Introduction

Over the last few months, most of you have noticed our increased activity in closed-end funds as the inflow of volatility finally shook them up and created various arbitrage and directional opportunities for active traders such as us. Now that these products have our attention, we are continuously monitoring most funds by sector and will reinstate our Weekly Review, publishing a recap of the groups of interest.

The News

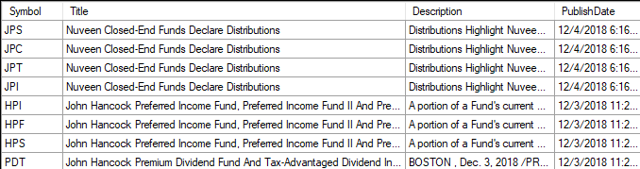

Source: Author's Software

Over the past week, several Nuveen closed-end funds declared their regular distributions:

Source: finance.yahoo.com

There is not a single change in the amount of dividends that these funds distribute.

The Benchmark

During the past week, the market once again tested its low levels. On the last trading day of the week, most of the equity exchange-traded funds finished at their lows. The leading benchmark of the preferred stocks (PFF) followed their example and recorded another negative week. The ETF even reached a new low of $34.47 per share. PFF has not been trading at such low levels from nearly seven years.

Source: Barchart.com - PFF Daily Chart (6 months)

By the last closing bell for the week, the ETF finished at a price of $34.75 per share. On a weekly basis, this is a loss of $0.43 or 1.22%.

Lately, PFF is not trading in harmony with the iShares 20+ Year Treasury Bond ETF (TLT). The total lack of correlation is quite easy to see.

Source: Barchart.com - TLT Daily Chart (6 months)

Source: Barchart.com - TLT Daily Chart (6 months)

The recent drop in the treasuries helped TLT to retrace quickly. On a weekly basis, the bond ETF gained $3.51 or 3.04%.

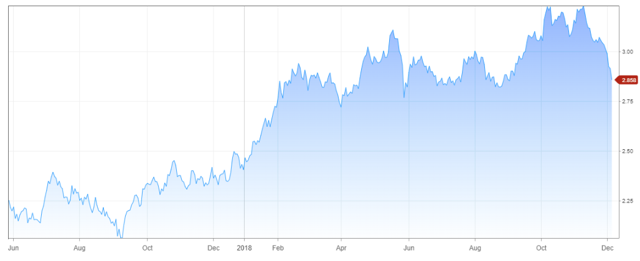

The 10-year treasuries, as we already discussed, have fallen to a level of 2.85 during the past trading week.

Source: cnbc.com - U.S. 10-Year Treasury

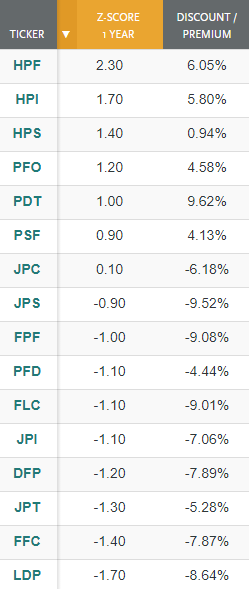

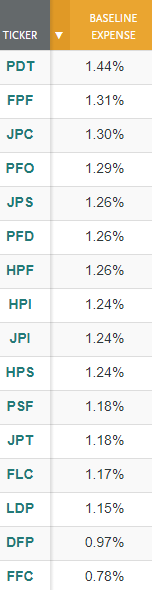

1. Sorted by Z-Score

Source: Cefconnect.com

Today, the Z-scores are a little bit lower than our previous article, but there are not any shifts between the leading positions.

Still the undisputed leader of the group is the John Hancock Preferred Income Fund II (HPF) with currently the highest Z-score of 2.30. HPF's score has shrunk during the week with the modest 0.40 points. The CEF is still overvalued from a statistical perspective.

HPF is once again followed by the other two members of the John Hancock family - the John Hancock Preferred Income Fund (HPI) with a Z-score of 1.70, and the John Hancock Preferred Income III Fund (HPS), which has a result of 1.40.

The Flaherty & Crumrine Preferred Income Opportunities Fund (PFO) is still among my "Sell" candidates list. The CEF is statistically overvalued with a score over 1.00, and about its high premium, I will talk a little bit later.

At the other side of the table, we find a new bottom pick in the face of Cohen & Steers Limited Duration Preferred and Income Fund (LDP). Compared to last week, LDP has a little bit lower score. Its NAV/Price spread has widened as well.

Right above LDP is the Flaherty & Crumrine Preferred Securities Fund (FFC) which currently has a negative score of -1.40.

The average Z-score in the sector is -0.13.

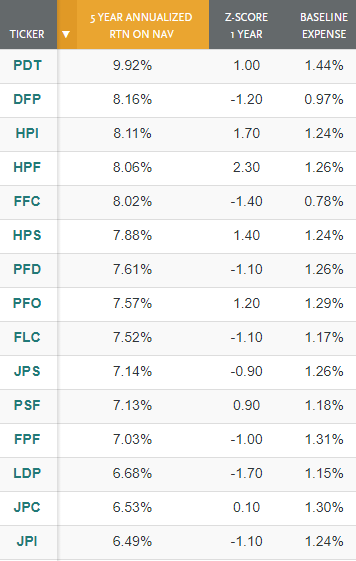

2. Baseline Expense

Source: Cefconnect.com

From the above table, we could get information on how much the different funds charge us for managing our portfolio. As we can see, the average charge in percent is 1.20%. Anything over 1% is a little bit high for me, but 1.20% is still acceptable, especially when we keep in mind the delightful performance of the sector.

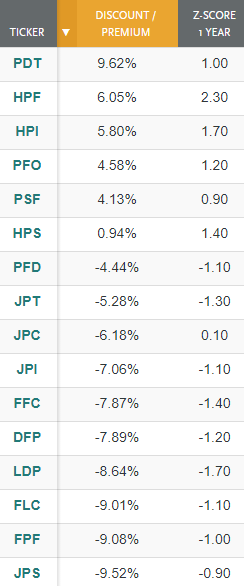

3. 5-Year Return On NAV

Source: Cefconnect.com

The aim of the above ranking is to show us the closed-end funds with the higher yields based on the net asset value. Combination of the return with the other metrics that we have is a foundation of our research for potential "Long" candidates.

Our undisputed leader on a regular basis is the John Hancock Premium Dividend Fund (PDT). The 7.55% yielder is the most generous closed-end fund in the sector for a long time now. Here, the quite high baseline expense of 1.44% could be justifiable.

The average return in the sector is 7.59%.

4. Discount/Premium

Source: Cefconnect.com

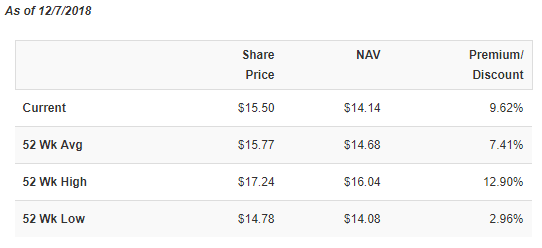

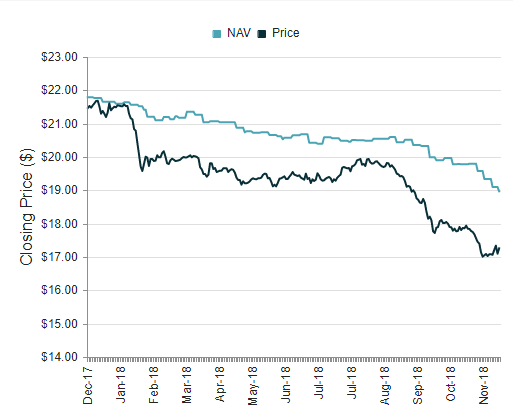

We continue with monitoring the most overvalued fund in the sector. PDT is not only the most generous fund but also the CEF which is trading at the highest premium among all others. Currently, the preferred CEF is trading at a 9.62% premium. The chart below shows that the fund is currently undervalued based on its discount if we compare to its peers: Source: cefdata.com

Source: cefdata.com

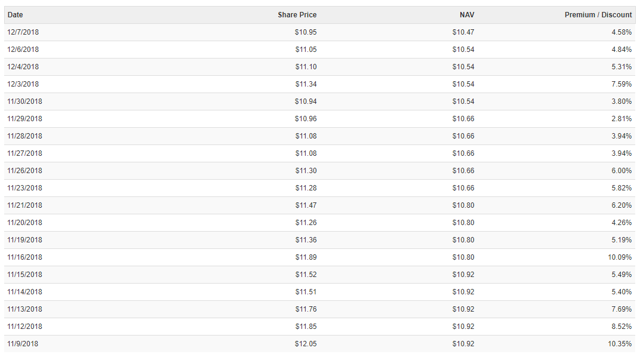

At these levels, the fund might be a little bit overvalued, if we take a look its current NAV compared to its current premium:

Source: Cefconnect.com

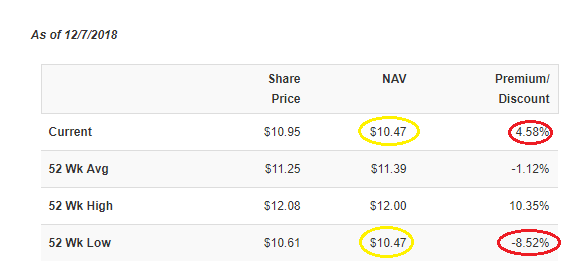

Another preferred closed-end fund with a lagging NAV compared to its price is the Flaherty & Crumrine Preferred Income Opportunities Fund (PFO). At the present moment, the fund is trading at a 4.58% premium, but its net asset value has fallen with more than 4.00%: Source: Cefconnect.com

Source: Cefconnect.com

Story repeats:

Source: cefdata.com

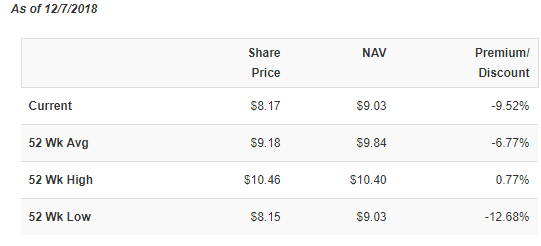

At the final place in today's chart, we find the Nuveen Preferred & Income Securities Fund (JPS) with the biggest discount of all. Currently, JPS is trading at a 9.52% discount:

Source: Cefconnect.com

The Flaherty & Crumrine Total Return Fund (FLC) is another fund which is quite undervalued compared to its peers: Source: cefdata.com

Source: cefdata.com

It is currently trading at a wide discount of 9.01%:

Source: Cefconnect.com

The average discount in the sector is -2.74%.

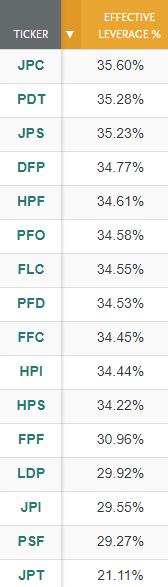

5. Effective Leverage

Source: Cefconnect.com

Leverage magnifies returns, both positively and negatively. And we look at the effective leverage percentage, and we can understand these high-return results that the funds provide us with. This indicator is also quite important when we do our homework on the closed-end funds. Basically, what we have concluded is that the average leverage percent in the group is 31.65%.

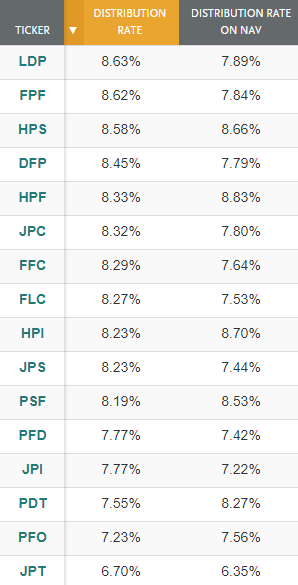

6. Distribution Rate

Source: Cefconnect.com

Above, we saw what was the historical performance of the funds, but, probably, most of you are interested in the current return which could be achieved, and that is the reason why I sorted the funds by the highest distribution rate.

The average yield on price for the sector is 8.07%, and the average yield on net asset value is 7.84%.

Conclusion

In this rising rate environment, fears of a trade war, and slowing global economy, it is normal for the sector to be depressed. But those who follow our weekly reviews know that there is an improvement in the sector.

Lately, there are more and more trading opportunities in the preferred stock sector, both "Long" and "Short". As we see from the tables above, there are closed-end funds trading from 9.00% discounts to 9.00% premiums. This gives us great opportunity to play on both sides and even hedge our long-term trades.

Note: This article was originally published on Dec. 9, 2018, and some figures and charts might not be entirely up to date.

Trade With Beta

At Trade With Beta we also pay close attention to closed-end funds and are always keeping an eye on them for directional and arbitrage opportunities created by market price deviations. As you can guess, timing is crucial in these kinds of trades; therefore, you are welcome to join us for early access and the discussions accompanying these kinds of trades.