There has been much focus this earnings season on the rising costs of transportation given strong economic activity that has boosted demand for trucking as well as a tight labor market that has led to strong wage growth of truck drivers. Yet, Ryder System (NYSE:R) has been a woeful underperformer of late. Shares are down about 35% this year and have shed over 25% of their value just since October 1. While investors may be worried about the sustainability of recent growth and used truck pricing, Ryder is reporting solid results and has taken actions to de-risk its business. As such, at less than 10x earnings, Ryder shares look extremely attractive.

In their third quarter, Ryder reported adjusted EPS $1.64, up 22% year on year. Now, Ryder has enjoyed significant benefits from the 2017 tax reform, so it is best to look at pre-tax earnings to see the underlying strength of the business. Pre-tax earnings rose 6%, not as fast as the headline, but still moderate growth. Operating revenues (which exclude fuel costs that are simply passed on to the customer) grew 13%, and adjusted EBITDA rose 12$ to $526 million. While rising trucker wages are a cost issue facing the company, it was encouraging to see Ryder essentially maintain its EBITDA margin. Additionally, sales activity for its for its Choice Lease and Dedicated Transportation Services units are up double-digits. Start-up costs for these accounts, which have been exacerbated by the very tight labor market, are a near-term headwind, but that is a high-quality problem to have as these accounts provide long-term, predictable cash flow.

Ryder essentially has two core businesses: rental and leases (within leases one can bucket Choice Lease and DTS with DTS being more comprehensive supply chain management). The key point for investors to understand is that lease revenue is more stable and durable through a cycle than rental because a customer can rent a truck today but if demand at its business goes down, it can cancel the rental tomorrow whereas leasing activity is multi-month. In particular, at its DTS unit, Ryder is integrating itself within a customer’s supply chain as they outsource their logistics needs to Ryder. By deepening the client relationship, they are more likely to maintain the business through an economic cycle.

Importantly in Q3, Dedicated operating revenue was up 12% as the company continues to shift customers from being rental customers to dedicated customers. With companies increasingly looking to outsource their logistics needs, Ryder has seen steady growth in this business. As this unit becomes an increasingly large part of the business, Ryder’s overall cash flows become a bit less exposed to cyclical factors. Dedicated is only 15% of the business, so there is room to grow this business further by winning new customers and deepening ties with existing Choice Lease and rental customers.

Now, given the strong economic backdrop, the rental portion of the business is of course doing well. Rental demand was up 17%, given strong economic activity. Rental utilization was up 2.4% to 80.4% even as the fleet grew 13%. Ryder also raised prices by 3%. So, Ryder has a bigger fleet that it is utilizing more, and it is charging more. That is a strong position to be in, and management expects the strong rental environment to persist at least through mid-2019. Rental is 22% of fleet management revenue, within the 20-25% target. It is important to note that Ryder is not getting too exposed to this business at the top of the economic cycle. I would be concerned if rental had risen to 30-35% of the business, which would suggest Ryder is trying to chase business and sacrificing its long-term strategy of moving its business to more stable leasing and supply chain management activity. The rental side of the business will fluctuate with economic activity, but it remains a manageable part of Ryder’s business. Ryder also structurally always needs a rental business because it provides support for its lease business as it can reposition those vehicles to support leasing activity as it wins new contracts or if there is an issue with a leasing fleet.

Ryder also continues to grow its fleet. The Lease fleet has increased by 5,600 units organically year to date. For all of 2018, lease fleet growth should be 8,500 or about 10%. Interestingly, there is so much demand for new trucks that it takes about 6 months from ordering a new truck for it to be delivered compared to the 3 months norm. These delays, along with the tight driver market, are responsible for some of the higher start-up costs seen in Q3.

Now while the market for new trucks is booming, the used market remains a challenge for Ryder as the company buys new trucks, leases or rents them out, and sells them after several years. Used vehicle sales were down by 13% in Q3, but proceeds are up 22% for tractors and 15% for trucks thanks to Ryder moving sales volume through retail rather than wholesale channels where they can get better prices. Admittedly, the company is selling somewhat younger vehicles so it is more like a mid-single digit pricing improvement on a like for like basis. A challenged used vehicle sale market has been a headwind for the company for the past 2-3 years, but management does think pricing should be stable at current levels in 2019.

The key theme for being bullish Ryder is that they are removing variability from their business. The move to contract leasing (and within leasing moving to Dedicated logistics management) from rentals is the first pillar. The second pillar is on used vehicle pricing. When Ryder prices a lease, it estimates the residual value it will receive when it sells the used truck. If the sales price is different than the residual, the lease’s profitability will be different than what Ryder expects. Historically, Ryder has priced its leases looking at the 5-year rolling average used vehicle price. Given the weak pricing environment the past 2 years, realized selling prices have been a headwind. However, thanks to the strong demand for its services, Ryder has been able to change its pricing model this year to price leases. Ryder is using current prices for used vehicles to price its leases, which given the bear market for used trucks the past two years is limiting the probability that it suffers a loss when selling these trucks in a few years. As such, this headwind that has hurt Ryder’s profitability the past 3 years is unlikely to persist, and if there is a rebound in truck pricing, it could reverse and boost profits in 2020 and beyond.

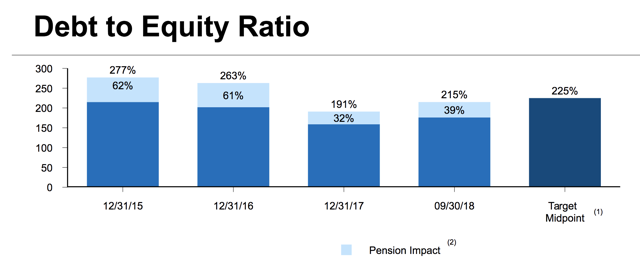

The third pillar of Ryder’s de-risking has been that fact it has also gradually de-levered its balance sheet and expects to end 2018 with a debt to equity ratio of 210%, well positioned within its 200-250% target range and consistent with investment grade ratings. Alongside its more conservative pricing model, its more conservative balance sheet posture than two years ago provides the company more flexibility during inevitable market downturns.

Alongside this more conservative strategy, Ryder is continuing to grow. As noted above, the fleet is up double digits. Accordingly, net capital expenditures should be about $2.9 billion. Ryder will generate cash of about $2.15 billion for a negative free cash flow of about $750 million. Next year, cap-ex spend should be a bit higher as Ryder grows its fleet alongside higher lease demand. Importantly during economic downturns, Ryder can age its fleet, allowing it to materially cut back cap-ex spending to move free cash flow positive. In Q3, Ryder narrowly raised its 2018 guidance and forecasts EPS of $5.72 to $5.82 versus the prior range of $5.62 to $5.82. The fourth quarter comparable EPS forecast is $1.75 to $1.85, an increase of 29% to 36% from $1.36 in 2017. While the company has yet to give formal 2019 guidance, on the earnings call, management said it expects earnings to be higher next year than in 2018 as double-digit increases in lease activity outstrip any remaining weakness in used vehicle sales.

At less than 10x 2018 earnings, the market does not appear to appreciate the fact Ryder has taken concrete actions to reduce its exposure to cyclical volatility in rental demand and used vehicle pricing nor that the company is growing earnings in 2018 and anticipates the same in 2019 despite a soft used vehicle market. With shares at this rock-bottom valuation and also offering a 3.8% dividend, Ryder’s share price is a compelling opportunity. As the company continues to report solid results and investors appreciate these business shifts, I could see shares move back towards $80 or about 15x earnings. Ryder stock is a buy.