Our best idea for 2019 is to buy Westaim (OTCPK:WEDXF) [TSE: WED]. At today's price of $1.80, Westaim is trading for ~75% of book value and <2/3 of our assessment of fair value. We believe 2019 should be a year of significant value creation for Westaim as they conclude their strategic process for their insurance company (Houston International Insurance Group, or HIIG) and as their asset manager (Arena) begins to achieve significant operating leverage. Management also has a track record of creating value through opportunistic acquisitions; we have not given them any credit for value creation in our fair value estimates, but that will likely prove a conservative assumption.

Note: Westaim reports their financials in U.S. Dollars; however, their main listing is in Canada and trades in Canadian Dollars. Unless otherwise noted, all figures in this article, including book values per share and share prices, will be in U.S. Dollars, and current trading prices will refer to their U.S. traded WEDXF shares.

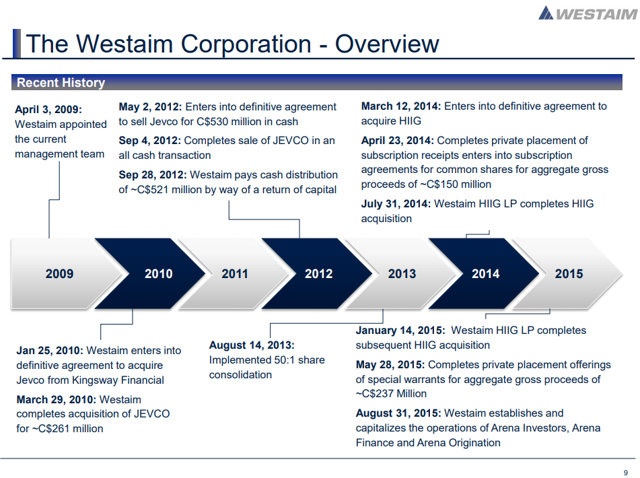

There are a lot of things to like about Westaim, and we will cover all of them in time. But let's start with a brief history of Westaim, because their history helps illustrate both how savvy Westaim's management team is and how shareholder friendly they are.

Westaim effectively started in December 2008, when Goodwood acquired ~20% of the company. At the time, Westaim was effectively a cash shell. Goodwood bought the shares well below cash value and clearly planned to push Westaim to maximize value by using their cash to pursue opportunistic acquisitions (see p. 11 of Goodwood's 2008 Annual Report for more; Westaim remains a major holding for Goodwood, and you can see their updated thoughts on Westaim on p. 7 of their 2017 Annual Report). Sure enough, in April 2009, Westaim announced plans to search for