After ripping through a half-dozen early posts over on my site Wednesday morning, I pivoted to this platform and put digital pen to digital paper in the interest of sounding the alarm for readers amid what, to my mind anyway, looked like a potentially dangerous selloff in U.S. equities.

That linked post began with the following disclaimer:

Let me say upfront that this comes with the usual caveat as regards intraday posts for this platform: Things could turn around by the time it's published.

I needn't have bothered. By the time the closing bell sounded on Wall Street, traders were sorting through the wreckage of an 800+ point dumpster fire in the Dow (DIA). It was the third worst point drop of the year, eclipsed only by the two 1,000+ point down days in early February. But the real story was the Nasdaq (QQQ), which had its worst day since Brexit.

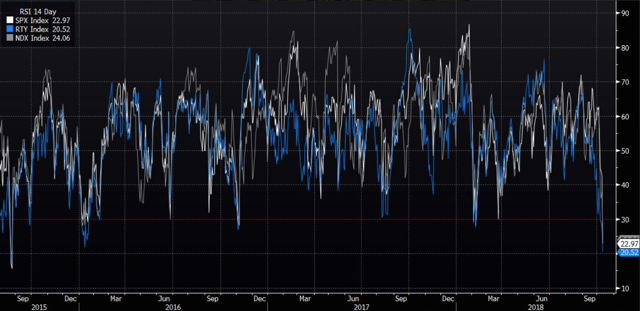

For what it's worth, the S&P 500 (SPY), Russell 2000 (IWM), and the Nasdaq 100 all ended in oversold territory. As the following visual shows, this is the first time that's happened since January 2016:

One of the things I tried to make clear in Wednesday's post (and really, this was the critical point), was that the anomalous character of the bond selloff is effectively exacerbating what would already be a precarious situation.

When rates rise rapidly (for instance, when 10-year yields jump by more than 2 standard deviations in the space of 30 days), you're likely to get selling pressure in stocks too. In the simplest possible terms, the key determinant of a flip in the equity rates correlation is the rapidity of the rise in yields. Recently, yields have risen rapidly enough to flip the stock-bond return correlation positive (equity-rates correlation negative). That's the narrative behind the weakness in