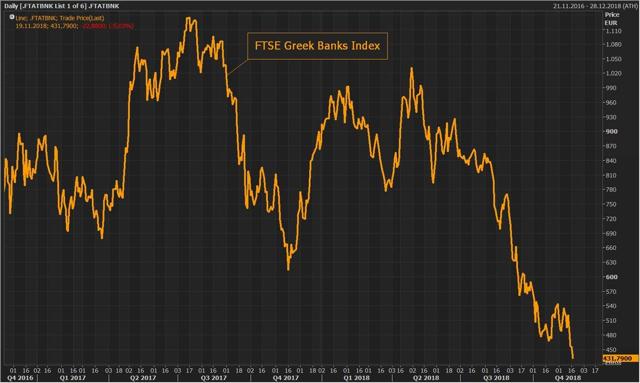

In case you've missed it, Greece (GREK) is back in the spotlights, with its bank stocks plunging 5%, 12% and 8% over the past few trading days.

What's behind the recent collapse? As always - growing debt concerns.

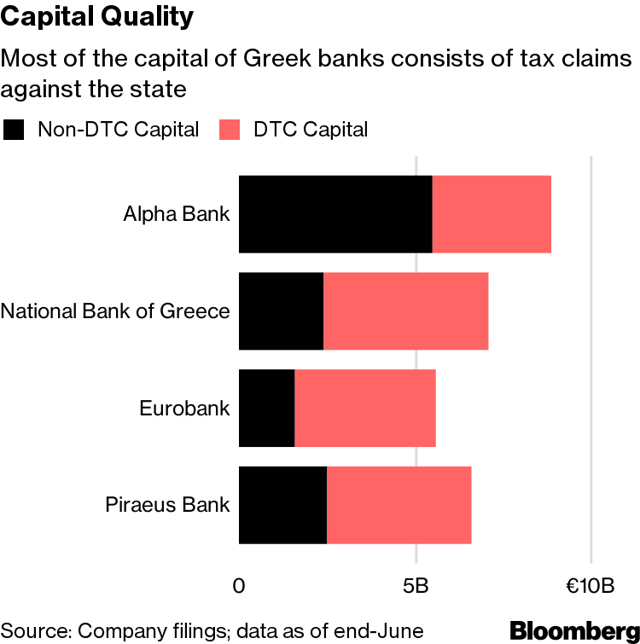

Greece wants bond investors to participate in the losses associated with $47B of bad loans that are heavily weighing on Greek banks. The government wish to free banks of these bad loans but it's hard, i.e. impossible, to strike a deal with terms that will be accepted by bond investors on one hand, while also making sense for Greece on the other hand.

In addition to the problematic bad-loan relief plan, MSCI decision to remove three out of the Greece's four systemic banks – National Bank of Greece (OTCPK:NBGIF), Piraeus Bank (OTCPK:BPIRY, OTCPK:BPIRF, BPISF) and Eurobank (OTCPK:EGFEY, OTCPK:EGFEF) – from its indices certainly doesn't help.

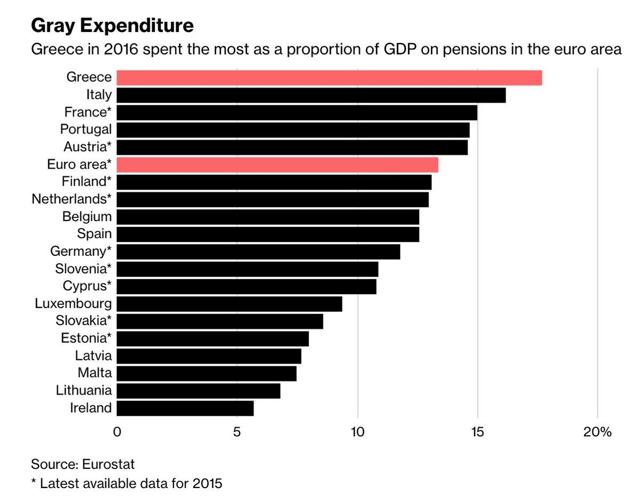

Greece is also contemplating a new pension cuts as government is eyeing the upcoming 2019 elections.

Creditors, meanwhile, see fiscal space allowing to skip/postpone such a measure, even as markets show concern over backtracking on reforms.

The most updated data (going back to 2016) shows that Greece spent the most on pensions in the Eurozone (VGK, EZU, HEDJ, FEZ).

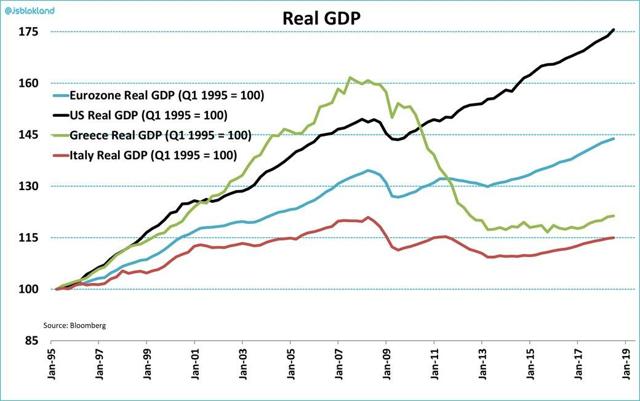

This remains a fascinating GDP chart. I don't know what is more striking - the massive boom-bust in Greece's GDP or Italy's (EWI) inability to grow GDP at all.

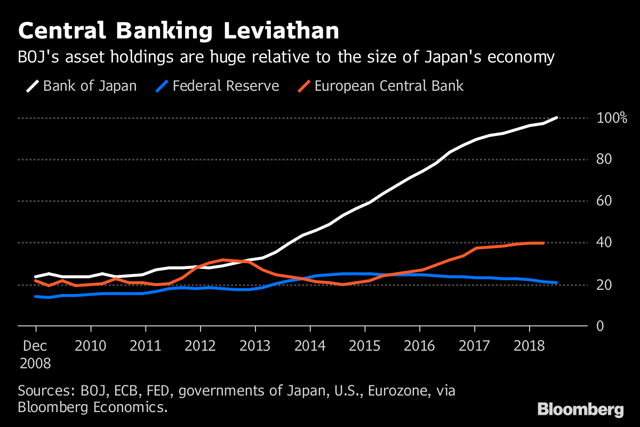

Many claim that Greece and Italy are well-run countries compared to Japan's (EWJ) horror story.

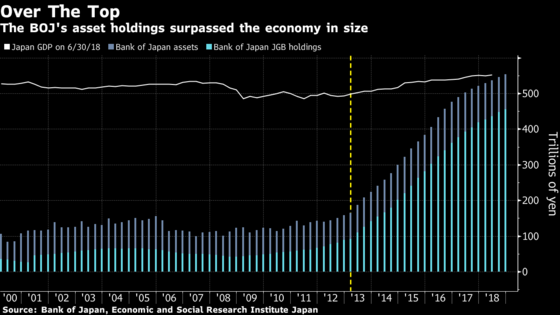

After all, the Bank of Japan now has a bigger volume of assets on its balance sheet than the size of the nation's economy.

That's, by far, greater that the total assets that both Fed and ECB hold compare to the respective American and Europeans GDPs.

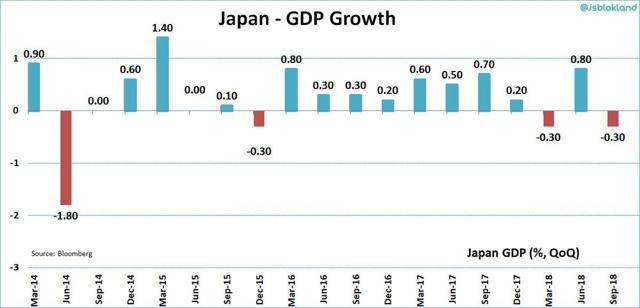

Add to that that the Japanese economy is shrinking and you get yourself a perfect doom loop.

Nevertheless, there is one "tiny" difference that makes the comparison irrelevant to begin with: An independent monetary policy.

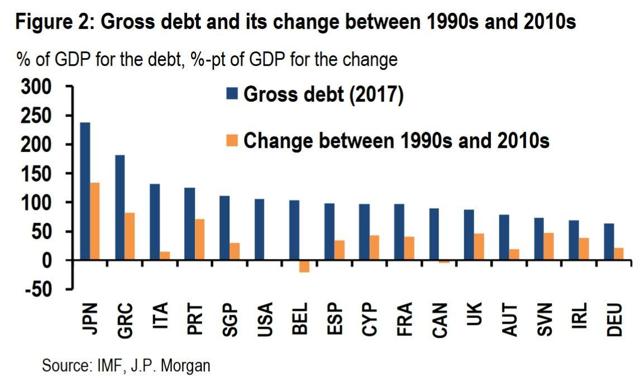

Even if Japan's debt to GDP ratio and its change from 1990s are far larger than any other major economy, including Greece and Italy, Japan still a central bank that has full control over its currency and interest rates, while Greece and Italy suffer from original sin fallacy.

Which economy is worse - that of Greece or that of Japan?

Truth is, I'm not trying to find an answer to this question with my money.

Author's note: Blog post notifications are only being sent to those who follow an author in real time. In order to receive notifications for both articles and blog posts, go to Author Email Alerts, which lists all the authors you follow and turn on "Get e-mail alerts" (see below).

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

The Wheel of FORTUNE is one of SA Marketplace's most comprehensive services. We view our service as a "supermarket of ideas" with an emphasis on risk management and risk-adjusted returns.

Our monthly review for October, where you can find all suggestions since launch, is only one click away.

We cover all asset-classes: common stocks, preferred shares, public debts, baby bonds, options, currencies, and commodities.

With Trapping Value on-board, you're getting two leading authors for the price of one.

Before committing to the service on a long-term basis, take advantage of the two-week free trial.