In this article, I will be covering a popular infrastructure related company that has performed poorly during 2018. Martin Marietta Materials (NYSE:MLM) supplies aggregates, cement, asphalt, etc for building and construction. Shares of Martin Marietta are down over 17% year to date, however I believe the stock is near a low and a rebound could be right around the corner. There is a disconnect between the stock price and the underlying fundamentals, which is an opportunity for investors. Martin Marietta is attractive because of the strong underlying fundamentals of the business, hurricane repairs and an appealing technical outlook.

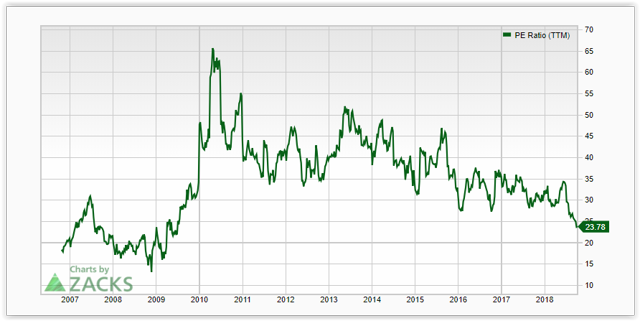

The knock on Martin Marietta has always been valuation. Historically the company has traded at a high PE; however the following chart shows the PE ratio is now at levels not seen since 2009. The situation is completely different now compared to 2009, given the record results the company has continued to post.

Zacks

Strong fundamentals

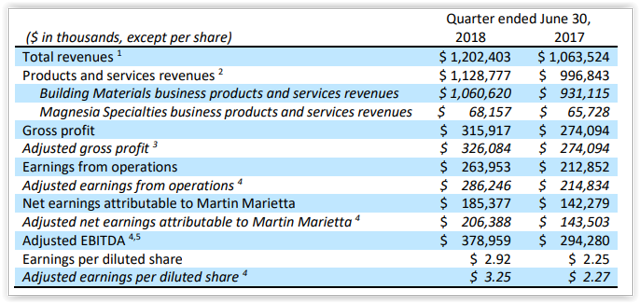

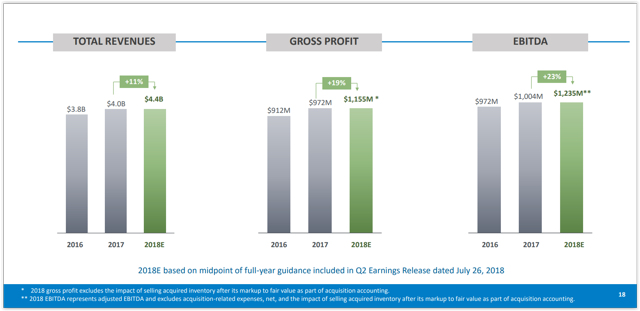

In the last earnings release, Martin Marietta noted that pricing and volumes were up, gross margins were up and the company increased their guidance. Even in the face of all these positives, shares have continued to decline, which has created this opportunity. The following table shows an overview from the earnings release and shows that all metrics showed improvement y/y. In addition, the second table shows in visual form that estimates for 2018 are expected to be a record for revenues, gross profit and EBITDA.

MLM Q2 2018 Investor presentation

Martin Marietta has a strong foundation for continued growth because construction spending is still below 2006 levels and should be a driver for future growth. There are always stories about the poor condition of the roads or the staggering amount of money needed to fix the aging infrastructure of the United States. I