This article is a continuation of a monthly series highlighting the top net payout yield (NPY) stocks that was started back in June 2012 and explained in August 2012. The series highlights the best stocks for the upcoming month, utilized in part to make investment decisions for the IB Asset Management model. Please review the original articles for more information on the NPY concept.

December Returns

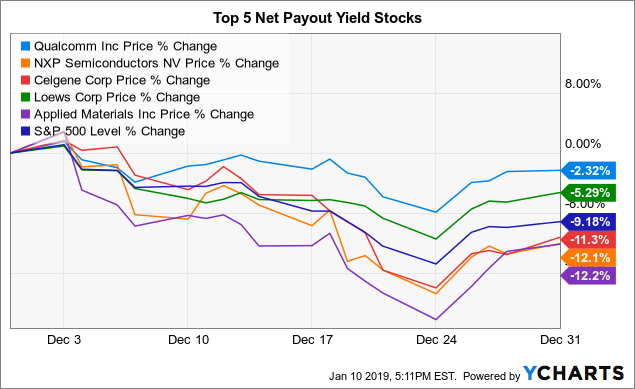

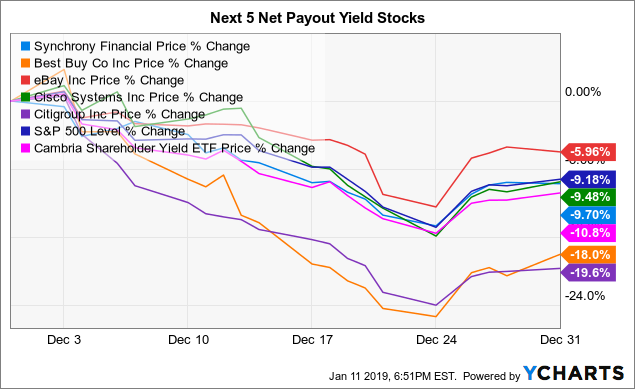

Below are two charts highlighting the monthly returns of the top 10 stocks from December (see list here). For presentation reasons, the chart is broken into the Top 5 and Next 5 lists and compared to the S&P 500 benchmark index along with the Cambria Shareholder Yield ETF (NYSEARCA:SYLD), which offers a fund for comparison purposes that is aligned with the NPY concept.

The Top 5 stocks hit a rough stretch over the last few months along with the market. The group had a rather weak December with three stocks seeing losses in excess of 11.0%. Even with the benchmark S&P 500 index losing 9.2%, Celgene (CELG), NXP Semiconductors (NXPI) and Applied Materials (AMAT) managed to lose in excess of the market with losses of 12.0% on average. Those large losses were somewhat offset by a relatively small 2.3% loss of Qualcomm (QCOM) and the 5.3% loss of Loews Corporation (L). The Cambria fund produced a very large 10.8% loss, far in excess of the Top 5 stocks and the benchmark index. In total, the Top 5 stocks lost 8.6% for December to slightly outperform the benchmark S&P 500 index and easily beat the Shareholder Yield ETF.

QCOM data by YCharts

QCOM data by YCharts

The Next 5 stocks had another bad month in December with only one stock beating the performance of the benchmark index. In addition, a couple of massive losses crushed the group of stocks. Both Citigroup (C) and Best Buy (BBY) lost in excess of 18.0% for the period. The relatively small 6.0% loss of eBay (EBAY) was further offset by ~9.5% losses of both Cisco Systems (CSCO) and Synchrony Financial (SYF). In total, the Next 5 stocks lost an incredibly large 12.6% for the month, under performing the 9.2% loss of the S&P 500 index and the 10.8% loss of the Shareholder Yield ETF.

SYF data by YCharts

SYF data by YCharts

In all, the top 10 stocks had a very weak month with no stocks gaining during the period. The massive losses of five stocks that exceeded 10.0% dips in December led the way down. In total, the NPY stocks lost a large 10.6% in comparison to the 9.2% loss of the benchmark index and the 10.8% loss of the comparable ETF.

January List

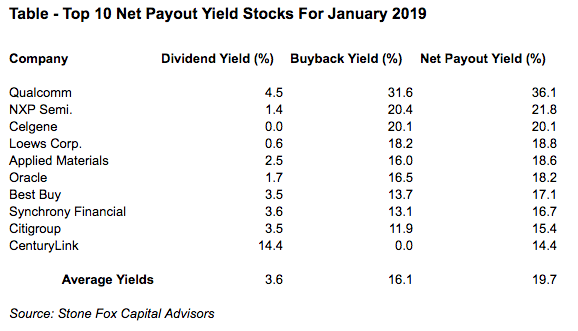

The top 10 list only saw a few minor shifts for January despite the market selloff that tends to vastly adjust net yields. The top of the list continues to see an influx of tech stocks. Four of the top six yields are tech stocks. All of these tech stocks yield in excess of 18% due to a suddenly cheap sector and tax reform providing extra cash due to lower income tax rates and repatriation of foreign cash.

Both eBay and Cisco Systems dropped off the list to start 2019. The stocks still maintain yields of ~14% so investors need not dump these stocks in their portfolios to remain in this investment concept.

The additions to the list for January were Oracle (ORCL) and CenturyLink (CTL). Oracle is a new addition to the monthly NPY list due to a large increase in stock buybacks that pushed yields above 18% while CenturyLink has consistently been on and off the list over the last few years.

A new section of the report will regularly provide monthly commentary on individual stocks with this month focused on the addition of Oracle and the Celgene buyout.

Oracle Joins List

Oracle joined the growing list of large tech companies that have implemented aggressive share repurchase plans. The tech giant spent an additional $10 billion on share buybacks in the November quarter that, combined with a small dividend, boosted the yield up to the 18% level. The company has over $49 billion in cash to continue share repurchases at an aggressive pace.

The NPY is interesting here because the stock has a market type froward PE ratio at 14x. One has to question whether Oracle wisely spent all that money versus making consistent purchases on weakness over time.

ORCL PE Ratio (Forward) data by YCharts

ORCL PE Ratio (Forward) data by YCharts

Celgene Buyout

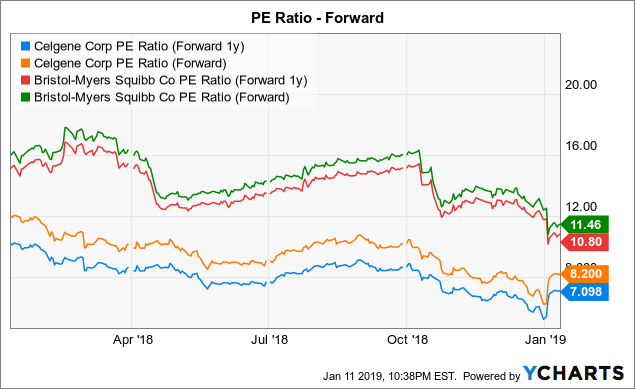

Recently, Bristol-Myers Squibb (BMY) announced the intent to acquire Celgene for cash and stock plus a contingent value right in a deal valued at up to $112 with the stock currently trading around $87. As with most acquisitions, the deal will eliminate stock buybacks during the year that the deal takes to close.

Image Source: Bristol-Myers website

Image Source: Bristol-Myers website

An investor can choose whether to stick with Celgene or take the quick gains and move into another NPY stock. A technical NPY investor would keep the stock as long as the yield remains high. The company aggressively started stock buybacks during the December quarter in 2017 so the yield will start rolling off this year.

The intriguing part is that the new Bristol-Myers offers a 3.3% dividend yield and promised an immediate $5 billion accelerated-stock repurchase plan fitting right into the NPY concept at closing the deal.

Unlike Oracle, these biopharma stocks trade more at the valuations one might expect from a stock able to offer a consistently high NPY. Not to mention, my previous research identified that the new BMY will trade at about 6.8x EPS estimates of $7 once the deal is closed.

CELG PE Ratio (Forward 1y) data by YCharts

CELG PE Ratio (Forward 1y) data by YCharts

Back in September, none of the stocks on the list maintained an NPY above 15% while the December list now has all but one stock above above that level. The lowest yield is back above 14%, providing yields far in excess of normal dividend yields.

The average yield surged to 19.7% to start January, up from only 17.5% to start December and down at only 11.6% in September. The buyback yield jumped again to 16.1% due to the large new buybacks of Qualcomm and NXP Semiconductors, amongst the others. The dividend yield got a big bump to 3.6% to mostly reflect the addition of the 14.4% yield of CenturyLink.

As mentioned last time, anybody looking for more dividend yield can leave the large dividend yield of CenturyLink in their portfolio. The stock only slightly misses the cut on most months it isn't included.

Conclusion

The yields of the NPY surged back to the massive yields of a few years ago. The average stock on the list has substantial buybacks to take advantage of the recent weakness in the market. Investors will want to look at December quarterly reports to see which management teams took advantage of their individual stock dips.

The NPY has become more volatile in the last few years as the list is now made up of a lot of tech stocks. Investors should consider diversifying away from a high concentration of any sector.

Ultimately, the NPY concept didn't provide the downside protection in the last quarter in the weak market due in part to the recent shift into more tech stocks. The stocks on the list should see an EPS boost in 2019 from stock buybacks at substantially lower prices that reduce share counts at a faster pace.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.