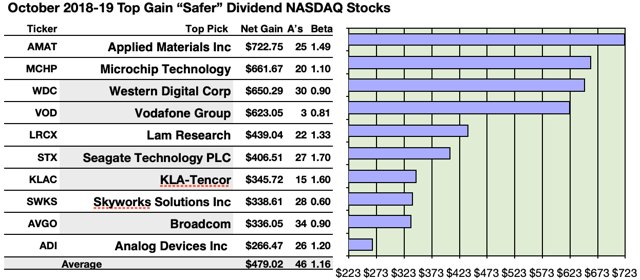

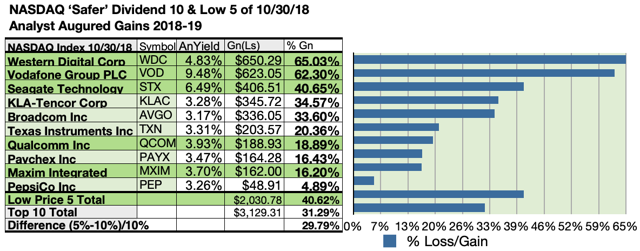

Actionable Conclusions (1-10): Brokers Forecast Top Ten NASDAQ "Safer" Dividend Stocks to Net 26.65% to 72.28% Gains By October 2019

Five of the ten top yield "safer" dividend NASDAQ stocks (with name backgrounds tinted grey in the list above) were scattered in with the top ten gainers for the coming year based on analyst one-year target prices. Thus, the yield strategy for this group as graded by analyst estimates for October turned out 50% accurate.

Projections based on estimated dividends from $1,000 invested in the highest yielding stocks and their aggregate one-year analyst median target prices, as reported by YCharts, created the 2018-2019 data points. Note: one-year target prices by lone analysts were not applied. Ten probable profit-generating trades projected to October 30, 2019, were:

Applied Materials Inc. (AMAT) netted $722.75 based on a median target price set by twenty-five analysts plus estimated dividends less broker fees. The Beta number showed this estimate subject to volatility 49% more than the market as a whole.

Microchip Technology (MCHP) netted $661.67 based on a median target estimate from twenty analysts plus dividends less broker fees. The Beta number showed this estimate subject to volatility 10% more than the market as a whole.

Western Digital Corp. (WDC) netted $650.29 based on dividends plus a median target price estimate from thirty analysts less broker fees. The Beta number showed this estimate subject to volatility 10% less than the market as a whole.

Vodafone Group (VOD) netted $623.05 based on a mean target estimate from three analysts plus dividends less broker fees. The Beta number showed this estimate subject to volatility 19% less than the market as a whole.

Lam Research (LRCX) netted $439.04 based on a median target price estimate from twenty-two analysts plus dividends less broker fees. The Beta number showed this estimate subject to volatility 33% more than the market as a whole.

Seagate Technology PLC (STX) netted $406.51 based on dividends plus a median target price estimate from twenty-seven analysts less broker fees. The Beta number showed this estimate subject to volatility 70% more than the market as a whole.

KLA-Tencor (KLAC) netted $345.72 based on dividends plus a median target price estimate from fifteen analysts less broker fees. The Beta number showed this estimate subject to volatility 60% more than the market as a whole.

Skyworks Solutions, Inc. (SWKS) netted $338.61 based on a median target price estimate from twenty-eight analysts plus projected annual dividends less broker fees. The Beta number showed this estimate subject to volatility 40% less than the market as a whole.

Broadcom (AVGO) netted $336.05 based on dividends plus a median of target price estimates from thirty-four analysts minus broker fees. The Beta number showed this estimate subject to volatility 10% less than the market as a whole.

Analog Devices Inc. (ADI) netted $266.47 based on the median of estimates from twenty-six analysts plus dividends less broker fees. The Beta number showed this estimate subject to volatility 20% more than the market as a whole.

Average net gain in dividend and price was 47.9% on $10k invested as $1k in each of these ten "safer" dividend NASDAQ 100 stocks. This gain estimate was subject to average volatility of 16% more than the market as a whole.

The Dividend Dog Rules

The "dog" moniker was earned by stocks exhibiting three traits: (1) paying reliable, repeating dividends, (2) their prices fell to where (3) yield (dividend/price) grew higher than their peers. Thus, the highest yielding stocks in any collection became known as "dogs." More specifically, these are, in fact, best called, "underdogs".

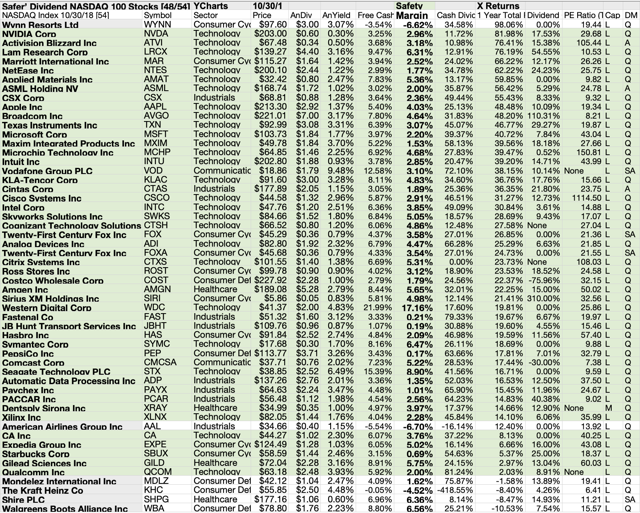

48 of 54 NASDAQ 100 Firms Showed "Safer" Dividends

Periodic Safety Inspection

A previous article discussed the attributes of the 54 constituents of this master dividend NASDAQ 100 Index list.

You see collected below the tinted list documenting 48 of 54 that passed the dividend dog "safer" check with positive past-year returns and cash flow yield sufficient to cover their anticipated annual dividend yield. The margin of excess is shown in the boldface "Safety Margin" column. The total returns column screened out 4 with sagging price returns.

Financial priorities, however, are easily readjusted by boards of directors revising company policies cancelling or varying the payout of dividends to shareholders. This article contends that adequate cash flow is strong justification for a company to sustain annual dividend increases to shareholders.

Three additional columns of financial data, listed after the Safety Margin figures above, reveal payout ratios (lower is better), total annual returns, and dividend growth levels for each stock. This data is provided to reach beyond yield to select reliable payout stocks. Positive results in all five columns after the dividend ratio send a remarkably solid financial signal.

Six of Eleven Sectors Show "Safer" Dividend NASDAQ Stocks

Six Morningstar sectors of eleven are represented by the 48 "Safer" members of the NASDAQ 100 Index. They showed positive annual returns and margins of cash to cover their dividends as October 30.

The "safer" dividend NASDAQ 100 Index sector representation broke out, thus: Communication Services (2), Technology (26), Industrials (7), Consumer Defensive (2), Healthcare (3), Consumer Cyclical (8), Basic Materials (0), Energy (0), Financial Services (0), Real Estate (0), and Utilities (0).

The first four industries listed above made the top ten "safer" dividend NASDAQ 100 Index team by yield.

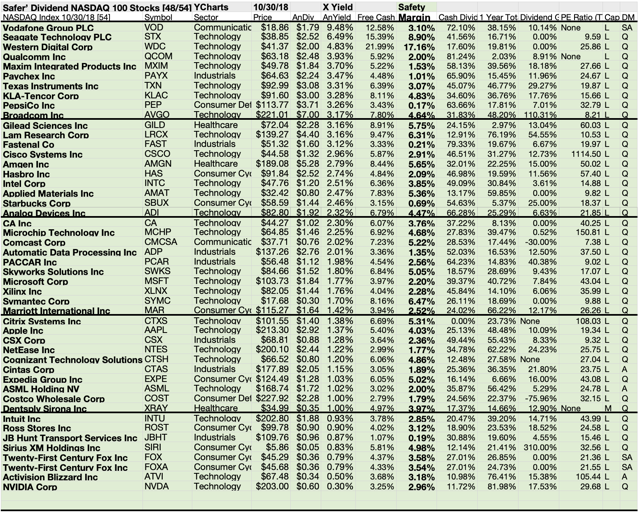

To quantify top dog rankings, analyst median price target estimates provide a "market sentiment" gauge of upside potential. Added to the simple high yield "dog" metric, analyst median price target estimates became another tool to dig out bargains.

Yield Metrics Revealed Real Bargains From Lowest-Priced 5 of Top 10 Yielding "Safer" Dividend NASDAQ Stocks

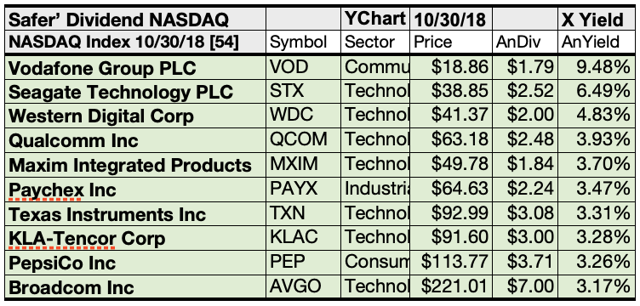

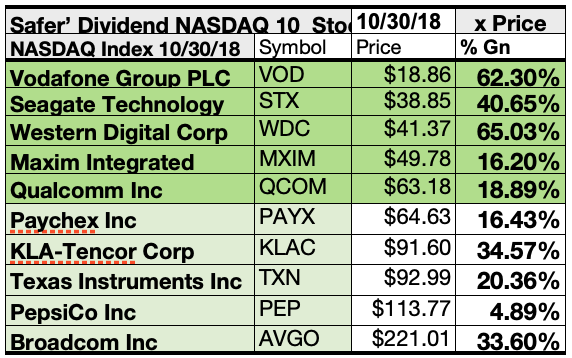

Ten "safer" dividend NASDAQ firms with the biggest yields October 30 per YCharts data ranked themselves by yield as follows:

Actionable Conclusions: Analysts Predicted 5 Lowest-Priced of Ten "Safer" Dividend NASDAQ Stocks Could Likely (11) Deliver 40.62% Vs. (12) 31.29% Net Gains from All Ten by October 2019

$5,000 invested as $1k in each of the five lowest-priced stocks in the "safer" NASDAQ 100 Index 10 pack by yield were determined by analyst one-year targets to deliver 29.79% more gain than $5,000 invested as $.5k in all ten. The third highest priced "safer" NASDAQ 100 stock, Western Digital Corp. showed the best analyst-predicted net gain of 65.03% per target estimates.

Lowest-priced five "safer" dividend NASDAQ 100 Index stocks as of October 30 were: Vodafone Group, Seagate Technology, Western Digital Corp, Maxim Integrated Products, Inc. (MXIM), and Qualcomm Inc. (QCOM), with prices ranging from $18.86 to $63.18.

Higher priced five "safer" dividend NASDAQ 100 Index dogs as of October 30 were: Paychex (PAYX), KLA-Tencor Corp, Texas Instruments Inc. (TXN), PepsiCo Inc. (PEP), and Broadcom Inc., with prices ranging from $64.63 to $221.01. The little, low-priced NASDAQ 100 "safer" dividend contingent stayed on top.

This distinction between five low-priced dividend dogs and the general field of ten reflects the "basic method" Michael B. O'Higgins employed for beating the Dow. The added scale of projected gains based on analyst targets contributed a unique element of "market sentiment" gauging upside potential. It provided a here and now equivalent of waiting a year to find out what might happen in the market. It's also the work analysts got paid big bucks to do.

Caution is advised, however, as analysts are historically 20% to 80% accurate on the direction of change and about 0% to 20% accurate on the degree of the change.

The net gain estimates mentioned above did not factor-in any foreign or domestic tax problems resulting from distributions. Consult your tax advisor regarding the source and consequences of "dividends" from any investment.

See my instablog for specific instructions about how to best apply the dividend dog data featured in this article, this glossary instablog to interpret my abbreviated headings, and this instablog to aid your safe investing. --Fredrik Arnold

Stocks listed above were suggested only as possible starting points for your safest "Safer" Dividend NASDAQ 100 Index dog dividend stock research process. These were not recommendations.

Disclaimer: This article is for informational and educational purposes only and should not be construed to constitute investment advice. Nothing contained herein shall constitute a solicitation, recommendation or endorsement to buy or sell any security. Prices and returns on equities in this article except as noted are listed without consideration of fees, commissions, taxes, penalties, or interest payable due to purchasing, holding, or selling same.

Graphs and charts were compiled by Rydlun & Co., LLC from data derived from www.ycharts.com, www.finance.yahoo.com, analyst mean target price by Thomson/First Call in Yahoo Finance. Dog photo from: store.nascar.com

Catch A Dog Of The Day on Facebook!

At 8:45 AM every NYSE trading day on Facebook/Dividend Dog Catcher, Fredrik Arnold does a video summary of a candidate for his new Ivy portfolio in his Underdog Daily Dividend Show!

NASDAQ pups qualify! Find them among the 52 Dogs of the Week I, Dogs of the Week II, and Dogs of the Week III, plus, the new portfolio named Ivy (IV)! Click here to subscribe or get more information.

Always remember: Root for the Underdog. Comment on any stock ticker to make it eligible for my next FA follower report.