Closed-end funds [CEF] offer a unique way to capture value as discounts and premiums often skew for no apparent reason other than limited supply and demand, a situation that is exacerbated by low institutional ownership and low liquidity for many CEFs. One of the key services that we provide to members of CEF/ETF Income Laboratory is to warn when specific closed-end funds [CEFs] become egregiously overvalued. Selling an overvalued fund can lock in capital gains equivalent to several years of distributions, or viewed alternatively, can avoid the loss of several years of distributions when the valuation inevitably corrects. This idea is the core of our "CEF Rotation = Compounding Income On Steroids" strategy.

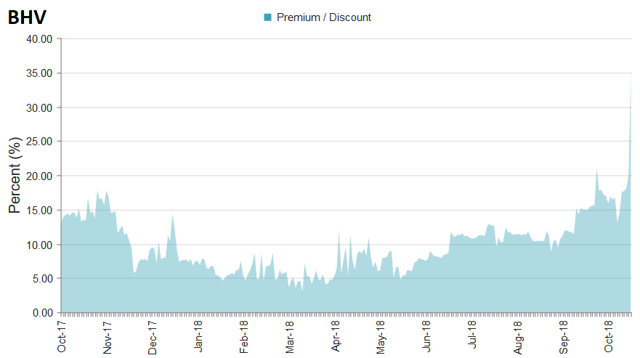

For example, a couple of weeks ago, I highlighted the BlackRock Virginia Municipal Bond Trust (NYSE:BHV) as gaining a whopping 21% in premium over a week in our Weekly Closed-End Fund Roundup (released 2 weeks later to the public here).

Here's what I wrote at the time:

The current premium of 35.93% is the highest since 2008, and is accompanied by a 1-year z-score of +5.9 suggesting extreme overvaluation.

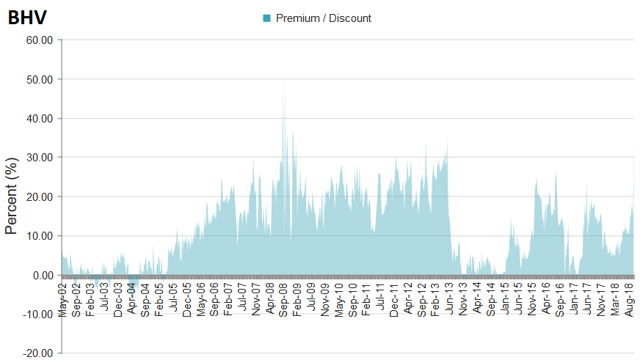

Here's the premium/discount history for the fund since inception. We can see that BHV, for some reason or another, has attracted a very high premium for large swathes of its lifetime.

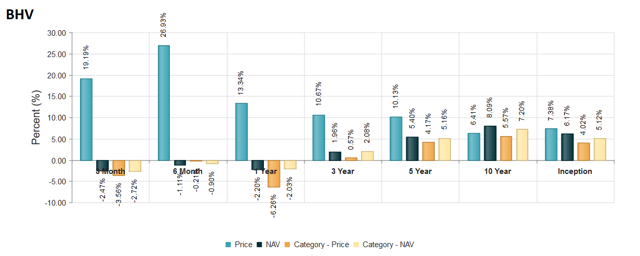

Does this tiny $24 million Virginia muni fund have some kind of magic allure? To be honest, I'm not seeing it. The fund does perform 24 bps and 89 bps per year better than the peer group over 5- and 10-year time spans at the NAV level, but I'm not sure this justifies the massive premium rise of the fund over the past year.

BHV currently yields 3.83% at market (5.20% at NAV), with 89% coverage. Sell this fund if you can!

BHV only has a

We’re currently offering a limited time only free trial for the CEF/ETF Income Laboratory with a 20% discount for first-time subscribers. Members receive an early look at all public content together with exclusive and actionable commentary on specific funds. We also offer managed closed-end fund (CEF) and exchange-traded fund (ETF) portfolios targeting ~8% yield. The sale has been EXTENDED for 1 more week only, so please consider joining us by clicking on the following link: CEF/ETF Income Laboratory.