You'd be forgiven for pondering whether now is an opportune time to buy the dip in emerging market assets and ex-U.S. assets more generally.

Even the Wall Street Journal has picked up on the "divergence" narrative. On Monday, the paper ran a feature story called "U.S. Stocks Widen Lead Over Rest of the World" the point of which is to highlight what I've been documenting for going on two months in these pages and elsewhere.

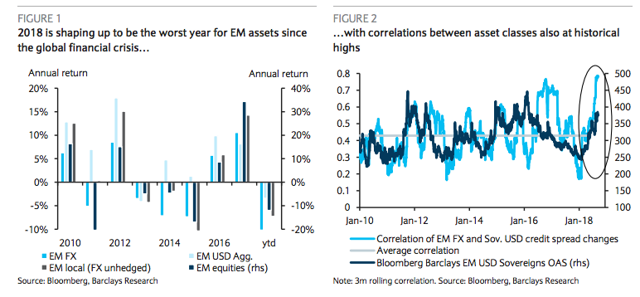

It's been a horrendous year for emerging markets (hereafter "EM"). Have a look:

While it was initially possible to argue that weakness in developing economy assets was primarily down to the effect idiosyncratic flareups (e.g., Turkey and Argentina) had on sentiment, it's become abundantly clear over the past six or so months that the proximate cause for the malaise is the Fed's tightening cycle.

Sure, country-specific risk is at play, but even if you want to suggest that sentiment wouldn't have turned so sour so quickly were it not for the collapse of the Argentine peso and Turkish lira, you run into a chicken-egg problem pretty quickly.

That is, was the combination of December's poorly communicated decision to up the inflation target and a couple of equally ill-advised policy rate cuts (in January) just too much for investors when it came to Argentina? And did market participants finally decide that enough is enough when it comes to Turkish President Recep Tayyip Erdogan's autocratic tendencies and unorthodox economic views? Or were Argentina and Turkey simply the wobbliest dominos in an environment where the post-crisis dynamics that drove investors out of the risk curve in search of yield are reversing thanks to Fed tightening? Again, it's a bit of a chicken-egg dilemma.

Whatever the case, what's clear is that Jerome Powell was mistaken when he said the