For MannKind's (NASDAQ:MNKD) investors 2019 is here. Some will say that this is the year in which the company turns things around, delivers on metrics that the Street will appreciate, and finally makes this a compelling story. Others will say that the company still has many challenges ahead, is still operating in a less than ideal environment, and needs another 18 months to get to where it needs to get. As those two schools of thought square off, you have savvy traders that profit from the ongoing debate. Some traders play the stock for instant profit, some play the stock to build a position on house money. Either strategy is fine, and the irony is that effective trading of the stock can be a tool for both sides of the debate to deploy as the company makes its way through these tough times.

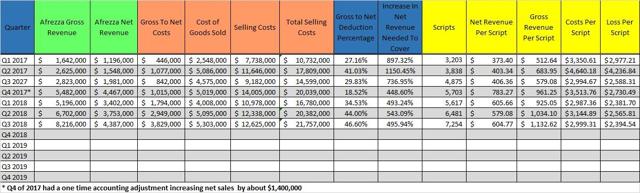

For the week ending January 4, Afrezza scripts came in at 558. The lower number is attributable to the New Year holiday, thus scripts should return to levels above 700 in short order. An important factor that investors should be aware of is that the price point of Afrezza and thus the revenue numbers attached are now pretty stable. Each Afrezza script now has a retail value of about $1,350 to $1,400. This price stability has now been in play for about 7 months and there is no indication that this will move very much. This dynamic relates to the newer packaging now being fully integrated into the channel. This dynamic will create some inflated year-over-year comparisons in Q1 and Q2 which will appear to be good, but in reality will correct downward in Q3 and Q4 in terms of year-over-year comparisons. Savvy investors bear these things in mind, while less savvy investors get taken in by the spin and talking points.

When looking at the dynamics surrounding Afrezza scripts, it is important to grasp the front end and back end and thus the cycle created. A refill cannot happen until a new script happens first. There was a point in time when the owner of the Dallas Cowboys (Jerry Jones) said to Emmit Smith (Hall of Fame running back) that the key to financial success was having a very big front door and a very small back door. What Jones was referring to was a front door that takes in as much money as possible and a back door that restricts the outflow of money. Such a strategy means that Jones keeps money in his hands as long as possible.

We can apply that analogy to Afrezza in several ways:

- new scripts is the front door. You need to feed the bucket with as many new scripts as possible. A certain percentage of the new scripts will translate into future refills. If you slow down the new scripts entering the front door, the absolute number of new refills will decrease. With Afrezza, the company has seen new scripts essentially flat-line for the last 6 months. This has allowed the refill customers (built over the last 4 years) to overtake the front end and have a better trajectory, whilst lowering the number of potential refills that can build in the future months. What this means is that the slow-down in new scripts in the second half of 2018 will carry a negative impact on refills in the first half of 2019. Savvy investors can see this dynamic and already know the impact will likely show through in the months ahead. The company has stated it will be more aggressive with advertising in Q1, so that should help to correct the problem.

Chart Source - Spencer Osborne (based in part on Symphony data)

Chart Source - Spencer Osborne (based in part on Symphony data)

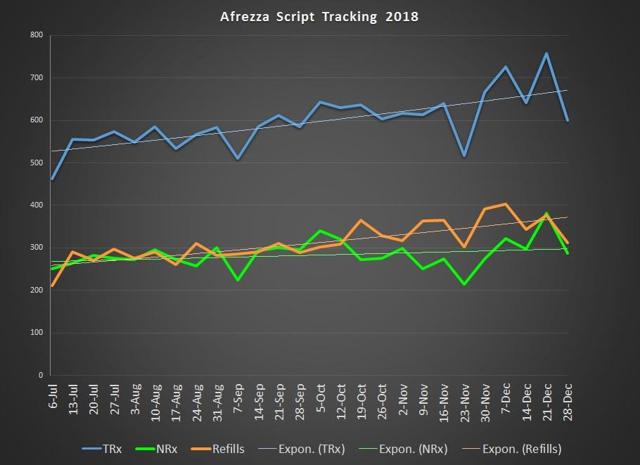

- In its current state, Afrezza has a small front door and a big back door. The company is actually spending more to get Afrezza in consumers' hands than it receives in net revenue at the end of the transaction. The numbers have improved a bit, but is still problematic. It seems that the company's strategy at the moment is to use new cash from the recent offering to increase marketing. This will help to improve the front end of getting more new scripts, but will see money flowing out the back door at a greater rate than we saw in the previous 6 months. In Q3 of last year, the total costs associated with each Afrezza script was $3,000. The net revenue per Afrezza script was $605. Essentially each Afrezza script sold costs the company $2,400. That is a big back door!

Chart Source - Spencer Osborne (based in part on Symphony data)

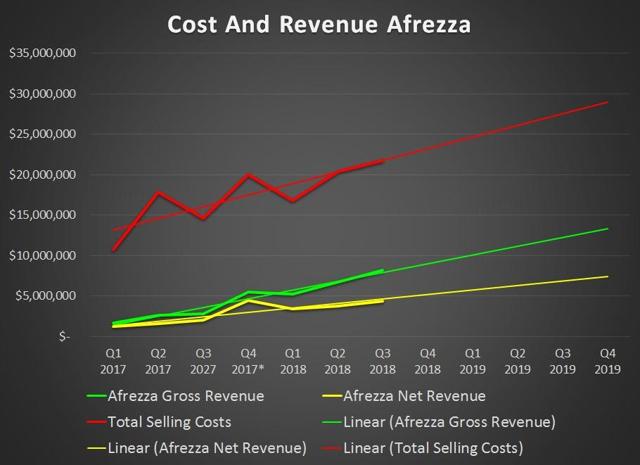

- The company can reduce the size of the back door by trimming costs. Doing that runs the risk of reducing the size of the front door as well. The big question mark for Afrezza has always been whether or not the drug can be profitable. One danger that investors will face is that of spin. It is great to hear that net revenue is increasing, but if you fail to consider the costs, the warm and fuzzy feeling that the spin gave you might be misplaced. If revenues are increasing at the same rate as costs on a product which is already losing money, then you are not really gaining ground. In the chart below you can see that gross revenues and costs are on pretty much the same trajectory, while the all-important net revenue is on a trajectory lower than costs. That is an indication that pretty much every effort to increase sales has not been effective at shifting the trajectory to where it needs to be. In this case, the front door is not big enough, and the back door is bigger than it needs to be. The good news is that the company is getting slightly better here. The bad news is that with an increased marketing spend, a step backwards (again) is likely to happen and it is uncertain as to whether that expense will show justification. If the company invests an additional $5 million in selling costs, it projects to cost an additional $485 per script (assuming Q1 scripts land between 9,200 and 9,300).

Chart Source - Spencer Osborne

Chart Source - Spencer Osborne

The positives MannKind has in early 2019 are that it can deliver some good talking points on year-over-year comparisons. The job of investors is to grasp how much of the year-over-year talking points can actually be delivered upon. It will be interesting to see if the extra dollars invested in advertising can deliver the needed bang for the buck or whether it is still a function of treading water. Treading water can be okay so long as it leads to actual swimming within a reasonable time frame.

The idea is to get to a point where the efficiency of sales reach a critical mass and can grow at a rate that provides a better trajectory than what is being spent. There is a saying that it takes money to make money or that dollars invested into advertising now will provide a positive return later. Thus far, nothing that MannKind has done on selling and marketing spending has really paid off in a timely manner. Whether the new 2019 efforts can deliver what is needed will need to play out over time. For some perspective, in Q4 of 2017 the company did an ad blitz. The selling cost line rose from $9.2 million to $14 million, the cost per script rose from about $3,000 to $3,760, and scripts rose by about 800. Meanwhile, net revenue per script rose by about $131. The net revenue is skewed a bit with new packaging, but you see the numbers pretty clearly.

The key thing to watch for in early 2019 is whether the advertising is delivering new scripts in large enough numbers. If we assume an additional $5 million in advertising expense, then the goal will be to deliver much better new script growth than we have been seeing. MannKind has some cash to work with, but it is not an endless supply. Rest assured that the players on the Street will be watching these metrics closely.

As most readers know, MannKind has offered no guidance for 2019 as yet. This leaves investors to assess the success or lack of success on their own. I have already modeled out an early projection for 2019. It assumes about 9,200 scripts in Q1. My projections for scripts do show growth. Historically MannKind has trended at the lower end of my script projections, and in 2018 was actually below my lower end for the year. If MannKind script growth is tracking below what I am projecting, it will be very likely that the costs associated with more marketing are not delivering an immediate return in terms of sales. Yes, ads take time to work, but it is not like people that see the ad may not already have a scheduled appointment. It takes a lot of ads to deliver the needed message, and a lot of ads cost a lot of money. Given the return on advertising investment in Q4 of 2017 and in Q2 and Q3 of 2018, investors would be wise to be a bit skeptical unless the number of ads run is an order of magnitude higher than what was done previously.

The bottom line is simple. We may not get company numbers to digest for a few months, but we have some decent modeling to work with and compare against. While executive compensation and bonuses seem to be a hot topic, it is only a small part of the overall problem. The data and numbers tell a more meaningful near-term story than whether or not management gets handed a hefty bonus for last year's effort. Stay Tuned!