Management in TherapeuticsMD (NASDAQ:TXMD) has been exercising options and selling shares one after another. Given an upcoming pivotal catalyst, the timing seems oddly suspicious. However, I believe these sales are pre-planned and nothing more than noise. Investors should focus on execution. And early numbers are positive.

Background of the insider sales

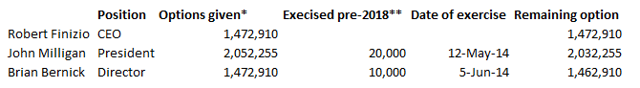

Table 1: Breakdown of options due to expire 1/1/2019

Source: *SEC filings for Finizio, Milligan and Bernick in 2011; **SEC filings for Milligan and Bernick in 2014 (options are exercised and not sold)

Founders of the company were provided with ~5 million options when the company was established via a reverse merger with AMHN Inc in 2011. These options are exercisable any time from 1/1/2012 to 1/1/2019. As seen in Table 1, the founders still have a significant chunk of their options left unexercised for over seven years.

With these options expiring in the next few months and an exercise price of $0.1018, any rational person will exercise these options before expiry. And that is exactly what happened with insiders selling a total of 1,050,800 shares at an average price of $6.4 as of September 28, 2018. An often overlooked detail is these sales have been executed via a 10b5-1 trading plan.

10b5-1 trading plan

A 10b5-1 trading plan is a strategy that allows insiders to arrange for shares to be sold at a predefined time, quantity and/or price. It is mainly used as a tool to ward off insider trading accusations. Given there is a number of upcoming catalysts, setting such a plan is the best option to avoid insider trading accusations.

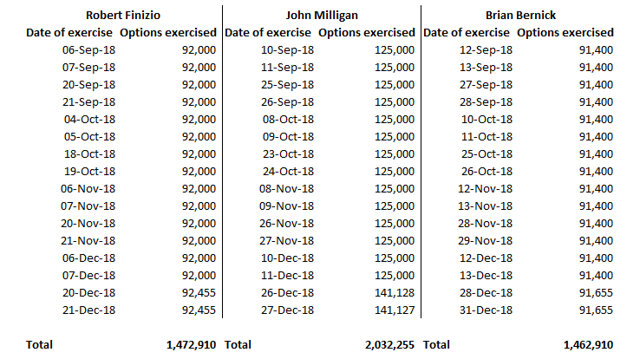

Table 2: 10b5-1 projected insider selling timeline

Source: SEC form 4 sales filings and internal projection for sales after 26 September 2018 (expect to see official SEC filing by next working day)

Investors can get a