Trade Wars and Slowing Global Economy May Present A Buying Opportunity

Expeditors International of Washington, Inc. (NYSE:EXPD) is the third company I'm analyzing with no debt and a growing dividend. The company is focused on freight forwarding and customs brokerage. Expeditors International has an asset light business model permitting it to grow organically with little capital expenditures that in turn permits the company to return cash to shareholders.

Individual investors focused on dividend growth may want to keep an eye on this company since it is growing revenue and EPS and increasing dividends over time. But I currently view this stock as somewhat overvalued and am tracking it from the perspective of possibly making a buy. The company faces possible future end market weakness due to trade wars and slowing global trade volumes thus presenting a potential entry point. In this article, I analyze the company from the perspective of growth drivers, four criteria for evaluating a dividend growth stock, valuation, and global trade.

Expeditors International is Global Provider of Freight Forwarding Services and Customs Brokerage Services

Let’s first review the company’s business model. Expeditors International is a global provider (or broker) of freight forwarding and customs brokerage services. The company has 177 district offices worldwide, smaller branches, and contracts with independent agents in 103 countries. The company ships over 800 million kg of airfreight and over 900 million kg of ocean freight annually.

Expeditors International

Source: expeditors.com

Source: expeditors.com

The company’s business model is simple. It is a third-party logistics provider that buys bulk cargo space on aircraft and ocean going ships and resells the space to clients in order to move their freight. Expeditors International does not own its own aircraft or ships leading to an asset light business model. The company offers services typical of a large global logistics provider including order management, freight consolidation and forwarding, warehousing, cargo insurance, specialized cargo monitoring and tracking, temperature-controlled transit, and other specialized freight solutions.

In the customs brokerage business, which is the company’s third business segment, it prepares documentation, calculates and pays duties and other taxes on behalf of the importer, arranges government inspections, and arranges local pick up and delivery on behalf of its clients.

Freight Forwarding and Logistics Management

Source: logisticsmgmt.com

Source: logisticsmgmt.com

Expeditors International operates worldwide in a fragmented market that includes global and niche competitors. Major global competitors include international companies such as Deutche Post’s DHL, Kuehne + Nagel, Deutsche Bahn's DB Schenker, Panalpina, DSV A/S, and Ceva Logistics. In 2017, Expeditors International was the fifth largest airfreight forwarder and seventh largest ocean freight forwarder. Despite being in the top ten globally for both business segments, the company has only a low single-digit percentage market share worldwide relative to the top 25 air and ocean freight forwarders. The company believes that is has distinguished itself from the other large players through quality service and is competitive on price. Expeditors International makes use of a global IT platform to provide the company a competitive edge and continues to invest in the platform.

Growth Drivers

Expeditors International has historically grown organically rather than through acquisitions. The company will likely grow by adding new offices and branches, or partnering with extant independent agents. The industry’s global demand growth averages above 4% YoY for airfreight and 2% - 3% YoY for ocean freight and the company plans to meet or exceed these market growth rates. In many years the company’s growth rate has exceeded these averages indicating that it is successful in taking market share from smaller players.

Although traditionally the company has not pursued acquisitions, the company has stated in the 2017 Annual Report “…we have also been open to growth through acquisition of…existing agents or others within the industry.” In addition, the company also stated that “Nevertheless, despite our history of organic growth, we are not opposed to acquisitions and we will continue to identify and assess potential acquisitions.” Based on these statements it is probable that Expeditors International will complete an acquisition in order to grow.

Notably, Expeditors International is planning on expanding market share in North America, build a stronger import presence in China, and align and integrate their European-Asian Pacific and European-North Americas interests. Along these lines it is possible that the company is evaluating acquisitions in China or Europe. Besides the top 25 global freight forwarders, there are numerous smaller niche players. In any case, I anticipate smaller bolt-on acquisitions rather than a larger one due to the company’s emphasis on its culture, internal processes and IT systems. This is supported by the company’s recent statement in the 2017 Annual Report, “…Expeditors has pursued a strategy emphasizing organic growth supplemented by certain strategic acquisitions.”

Furthermore, the company formed a strategy group and appointed a Chief Strategy Officer in early 2017. Although the company has not yet announced an acquisition, the Q2 2018 8-K indicated “The team has spent a significant amount of time understanding the market, assessing new entrants, and engaging with our customers to understand their needs.” I take this to mean that the Expeditors International is evaluating the market and competitors in context of its customers needs with the possibility of a future acquisition.

Revenue and EPS Growth

Revenue was ~42% from airfreight, ~30% from ocean freight, and ~28% from customs brokerage in 2017. Net revenue (after expenses) was ~32% from airfreight, ~24% from ocean freight, and ~44% from customs brokerage. Net revenue from airfreight has decreased from ~34% in 2015 to ~32% in 2017, while net revenue from customs brokerage has increased from ~41% in 2015 to ~44% in 2017. Net revenue from ocean freight has remained relatively constant during this time period.

Note that in terms of geographic region, both North America and North Asia combined generate more than half the company’s revenue. In 2017, $2,230.7M of revenue was from North America and $2,598.4M of revenue was from North Asia out of total revenue of $6,920.9M. However, North America contributes a greater percentage of net revenue at $1,127.9M as opposed to $509.2M for North Asia out of total net revenue of $2,319.2M.

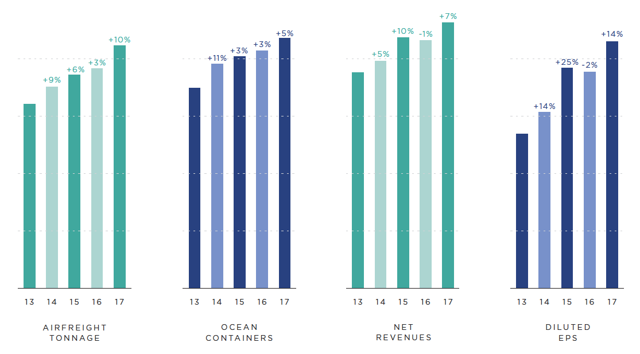

Revenue and EPS growth is driven by increases in airfreight tonnage and ocean containers through global trade. In that regard the company’s growth has increased consistently since 2013 as seen in the chart below. The company has successfully increased revenue since 2013 with the exception of 2016 as seen in the chart below. In parallel, the company has grown diluted EPS with the exception of 2016. However, both revenue and diluted EPS recovered in 2017 after dropping in 2016. In 2016, lower average sell rate in both airfreight and ocean freight negatively impacted net revenues and diluted EPS even though volumes grew +3% in both business segments.

Expeditors International Freight, Revenue, and EPS Growth Since 2013

Source: Expeditors International 2017 Annual Report

Source: Expeditors International 2017 Annual Report

What’s The Dividend Yield?

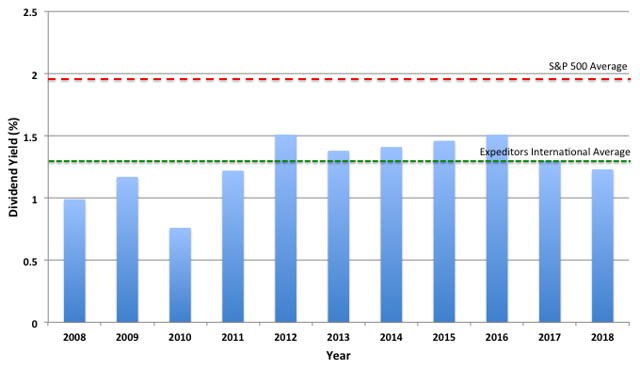

The dividend yield is currently only 1.2% - 1.3%, which is lower than its historical average on a year-end yield basis over the past 10 years as seen in the chart below. Note that the company pays its dividend semi-annually, which some individual investors may dislike. I generally look for a dividend yield that is preferably > 3% or at least greater than a company’s average over the past 10-years. I also prefer the stock to have a yield greater than the average of the S&P 500, which is currently 1.9% - 2.0%. Expeditors International does not meet currently meet these criteria although this by itself is not a disqualifier.

But the current payout ratio is ~27% giving the company significant room to increase the dividend. However, I do not expect this value to increase appreciably in the near future since the payout ratio has ranged between ~23% and ~36% since 2008. Expeditors International is currently spending more cash flow on share buybacks rather than dividend payout. In 2017, the company spent $478M on buybacks and only $150M on dividends although some of the buyback was to reduce dilution from $205M in issued common stock. This differential has been consistent for the past several years.

Expeditors International Year-End Dividend Yields Compared To Averages

Source: Data from Seeking Alpha, S&P 500 average yield from YCharts.com

Source: Data from Seeking Alpha, S&P 500 average yield from YCharts.com

Is the Dividend Growing?

Expeditors International has consistently grown its dividend for the past 19 years and the company will most likely become a Dividend Aristocrat. The 10-year dividend growth rate is ~11.6% but the growth rate has slowed a bit to ~8.5% in the past 5 years, and ~9.5% in the past 3 years. The annual dividend was increased to $0.90 per share in 2018 from $0.84 per share in 2017, a 7.5% increase. The comparatively long duration of dividend increases combined with the low payout ratio provides an individual investor some confidence that this will continue into the near future. In addition, the company increased the dividend from $0.32 per share in 2008 to $0.38 per share in 2009 and $0.40 per share in 2010 during the recession. This suggests that the company had sufficient cash flow to continue increasing the dividend despite a drop in revenue during this time.

Is the Dividend Safe?

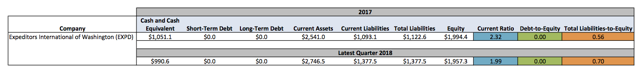

Expeditors International has no short-term debt or long-term debt as seen in the chart below. The company maintains healthy cash position that was $990.6M in the most recent quarter that is greater than the amount needed for the annual dividend. In addition current assets exceed current liabilities as seen by the current ratio. The balance sheet provides an individual investor some certainty that the dividend is safe. Lastly, the dividend is covered by FCF. In 2017, Expeditors International had FCF of $394M and dividend cost of $150M giving a ratio of 2.63.

Expeditors International Recent Debt Metrics

Source: DP Research and Calculations Based on Data from Annual Reports, 10-Q for Q3 2018, and Morningstar.com

Source: DP Research and Calculations Based on Data from Annual Reports, 10-Q for Q3 2018, and Morningstar.com

Final Thoughts and Trade Wars

Overall, I like Expeditors International as a dividend growth stock since it has no short-term or long-term debt and in addition the company has an asset light business model. I view the company as a buy at the right price, which I believe is sub-$65 or an approximately -10% drop or more in the current stock price. The stock’s current PE ratio is ~21.6, which is near the S&P 500 average PE ratio of ~21.5 and exceeds the long-term S&P 500 average PE ratio of ~15.7 making it overvalued relative to the broader market’s historical average. Furthermore, the dividend yield is below the stock’s 10-year average and the S&P 500’s average also indicating that the stock is currently overvalued.

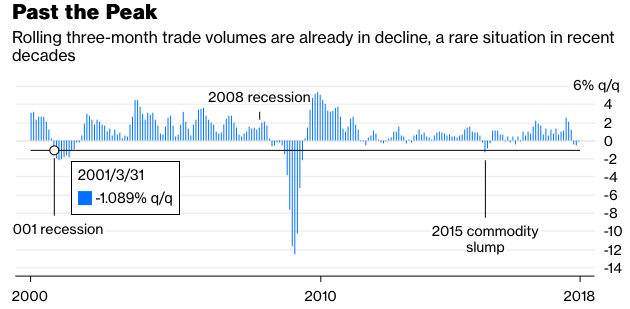

So far trade wars have not negatively impacted the company’s businesses in terms of revenue or EPS growth and thus have not significantly affected stock price, which is up ~12.7% YTD. The company grew earnings on a YoY basis from $1,802.2M in Q3 2017 to $2,090.9 in Q3 2018. In the same time period diluted EPS grew from $0.67 to $0.92. Revenue and EPS also grew for the nine months through September relative to 2017. However, trade wars are a risk to the company’s freight forwarding businesses since Expeditors International depends on global trade. Some news articles this year have indicated that global trade volumes are slowing as seen in the chart below. If the slow down is severe enough or lasts for an extended duration then it may negatively affect stock prices of freight forwarders presenting a buying opportunity.

Slowdown in Global Trade in 2018

Source: bloomberg.com

Source: bloomberg.com

As a last item, for my readers who are interested in other debt free dividend growth companies I have recently analyzed T. Rowe Price (TROW) and Paychex (PAYX). For analysis on TROW, see my article entitled “T. Rowe Price Is A Dividend Aristocrat That Should Be On Your Watch List” and for analysis on PAYX see my article entitled “Paychex: Debt-Free Dividend Growth But Not Yet A Buy”.

If you liked this article, click on the "Follow" button next to my name to see future articles in your feed.