This article is part of a series that provide an ongoing analysis of the changes made to Baupost Group's 13F stock portfolio on a quarterly basis. It is based on Klarman’s regulatory 13F Form filed on 11/13/2018. Please visit our Tracking Seth Klarman’s Baupost Group Holdings article for an idea on how his holdings have progressed over the years and our previous update for the fund's moves during Q2 2018.

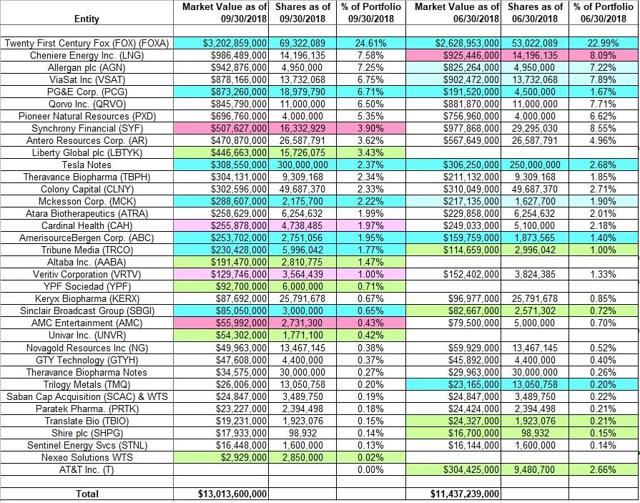

Baupost Group’s 13F portfolio value increased ~14% from $11.44B to $13.01B this quarter. The total number of 13F securities increased from 31 to 35. The portfolio is heavily concentrated with Twenty First Century Fox, Cheniere Energy, Allergan plc, ViaSat Inc., and PG&E together accounting for ~53% of the 13F holdings.

Since inception (1982), Baupost Group’s 13F portfolio has accounted for between 2.4% to 15% of the Assets Under Management (AUM). The current allocation is at the high-end of that range. The rest of the AUM is diversified among cash, debt, real estate, and hedges. The fund continues to hold well over a quarter of the AUM in cash. Seth Klarman’s distinct investment style is elaborated in his 1991 book “Margin of Safety: Risk-averse value investing strategies for the thoughtful investor”. The book is out-of-print and copies sell for a huge premium.

New Stakes:

Liberty Global (LBTYK) (TBTYA), Altaba Inc. (AABA), YPF Sociedad (YPF), Univar Inc. (UNVR), and Nexeo Solutions WTS: These are the new positions this quarter. LBTYK is a 3.43% portfolio stake established at prices between $25 and $28.50 and the stock currently trades below that range at $23.21. The small 1.47% AABA position was purchased at prices between $63.75 and $77.50 and it is now below that range at $61.21. YPF is a very small 0.71% stake established at prices between $13.15 and $17.25 and it now goes for $14.96. UNVR is a minutely small 0.42% stake and it now trades at $22.28, well below the low end of the price-range it traded during the quarter.

Stake Disposals:

AT&T Inc. (T): The 2.66% T stake came about as a result of the acquisition of Time Warner by AT&T. Baupost had a large merger-arbitrage stake in Time Warner established in Q4 2017. In October 2016, AT&T (T) agreed to acquire Time Warner in a cash-and-stock deal valued at $107.50 per share (half cash). That transaction closed in June and the AT&T shares so acquired were disposed this quarter.

Stake Increases:

Twenty First Century Fox (FOX) (FOXA): FOX is currently the largest position at ~25% of the portfolio. It was established in Q3 2015 at prices between $25.41 and $33.52 and increased by ~40% in Q1 2016 at prices between $24 and $28. H2 2016 also saw a two-thirds increase at prices between $24 and $29. Last four quarters have seen a ~160% stake increase at prices between $24.30 and $50. The stock currently trades at $47.72.

Note: In December 2017, Walt Disney (DIS) agreed to acquire certain assets (excludes Broadcasting network and stations, Fox News, Fox Business, FS1, FS2 and Big Ten Network) from Twenty First Century Fox in an all-stock deal (0.2745 shares of DIS per FOX share).

PG&E Corporation (PCG) and Tesla Notes: These two new positions established in Q1 2018 saw increases in the last two quarters. PCG is now a large (top five) 6.71% stake. It was established at prices between $38 and $45 and increased by ~43% last quarter at prices between $39 and $47. This quarter saw a stake doubling at prices between $41.50 and $47. The stock currently trades well below their purchase price ranges at $32.72. The 2.37% position in Tesla Notes saw a 20% increase this quarter.

Note: The last three trading days saw a one-third drop in PCG PPS as wildfires caused major damage and loss of life in Northern and Southern California. Last year, PG&E shares dropped in December as they halted the dividend citing liability concerns from the October 2017 Northern California wildfires. Following that, several hedge funds (Abrams, Tepper, Loeb, Romick, etc.) added PG&E shares to their portfolios.

McKesson Corp. (MCK): MCK is a ~2% portfolio stake established in Q3 2017 at prices between $146 and $168 and increased by ~170% in the following quarter at prices between $135 and $163. The stock currently trades below those ranges at ~$130. For investors attempting to follow Baupost, MCK is a good option to consider for further research. There was a ~19% stake increase in Q1 2018 at prices between $139 and $177 and that was followed with another one-third increase this quarter at prices between $123 and $139.

Note: MCK had a previous round-trip. It was a 1.75% portfolio stake established in Q4 2016 at prices between $124 and $167 and sold out in Q2 2017 at prices between $135 and $168.

AmerisourceBergen (ABC): ABC was a minutely small position established in Q3 2017. It was built to a 1.30% portfolio stake next quarter at prices between $73 and $94. The stock is now at $91.31. Last two quarters have seen a stake doubling at prices between $79 and $95. The position is now at ~2% of the portfolio.

Tribune Media (TRCO) and Sinclair Broadcasting (SBGI): These are small (less than ~2% of the portfolio each) stakes established last quarter and increased substantially this quarter. The 1.77% TRCO position was purchased at prices between $35 and $41 and doubled this quarter at prices between $32 and $39. The stock currently trades at $38.78. SBGI is a 0.65% portfolio stake established at prices between $27 and $33.50 and it is now at $31.38. The position was increased by ~17% this quarter.

Stake Decreases:

Synchrony Financial (SYF): SYF, the November 2015 split-off from General Electric (GE) is at ~4% of the portfolio. It was established in Q3 2016 at prices between $25 and $28.50. Q2 2017 saw a two-thirds increase at prices between $26.50 and $34.50. This quarter saw an about turn: ~44% reduction at prices between $29 and $35. The stock currently trades at $27.65.

Cardinal Health (CAH): The ~2% CAH position was purchased in Q4 2016 at prices between $65 and $78 and almost doubled in Q2 2017 at prices between $71.50 and $83. There was another ~25% increase the following quarter at prices between $64 and $79 and that was followed with a stake doubling in Q4 2017 at prices between $55 and $68. The stock currently trades near the low end of those ranges at $56.73. For investors attempting to follow Baupost, CAH is a good option to consider for further research. There was a ~7% trimming this quarter.

Veritiv Corporation (VRTV): VRTV is a 1% of the 13F portfolio position established in Q3 2014 at prices between $32.50 and $50.50. Q4 2017 saw a ~20% stake increase at prices between $22.50 and $32.50. The stock currently trades at $29.94. There was a ~5% stake increase in Q1 2018 while this quarter saw similar trimming.

Note: Klarman’s ownership interest in VRTV is ~24%.

AMC Entertainment (AMC): AMC is a very small 0.43% of the portfolio position purchased in Q3 2017 at prices between $12.50 and $23.20 and increased by ~40% in Q1 2018 at prices between $11 and $16. The stake was sold down by ~45% this quarter at prices between $15.25 and $21.35. The stock is now at $15.54.

Note: Baupost has a ~5% ownership stake in the business.

Kept Steady:

Cheniere Energy (LNG): LNG is Klarman’s second-largest 13F position at ~7.5% of the portfolio. The original stake was established in Q1 2014 at prices between $41 and $55. In H2 2014, it was doubled at prices between $62 and $84. The three quarters thru Q1 2016 saw another stake doubling at prices between $24 and $71. Q4 2016 saw a reversal: 22% sold at prices between $35.50 and $43.50 and that was followed with a roughly one-third reduction last quarter at prices between $53 and $69. The stock currently trades at $59.60.

Note: Baupost controls ~5.7% of Cheniere Energy.

Allergan plc (AGN): AGN is a large (top five) 7.25% of the 13F portfolio stake established in Q1 2016 at prices between $266 and $299. Q2 2016 saw a ~16% increase at prices between $202 and $278. There was another ~70% increase in Q4 2016 at prices between $189 and $243. The pattern reversed in Q1 2017: almost 30% sold at prices between $210 and $250. The stock currently trades at ~$163. Q3 2017 saw a ~22% stake increase at prices between $202 and $256 and that was followed with a ~50% increase the following quarter at prices between $164 and $211. For investors attempting to follow Baupost, AGN is a very good option to consider for further research. Q1 2018 saw a ~6% increase and that was followed with a ~4% increase last quarter.

ViaSat (VSAT): VSAT is a large (top five) position at 6.75% of the portfolio. The stake has only seen minor increases since Q3 2012. Klarman first purchased VSAT in 2008 at much lower prices and his overall cost-basis is in the high-teens. The stock currently trades at ~$70. Q4 2016 saw a ~14% increase at prices between $66 and $81. He is sitting on huge gains on the position. There were minor increases in the last two quarters.

Note: Klarman controls ~23% of VSAT.

Qorvo Inc. (QRVO): QRVO is a large 6.50% portfolio stake established in Q1 2017 at prices between $53 and $69 and increased by ~25% the following quarter at prices between $63 and $79. There was another ~22% stake increase in Q4 2017 at prices between $65 and $81. The stock is now at $63.65.

Note: Baupost controls ~9% of the business.

Pioneer Natural Resources (PXD): PXD was a minutely small stake established in Q3 2017. The position was built up to a 3.42% portfolio stake in Q4 2017 at prices between $142 and $174. There was a stake doubling last quarter at prices between $165 and $189. The stock is now at ~$150 and the stake is at 5.35% of the portfolio.

Antero Resources Corporation (AR): AR is a 3.62% of the portfolio position established in Q3 2014 at prices between $54.50 and $66. The stake was increased by ~185% the following quarter at prices between $38.50 and $55.50. Recent activity follow: Q2 2016 saw a one-third reduction at prices between $24.50 and $30 while Q2 2017 saw a ~45% increase at prices between $19.50 and $22.50. The stock currently trades at $15.27. The three quarters thru Q1 2018 had seen a combined ~25% stake increase at prices between $17 and $22.

Note: Klarman controls ~8% of the business.

Theravance Biopharma (TBPH): TBPH is a 2.34% of the portfolio position established in Q2 2014 as a result of the spinoff of TBPH from Theravance (now Innoviva). The spinoff terms called for Theravance shareholders to receive 1 share of TBPH for every 3.5 shares of Theravance held. The original stake was increased by ~5% in Q1 2015 at prices between $14.50 and $22. Q2 2016 saw another ~13% increase at prices between $17.50 and $24. The stock is now at $24.62. Q4 2016 also saw a ~25% increase at prices between $24.50 and $38.50.

Note: Klarman controls ~19% of the business.

Colony Capital (CLNY): The 2.33% stake in Colony Capital came about as a result of the three-way merger of Colony Capital (CLNY), Northstar Asset Management Group (NSAM), and Northstar Realty Finance (NRF) that closed in January last year. Baupost held stakes in all three of these stocks and those got converted into CLNY shares. They control ~10% of CLNY and their overall cost-basis is ~$12.50 per share. CLNY currently trades well below that at $6.07. For investors attempting to follow Baupost, CLNY is a good option to consider for further research. There was a ~4% stake increase in Q1 2018.

Atara Biotherapeutics (ATRA): ATRA is a ~2% of the portfolio stake established in Q4 2014 at around $19 per share. In Q1 2015, the stake was increased by ~90% at prices between $18 and $42.90. The stock currently trades at $34.76. There was a ~17% stake increase in Q1 2018 at prices between $18 and $48.

Note: Klarman controls ~15% of the business.

Keryx Biopharma (KERX): KERX is a 0.67% of the portfolio position established in Q1 2014 at prices between $12 and $17. Q2 & Q3 2014 saw the position more than doubled at prices between $12.50 and $18. H1 2015 had also seen a ~40% further increase at prices between $9.50 and $14.50. The stock currently trades well below the low-end of those ranges at $2.90. Klarman’s cost-basis is at around $12.

Note: Keryx is merging with Akebia Therapeutics (AKBA) in a transaction announced in June. KERX shareholders will receive 0.37433 common shares of AKBA for each share held. Baupost agreed to redeem their convertible notes at an effective conversion price of $4.17 (39.6M shares – outlay was $164.75M). Overall, the current ownership will amount to a stake of 24.48M shares (21.1% of business) in the combined business. It is based on 116M shares projected to be outstanding.

NovaGold Resources Inc. (NG): The very small 0.38% long-term stake in NG saw a ~13% increase in Q4 2017 at prices between $3.40 and $4.25 and another ~25% increase in Q1 2018 at prices between $3.60 and $4.70. The stock is currently at $3.72.

Trilogy Metals (TMQ): The minutely small 0.20% stake was increased by ~40% last quarter.

Note: Baupost controls ~14% of Trilogy Metals.

Paratek Pharmaceuticals (PRTK): PRTK is a minutely small 0.18% position that saw a ~17% increase in Q2 2017 at prices between $18.50 and $25.50. The stock is now at $6.85.

Note: Baupost Group controls ~9% of Paratek Pharmaceuticals.

Translate Bio (TBIO) and Shire plc (SHPG): These are minutely small (less than ~0.15% of the portfolio each) positions established last quarter and kept steady this quarter.

Note: TBIO had an IPO in June. Its main asset is a compound to treat Cystic fibrosis (mRNA therapy) acquired from Shire plc.

Sentinel Energy Services (STNL): STNL is a SPAC established by former executives of Schlumberger (SLB) to acquire an underperforming energy services business. The minutely small 0.13% stake was acquired in Q4 2017. Last month, Sentinel agreed to acquire a majority interest in Strike Capital, a provider of full-life-cycle pipeline infrastructure services. Following the close of the transaction, Sentinel Energy Services will be renamed Strike Inc.

GTY Technology (GTYH) and Saban Capital Acquisition Corp. (SCAC): These very small (less than ~0.5% of the portfolio each) stakes were kept steady this quarter. In September Saban Capital agreed to acquire Panavision and Sim.

Note 1: Baupost controls ~9% Saban Capital Acquisition and ~8% of GTY Technology.

Note 2: The 13F also lists a small position in Theravance Biopharma Notes.

The spreadsheet below highlights changes to Klarman's 13F stock holdings in Q3 2018:

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.