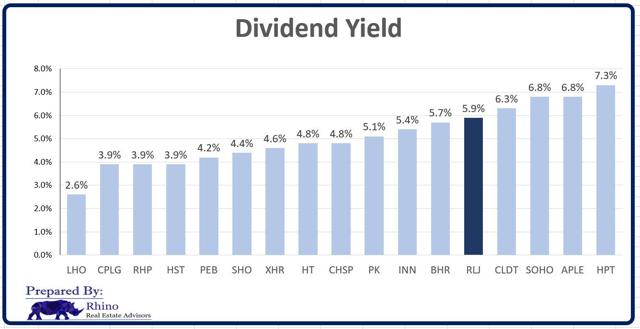

Now let’s consider RLJ’s valuation metrics, starting with dividend yield:

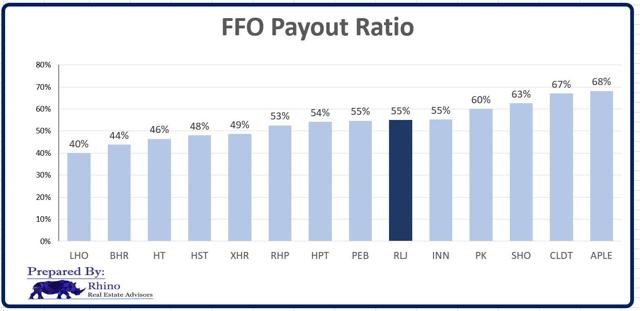

As you can see, RLJ has an attractive 5.9% dividend yield; let’s compare the payout ratio:

Now consider RLJ’s P/FFO multiple, compared with the peers:

As you can see, RLJ is trading well below the direct peers and is only cheaper than Braemar Hotels (BHR), Sotherly Hotels (SOHO), and Hospitality Properties Trust (HPT). I find this valuation metric interesting and suggests that this REIT has room for multiple expansion.

As you can see, RHP and Park Hotels (PK) have delivered impressive price performance year-to-date and RLJ appears to be a perfect pick for the New Money Portfolio. The lack of dividend growth is concerning, but the recycling efforts should profit future fruits in the quarters ahead.

Keep in mind, my recommendation (STRONG BUY) is also based upon the broader macroeconomic growth data, including GDP and corporate earnings. RLJ’s properties cater to business travelers and there’s a direct correlation to corporate travel and lodging profitability.

Note: Brad Thomas is a Wall Street writer, and that means he is not always right with his predictions or recommendations. That also applies to his grammar. Please excuse any typos, and be assured that he will do his best to correct any errors, if they are overlooked.

Finally, this article is free, and the sole purpose for writing it is to assist with research, while also providing a forum for second-level thinking. If you have not followed him, please take five seconds and click his name above (top of the page).

Sources: F.A.S.T. Graphs, Q2-18 Earnings Transcript, and RLJ Investor Presentation.