If you were to ask most people whether Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL) was a good investment, they would believe you were talking about a small, unimportant company that nobody had ever heard of. Had you instead mentioned Google, the very same person would have answered within seconds.

Due to the ever-expanding scope of businesses that Google had invested in, the Co-founder and CEO at the time, Larry Page decided to split Google from its non-core businesses and have it all under the holding company, Alphabet, so as to better control the core operations from the more risky (and unprofitable) ventures.

This creates a very interesting problem for someone who wishes to invest in Alphabet, since unlike many other companies that have one clear driving force for future growth, Alphabet has many. With many of the once insignificant sections now valued with a stand-alone valuation in the billions, I believe it is important to understand each individual part if you want to assess the value of the whole. Even when you look only at the components of the business under the Google name, the different areas from YouTube to search allow for many growth runways that should propel the company for many years to come.

I am finally going to use a Sum-Of-The-Parts analysis to come up with my fair price for the company today.

Alphabet: What does it contain?

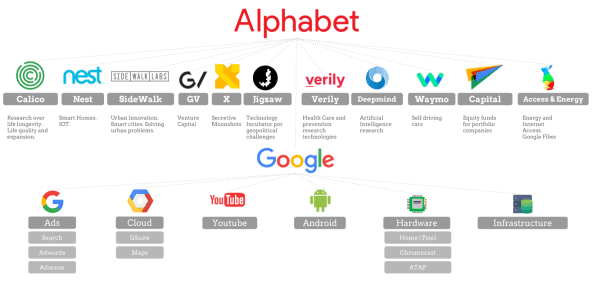

Firstly, I want to show what entities I am talking about when I mention Alphabet. As the above image shows, it comprises a vast array of industries from self-driving cars to the cloud. Although I can't talk about all of them, I aim to cover the ones I believe show the most potential to become very significant and leaders in their industries in the future, and will assign a value to all that already do (or could) contribute a sizeable amount to Alphabet's market cap in the future.

YouTube: 1.9 Billion strong

Unlike some of the other entities on this list, we can all agree that YouTube is a beast that deserves a huge valuation. With over 1.9 billion monthly active users, and over 180 million hours of content watched on the site daily, the only apps that can compare to its dominance are the ones owned by the social media giant Facebook (FB). Although Alphabet doesn't specify how much of Google's revenue comes from YouTube, analysts have predicted the number to be around $15 billion at the start of 2018, with Morgan Stanley predicting this to grow to $22.9 billion by the end of 2019. Since YouTube keeps 45% of the revenue from the platform and gives the other 55% to the creators, it is safe to say that their profits are between $5-8 billion at the least. This is why Morgan Stanley values the business at $160 billion, which given the growth in online video that has been happening over the last 5 years seems fair. When compared to competitors in the space such as Netflix (NFLX), which only made $11 billion in revenue and no profit last year, and yet has a market cap of around $145 billion and it is easy to understand why it should be valued so high. With annual growth in users at around 20% I believe that YouTube should continue to be a great asset for Google's ecosystem, and is worth $160 billion.

Waymo: The $150 billion wildcard

Moving outside of Google we have Waymo, Alphabet's self driving car division. Spun off into its own company in 2016, it is the undisputed champion in autonomous vehicles, with over 8 million miles driven in over 25 different cities, far outpacing any competition. They have over 20,000 different driving scenarios in their database and are well known as one of the safest and most reliable in the industry. But why does this give them a valuation of over $150 billion, more than the market cap of 3 Tesla's? The answer lies in the shear size this market is predicted to be in the near future, and how anyone who manages to perfect the technology needed for Autonomous vehicles first stands to benefit. As seen by this article here, which suggests that its valuation is over $175 billion, if Waymo can capture a big enough share of the driver-less taxi industry, along with the very lucrative logistics industry, they can easily expect a valuation in the range of $300 billion plus in 10 years time.

Although this is definitely a wild card for Alphabet, and one that assumes that they can keep their dominant position in this industry, I believe that it could end up being one of the main engines of growth for the company if they can take a big enough stake and transform these massive industries. This is why I give this a current valuation of around $150 billion, just below the $175 billion valuation from above.

Sidewalks lab- The smart cities of the future.

Unlike most of the other entities on this list, Sidewalks lab is very speculative and could end up being nothing - or a massive opportunity for Alphabet. The reason I say this is because of what they are trying to do: revolutionise the city for the 21st century. Although the video here explains their aims in far greater depth than I can, the basic idea is to create cities that use technology to create a better environment for whole communities . For example, buildings will be constructed in such a way so that they can constantly change to meet the city's purpose. If more parking is needed, a structure can be added to a preexisting building easily to implement it. If it is no longer needed, the space can be quickly changed into shopping space etc. Going further, AI would be implanted in every structure, from traffic lights to schools. This would allow the city to communicate with its self and function better than ever before.

This is just part of their ideas, which as I said are described in this video. They currently have permission to start designing in a small neighbourhood in Toronto, however if successful would scale up to encompass a much bigger area and eventually who cities. In terms of valuation, it is currently worth $1 billion or so at best, but give time has the chance to grow into a truly massive company worth tens of billions.

Search- Alphabet's profit machine and core.

Now onto the area of Alphabet we have all been waiting for. Google search, and the reason it is so profitable: Adwords. In a year, Google is estimated to have 1.2 Trillion searches take place on its platform, 72% of all worldwide searches every year (With the closest being Baidu (BIDU) in China at only 14%.) In Q1 2018, excluding the fine that they received (will talk about shortly) Alphabet had $32.3 billion in revenue and $7.8 billion in profit. Seeing that over 90% of Alphabets profits is known to come from Adwords, we can work it produced the company $29 billion and $7 billion in revenue and profits respectively, totalling around $120 billion and $30 billion for the full year (Q4 is typically more profitable than the rest.) Applying a PE of 25 to this, a more than fair number for their expected growth, and we get a total value for Adwords at $750 billion. After factoring the overlap that YouTube had with this, due to most of its value being derived from Adwords on its platform, and I get my fair value of Adwords or around $650 Billion

This doesn't factor how Google has been able to consistently increase prices on AdWords due simply to the fact that no better platform exists. For every $1 spent on Adwords, the customer makes $2 dollars in sales due to the advertisement. No other platform exists that offers the same level of control and value and this means customers continue to spend on it, despite the price rising considerably. This is why Adwords is worth so much and should continue being the backbone of Alphabets growth into the future.

(Google revenue increase overtime. Source: Statistica)

(Google revenue increase overtime. Source: Statistica)

Valuation

Before I give my final valuation of Alphabet based on the different parts of the company I would like to mention the areas I have missed. Most important are those such as Google Cloud and Android, which contribute a significant amount to Alphabet’s bottom line and which the company would be drastically damaged if they were to lose them. They are both multi-billion dollar businesses clearly should be taken into consideration when valuing the company. Despite this, due to the nature of Adwords, there’s a significant overlap between there earnings and those I have already mentioned. This is why so as to not over-complicate things, I have left them out of my valuation. Likewise, there are many other smaller ventures that do not yet influence Alphabet’s valuation significantly such as Deepmind, their AI division that I have left out, but could easily become valuable in the future.

With that out the way, my valuation for Alphabet comes to 160+150+650= 960 billion dollars for the whole of Alphabet. Based on their current valuation of of $770 billion, this gives them a potential upside of 25% from their current valuation to fair value, based primarily on my value of YouTube, Waymo, and the money generated from Adwords, and excluding any overlap that occurs.

Risks

Since I believe they are valued at a 25% discount to fair value, the market may be factoring some risks that my valuation doesn't allow for.

Firstly, as I mentioned in my earnings for Adwords, Google suffered a $5 billion fine last quarter due to regulatory fines due to anti-trust concerns. Although this in itself doesn't create a huge problem for the company since it is only a one off problem, if Alphabet cannot mitigate these in the future and they become a regular occurrence, it would create a drag on their earnings that would hurt my valuation. With the company appearing very lax when it comes to privacy concerns, such as the fact it didn't sent anyone to the recent senate meeting on the matter, my worry is that regulators could get more tough on the company as they have done with Facebook. This is a risk worth monitoring.

Another risk is Apple (APPL), not in the operating system war that we typically associate the two with - Android has been gaining market share on IOS for the last couple of years and shows no sign of slowing down. I am instead talking about how Google has to pay Apple each year to remain the default search engine on its platform. Although this hasn't been too big of a problem, with the company making far more back than the couple of billion it has to pay them, Apple is now using their position to charge Google far more, giving them no choice but to pay up. They are rumoured to have to pay $9 billion this year, and $12 billion next, up from around $3 billion previously. This could affect Google's profits significantly, however I believe that Apple won't push them too far since they have little to gain from losing Google - Customers like it and they can pay far more than any others would be willing to. This shouldn't be a huge concern.

Finally, Alphabet currently has a pile of cash totalling just shy of $100 billion. Although having this money is hardly something to worry about, investors should wonder whether the company is going to start paying a dividend soon. Although I still believe they have a good few years of growth ahead of them, they will eventually reach the point of matured status where share appreciation alone won't be enough to justify buying the stock. Starting a dividend now would allow them to establish a history of paying one and would let dividend only hedge funds invest in the company, along allowing for less volatility in the share price.

Conclusion

In conclusion, Alphabet is a great company with many growth prospects that should allow the company to grow into the future:

- 1.9 billion user strong YouTube

- The leader in self-driving cars - Waymo

- The platform that 1.2 trillion searches - 70% of all internet traffic - Google.

- The cloud, Android, and many other ventures, such as smart cities.

This is why Google... or for that matter Alphabet is a great buy with a 25% to fair value.

If you enjoyed reading be sure to follow and comment below.