Manole Capital Management

1st Quarter 2019 Investor Newsletter, January 2019

If you wish to view any of Manole Capital’s proprietary research, thematic notes, prior newsletters or individual stock calls, please visit the Seeking Alpha website and search for Manole Capital. We continue to make all of our research available 24/7 and for free. None of our proprietary research is walled off or behind “pay for” gates.

A Look Back, Both Right & Wrong:

Before we address the bigger issues of today, we would like to discuss where our predictions were both “right and wrong” from a year ago. To review our pre-2018 thoughts and last year’s 1st Quarter 2018 newsletter, click here.

2018:

2018 began with a global synchronized recovery and extreme bullishness. The economy was headed higher, fueled by over 20% earnings growth. The markets were at historically low volatility levels, with a clear “risk on” feel.

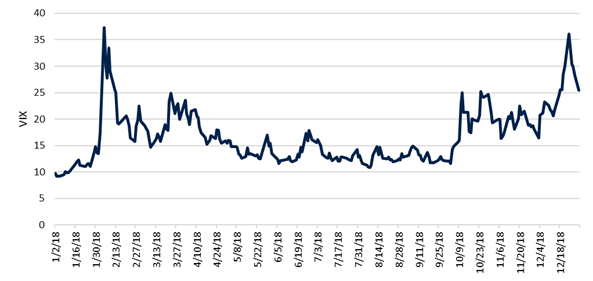

Rarely has a flipped calendar marked such a pronounced change in market dynamics and investor psychology. Just a year ago, there was giddiness regarding equities following the tax cut. Even more hype was laid on cryptocurrencies, that were soaring higher. Lastly, volatility was non-existent, and some thought the VIX (a) would stay suppressed forever.

Following the November 2016 election of President Trump, we were expecting a dramatic increase in volatility. We couldn’t have been any more incorrect. 2017 went down as the lowest average VIX for any calendar year in its history. If 2017 was a year of placidly rising markets, 2018 was a year marked by large gyrations and market swings. In fact, the VIX climbed 130% last year, making it the biggest annual increase in volatility since the VIX was created in 1993.

A year ago, “we stuck to our guns”, with expectations for heightened volatility. We were spot on in February/March and then quite right in September through December (see daily 2018 VIX chart). The VIX spiked dramatically higher with record volumes. With our portfolio heavily exposed to exchanges and transaction-based business models, results were positively impacted from these wild market swings.

As we begin 2019, we are 180 degrees different from a year ago. Some are forecasting a synchronized global slowdown with earnings only modestly up this year, and sentiment has definitely become much more bearish. Furthermore, high volatility and large market swings seem to be daily occurrences, not uncommon ones.

Taxes:

While one year may not be enough time to fully judge the tax-reform package effects, we strongly believe that it has positively impacted both personal and corporate results. The anniversary of the tax law is a good time to evaluate its initial impact. Corporate tax rates, falling from 35% to 21%, make US businesses much more globally competitive. For the first nine months of 2018, annualized economic growth was 3.3%, which puts the year on track for the best growth in 13 years. We should not forget that the prevailing wisdom before this current growth was that the US economy was in a “new normal” of 2%. Just 1% extra in growth, on a $20 trillion economy, equates to a huge difference in terms of deficit reduction, wage growth, et cetera.

With $2 trillion of overseas cash, many worried that companies would simply use their “found” cash to re-purchase their own stock. Roughly ¼ of that cash hoard ($571 billion), has returned to the US and companies are clearly investing in America. Intellectual property investment is up 10% annualized, its highest level since 1999. As of the 3rd quarter, real capital expenditures were up by $180 billion from the end of last year. Real, private non-residential business fixed investments are up 16%, to the highest level since 1993. We believe that incentivizing investment upfront, through 5-year, 100% expensing of new equipment / facilities, will encourage business growth.

In addition, tax reform significantly helped American families. Raising the standard deduction to $24,000 was just the beginning. According to Moody’s research, disposable income is up +2.7% year-over-year, personal savings are up +6.3%, and consumer spending has increased by an average of +2.7% over the last 4 quarters. Job openings reached a record high in August and there are more openings than unemployed people looking for jobs. This strong demand for labor has the benefit of raising wages, which funnels through the economy. Is the Tax Cut and Jobs Act of 2017 (TCJA) perfect? This is Washington, where no single piece of legislation is ever perfect.

We continue to believe that the US does not have a revenue problem; it has a spending problem. While we personally would have liked some spending cuts to help offset the deficit, we applaud an attempt to fuel the economy, stimulate job growth and improve average wages for the lower-and-middle class American worker.

“TINA” or There Is No Alternative (to US Equities):

For most of 2016 through the January of 2018, it did not matter where or what investors put their money into. We likened that environment to “a rising tide, lifting all boats.” From mid-May to the peak of the market in September, there clearly was a decoupling of American stocks. The US equity market was up over +7% versus the rest of the world, which was down by over (3%). However, as the 4 th quarter of 2018 showed, the US could not avoid worries of a global downturn forever. Chinese tensions came to boil and the S&P 500 lost (10%) in six short days, right before Christmas.

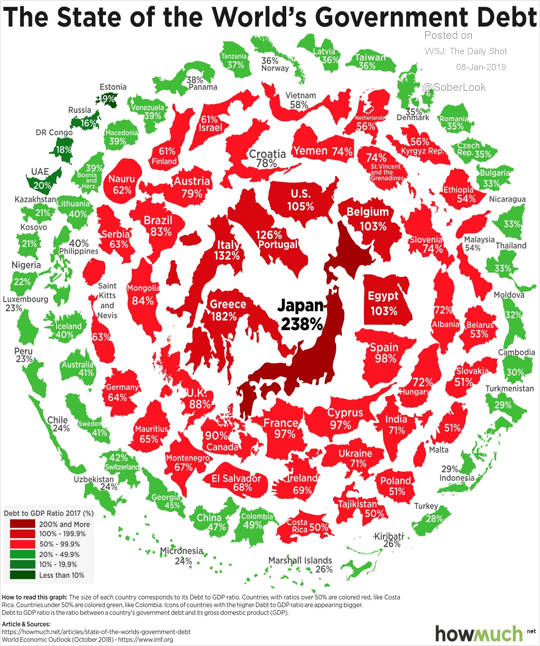

The S&P 500, our best reflection of the overall US equity market, was down (4.4%) for 2018. While this modest decline was significantly worse than the excellent +21.8% S&P 500 return in 2017, we continue to believe there is no alternative (or TINA) to the US equity market. Global stock markets fared much worse than those of the US last year. The Stoxx Europe 600 index fell 13% last year, despite many experts claiming Europe was due for a rebound. The UK is still wrestling with its Brexit issues (b), and the FTSE 100 declined by 12.5%. Japan’s Nikkei 225 Stock Average fell 12.1% and China’s Shanghai Composite declined by 24.6%. Ballooning leverage, growing debt to GDP levels, global trade tensions and weakening growth rates in certain emerging and developing markets, lead us to believe that the US equity market remains the “nicest house on the block.”

If you were a commodity investor, 2018 was just as awful. Lumber was down 25.8%, sugar declined 20.7%, and copper dropped 19.9%. The energy markets were equally challenged. Gasoline prices fell 26.4%, crude oil fell 24.8%, diesel fell 19.0%, while natural gas was the best of the bunch, essentially flat. In the 4 th quarter alone, US crude prices fell 38%, their worst quarter since 2014, when prices for West Texas Intermediate (WTI) fell below $30 per barrel. US production is climbing, and we now are the world’s top oil producer. Iran sanctions recently were triggered, causing supply uncertainty. Saudi Arabia kicked off the new year with a new OPEC agreement to cut production, while Russia remained a wildcard. The market is clearly wrestling with gyrating supply/demand issues.

Energy is the ultimate cyclical product. The energy sector was the single best area of the market in 2016, up +28%, but it was one of two sectors that declined in 2017, down 1%. In 2018, as represented by the XLE, energy fell another 18%. After hitting an 18-month low in late December 2018, energy has now posted 10 straight days of gains. There is one certainty for energy investors - expect and anticipate extreme volatility.

The world has never had as much debt (see chart below) as it has right now, standing at nearly $250 trillion. According to a recent Citigroup report, this is 3x the debt level of two decades ago. US household debt (comprised of credit cards, auto and student plus personal loans) is about to top $4 trillion for the first time. According to MeasureOne, student loans exceed $1.5 trillion, with 92% of it owed to the federal government. Non-mortgage debt, particularly credit-card loans, remain our biggest worry. For perspective, according to Experian, the average US household owes $6,826 on credit cards, nearly 2% higher than last year. For the top eight card issuers, losses are 3.16% and trending higher.

The market has never had a zero-interest rate environment, and we have no idea how it will respond once quantitative easing ultimately ends. The real test, for the fixed income market, will be seen over the next 1 to 2 years. Global central banks are beginning to raise interest rates and alter their easy money policies. While the Fed has telegraphed its intentions, some remain concerned with the shrinking of its $4.1 trillion portfolio of bonds. With the Fed rising interest rates four times last year, debt instruments had their worst year in decades. Fixed income investors were looking for “safe assets” and ended 2018 disappointed. Long-term Treasury bills were down 1.9% last year, US TIPS fell 1.3% and high yield bonds declined 2.1%. Overall, fixed income investments struggled last year and the short-term looks just as gloomy.

Investing Philosophy:

Mike Tyson, former boxing champion, once said “everybody has a plan until they get punched in the mouth.” We love this quote, because it can be quite appropriate for the investing world too.

The (19.9%) drop in the S&P 500, from its peak in September, may not meet the traditional definition of a bear market, unless you round up. However, this harsh fall did bring back some nervousness and volatility. As you can see in this chart, the S&P 500 has seen 17 pullbacks of at least 5% since March of 2009, six of which have been greater than 10% declines.

While the stock market has rallied roughly +10% from its recent lows, there remains significant questions and uncertainty. Over the last decade, the strong equity market has led many to feel like they “missed out” on a historic bull run. Over the last year, these same investors are now concerned about seeing some gains melt away.

Many investors fail to do a deep investment analysis of their holdings, until a hard punch forces them to pay attention. Are your investments and portfolio in sync with your risk tolerance and financial goals? Each and every day, we focus our attention on maintaining a portfolio of FINTECH companies, rather than guessing when the next downturn will occur. We do deep dives into company fundamentals, as well as build our own models. Instead of churning portfolios and searching for momentum, we remain disciplined to our process and strategy. Due to our focus on free cash flow, we have built a portfolio that can withstand a significant downturn, if volatility spikes and that environment arises.

With the market’s recent sell-off, we believe now is an excellent time and opportunity to invest in America. Some may argue value stocks are due to outperform growth companies for the first time in a decade. Others claim small caps will rebound and outperform. Instead of making macro decisions, we will remain disciplined and follow our 20-year strategy of doing bottoms up, fundamental research. We will continue to identify and invest in wonderful FINTECH companies at attractive valuations with certain key characteristics. The critical traits that steer our investment process and philosophy are listed below.

Key Manole Capital Investment Characteristics:

- High barriers to entry and a “moat” around the franchise

- Market share leaders with durable competitive advantages

- Pricing power and flexibility to withstand market volatility

- Recurring revenues and sustainable business models

- Strong balance sheets with predictable free cash flow

- Excellent management teams properly allocating capital

Looking Forward To 2019:

Let’s start with the obvious – the US political system is a mess. We believe gridlock is here to stay and bi-partisan dreams are just that, dreams. With the Democrats taking control of the House of Representatives and Republicans still controlling the Senate and White House, we expect little to get accomplished.

Why are we so pessimistic about our government? President Trump’s biggest topic nowadays is building a wall and providing border security. To keep this campaign promise, he has forced what is now the longest government shutdown in US history. Democrats are adamant that they will not support Trump’s wall or even support his re-defined “steel barrier.”

We strive to remain independent on political issues, but isn’t it ironic that in 2013, under President Obama, that all 54 Senate Democrats voted for $46 billion in border security, including 700 miles of border fencing? Chuck Schumer and Elizabeth Warren both voted yes, but now they are steadfast in their opposition. Sorry, but in our opinion, this is the definition of partisanship. On the flip side, we find fault with Republicans, too. It was not a wise decision for President Trump to take full ownership of the government shutdown and be responsible for over 800,000 people not getting paid their weekly salaries. The current dialogue is that President Trump will declare a “national emergency,” which would allow him to invoke a statutory provision in the National Emergencies Act of 1976. Presidential advisors cite that the Defense Secretary, during national emergencies, can “undertake military construction projects, not otherwise authorized by law, that are necessary to support such use of the armed forces.” Because President Trump has already deployed troops to our southern border, he theoretically could allocate unobligated military construction funds for a wall.

While he may have the legal authority to do this, is it wise to act without Congressional consent? Conservatives, who strongly believe in the separation of powers, will view this as a terrible precedent. True constitutionalists will cite Article I, Section 9 to counter this emergency action. We expect legal proceedings from House Democrats arguing that this usurps Congress’s appropriations power. We do not like any presidential action bypassing Congressional approval, certainly not one that is done to fulfill a campaign promise. Isn’t it ironic that House Republicans sued the Obama Administration in 2015 for spending unappropriated funds for some of his ObamaCare subsidies? We see culpability on both sides of the aisle. In our opinion, this shutdown fight is just a “test of power”, especially since $5.7 billion is approximately 0.1% of the federal budget.

Washington, DC, is an amazing city, filled with great museums, restaurants and monuments. However, its politics can be terribly frustrating. While we can hope a bipartisan infrastructure bill can pass over the next year and possibly even some immigration reform, we remain quite skeptical that anything will get done in Washington this year. This is why we prefer to focus on the equity markets and our area of expertise, FINTECH investing.

The Biggest Issue for 2019 Is China:

In our opinion, the ongoing uncertainty of the trade dispute is the single largest market concern. President Trump has the authority and power to settle trade issues. His administration can resolve the US/China dispute and alleviate the biggest worry facing the equity markets. Ongoing threats of punitive tariffs continue to cause equity markets to slide. Time will tell if this is just a President Trump negotiating tactic, but the market is certainly apprehensive and concerned. Emblematic of this continuing back-and-forth, following a positive dinner at the G20, Beijing agreed to purchase US soybeans and to lower the levy on our automobiles from 40% to just 15%. While both measures by China are an attempt to reverse tensions, it remains to be seen if these minor changes will be enough to get President Trump’s approval. If the next three months of negotiations do not settle this dispute, the US will raise its tariff on $200-billion of Chinese goods from 25% from 10%.

Just last month, we published our thoughts on this critical trade issue in a 14-page research note. If you would like to read/re-read our thoughts on China, just click here. By the next time we publish our next quarterly newsletter in April, we should have a much better and clearer picture of the US & China’s trading relationship.

The Fed & Interest Rates:

In terms of interest rates, we always like to gauge market sentiment by viewing the CME’s expectations, viewed here. Just a few months ago, Fed officials were hinting at four rate hikes in 2019, following four rate hikes in 2018. In fact, Fed-fund futures were at 90% that rates would be higher than they are now. Now, there is a huge reversal of expectations with a 53% probability that Fed officials will cut rates by the end of 2019. These wild swings in expectations are music to our ears, considering our ownership of the derivative exchanges (where interest rate futures and options trade).

Fed Chairman Jerome Powell needs to walk a fine line between remaining “data dependent” and insuring the Fed stays “independent” from harsh criticism by the White House. Now, with elevated volatility and more uncertainty, expectations have been properly (in our opinion) lowered. The Fed can and will make changes to its outlook. For example, back in 2016, the Fed changed its mind due to a Chinese market slowdown. The Fed initially guided the market to anticipate four rates increases, only to lift Fed funds one time.

Chairman Powell recently said, “We will be prepared to adjust policy quickly and flexibly and use all of our tools to support the economy should that be appropriate.” He later added that “…the appropriate extent and timing of future policy is less clear. Against this backdrop, the Committee could afford to be patient about further policy firming.” In addition, Dallas Fed President Robert Kaplan said, “The central bank should hold off on additional rate increases until it determines whether rising anxiety about the economy and financial markets is temporary or a sign of something more troubling.” We couldn’t agree more when Chairman Powell recently said “…concerns over escalating trade tensions, global growth prospects and the sustainability of corporate earnings growth were among the factors contributing to the significant drop in US equity prices.” During his Economic Club of Washington interview, Chairman Powell said the word “patient” or “patiently” five times. In our opinion, the Fed will take a more dovish approach to future interest rate increases this year. Is it fair to question whether the Fed is more “data dependent” or “market dependent”?

Higher interest rates are needed to slow an economy growing “too fast” or to help offset runaway inflation. We do not believe either of these issues is a concern today. The US has a healthy labor market, inflation is tame and the economy continues to steadily grow.

Current Events:

Back in September, estimates for 4th quarter S&P 500 earnings were year-over-year growth of +17%. Some retailers have hinted at weak holiday sales and other companies are claiming Chinese trading tensions are impacting revenues. This has caused sell-side analysts to lower earnings expectations to just 11%.

In early January of 2019, Apple (ticker AAPL) negatively pre-announced earnings, primarily due to weakness in iPhone demand in China. For the first time in more than 15 years, AAPL cut its quarterly revenue estimate and forecast. In the Chinese smartphone market, AAPL’s market share has fallen to 7.8% from a high of 12.5% in 2015.

Last summer, AAPL was the first company ever to reach a market capitalization of $1 trillion and it was the largest company in the world. From 1926 through 2018, only ten US companies have ever ranked as #1, in terms of market capitalization. With Apple’s recent fall, Amazon (ticker AMZN) has now become the eleventh company to hold the position as “king of the mountain”.

For perspective, AMZN is now roughly 3% of the total value of US stocks. However, back in 1932, AT&T was 13% of the entire US market and IBM in 1970 was 7% of the total market. Typically, these types of size milestones are not the best indicator for positive, future performance.

For example, the length of time a company holds the “largest company title” is shrinking. From the late 1920s to the late 1950s, the largest company held that top spot for an average of 20 months. From 2000 through mid-2018, the average tenure at the top was 15 months. According to a recent Wharton Research Data Service report, once a company hits #1, it typically underperforms the overall US stock market, by an average of 6%, over the next five years. Want more proof? Back on October 3 rd, AAPL’s stock peaked in value at $233.47/share. Since that price, AAPL has fallen by over (39%). To put this decline in perspective, AAPL has lost over $400-billion in value or an amount that is larger in value than 496 members of the S&P 500. This decline in AAPL is roughly the same size as the entire valuations of JP Morgan (ticker JPM) or Wal-Mart (ticker WMT).

Optimism (The Glass Is More Than ½ Full):

What does the current mood indicate? Judging by investors’ words and deeds, it is obvious the market is rather gloomy. Some worry that recent manufacturing and consumer-confidence numbers indicate that our 9-year economic expansion is coming to an end. We disagree.

In the US, unemployment at 3.9% is near a 50-year low. More than eight million jobs were lost during the Financial Crisis, but job creation has been positive for an impressive 99 straight months. Just last month, the Labor Department found that the US added an impressive 312,000 new, non-farm payroll jobs. This is significantly above the 5-year average gain of 215,000 jobs per month.

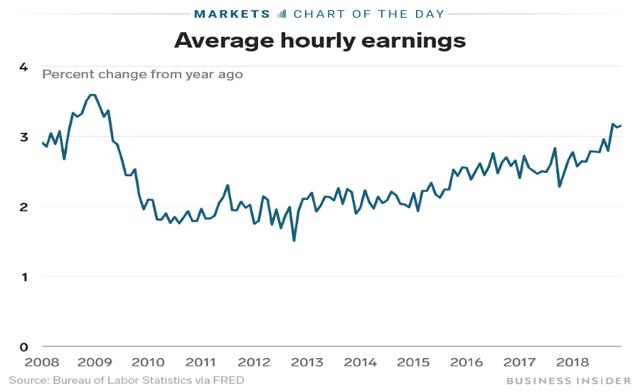

More than 500 companies, covering 6 million employees, have recently announced wage increases, bonuses, new hiring’s and/or enhanced benefits. Just as important, average hourly wages are rising, and are up by 3.2% year-over-year. As the chart shows, this increase represents the largest full-year gain in over a decade.

In our opinion, consumers drive our economy. If the labor market remains tight and wage growth continues to expand, consumers will continue to spend. According to MasterCard research, overall retail spending, across all payment types (both cash, check and card), was the strongest experienced in the last six years. This holiday season, MasterCard believes spending grew over +5.1% to $850 billion while online shopping experienced an impressive +19.1% growth year-over-year.

We agree with Stephen Stanley, the chief economist at Amherst Pierpont, who recently stated, “The consumer is on fire, and, I’m sorry, if the stock market is trying to signal that the US economy is crumbling. Mr. Market is wrong.” Strong US household income generates consumer spending, which then propels our economy higher.

From a macro perspective, quality healthcare continues to improve and the American Cancer Society just reported that cancer deaths have dropped by 27% over the last quarter century. That equates to 2.6 million fewer cancer deaths. Divorce rates are down, graduation rates are up, and violent crime is falling. We believe the recent market sell-off reflects more short-term thinking than current research and positive, long-term indicators confirm. Globally, child mortality and illiteracy have plummeted, while life expectancy has materially improved.

According to the Brookings Institution and World Data Lab research, ½ of the world’s population is now “middle class or rich.” This equates to 3.8 billion people being significantly better off than in 1980, when ½ of the world lived in “extreme poverty.” (c). Research shows that disease and deadly violence are way down. On the disease front, improvement comes from globalization, not necessarily through miracle drugs. As people get better paying jobs and markets open up for trade, incomes rise which permits a higher (and cleaner) quality of life. The world’s largest population is China and it has experienced a 25x per person rise in income over the last 40 years. India has the world’s second largest population and its economy just passed that of China in terms of growth.

Our Published Research:

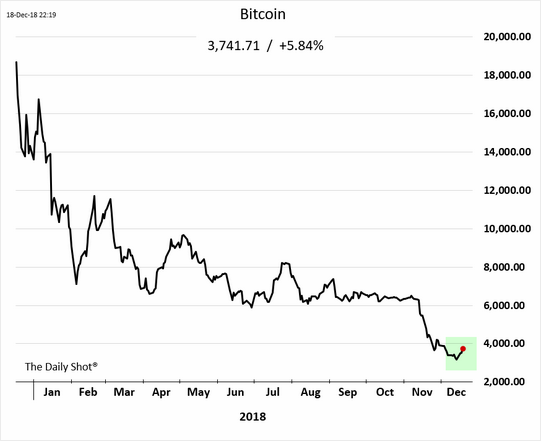

Over the course of 2018, we were quite active on publishing research. Starting in December of 2017, we published a 9-page note (click here to read it) highlighting the flaws we saw in bitcoin. Our thesis was simply that we did not and still do not believe bitcoin acts as a viable currency. As a method of payment and a store of value, it fails on both counts. Right after we published our bearish note, bitcoin soared from $11,000 to nearly $20,000. How’s that for bad timing?

During 2018, bitcoin got crushed, finishing the year down roughly 70%. We were a little early in calling bitcoin “a bubble waiting to burst,” but our rationale and thesis were sound. Perma-crypto bulls will claim that bitcoin has still tripled from under $1,000 from the end of 2016. In our thinking, that just means there is more volatility and uncertainty looking forward.

Even if we are incorrect, and bitcoin is a viable currency, our strategy is still sound. We invest in wonderful FINTECH companies, not currencies like the dollar, pound, euro, peso, et cetera..

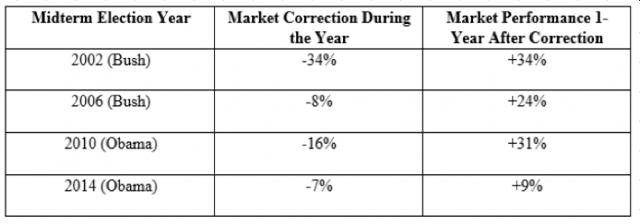

Also in August, we published our thoughts on what might happen during the important mid-term elections (click here). As that note and the chart below show, the market rarely performs well during the year of a midterm election. However, the market rewards investors the year after a midterm election. This obviously bodes well for 2019.

In November, we published our thoughts on the US economy (click here), analyzing many important macro conditions. Historically, we publish our macro thoughts in these quarterly newsletters, but we decided to focus on the 10-year anniversary of the Financial Crisis, with our 4th quarter 2018 newsletter. Click here for that 14-page piece of research.

In addition to macro and thematic research notes, we continued to publish stock-specific calls. In February, we once again wrote up our thesis for owning our large position in CME Group (CME). On the positive side of the ledger, CME’s stock price rose +21% since our publication. In June, we published the risks we see in the credit card issuing space, with our note titled “Are You Swimming Naked” (click here). On the less successful side of the equation, back in August, we wrote a detailed, 12-page note on the long-term opportunity we saw in Blackrock (BLK). Our timing could not have been worse with the stock falling by (16%) from the date of its publishing.

Conclusion:

We apologize for being optimistic. If the world is getting much better, why does everyone (especially newscasters) seem so miserable? Some might argue that it is careless to celebrate how the world is improving when there are still things like global warming, opioid addiction, nuclear proliferation, obesity, and other matters to tackle. In our opinion, today’s problems are smaller than the issues the world has already overcome and solved. For example, a front-page article, on January 9th, 2019, in the Wall Street Journal, discussed the rising popularity of gold flaked food and $26 cappuccinos covered in 24-karat gold. We believe that patience and through technological improvements, the world will address and solve many of these current matters. Are things perfect? No, but things are quite good and getting better each and every day.

The US market is performing well, and the underlying fundamentals look favorable and encouraging. Despite the negative sentiments on the news, the numbers tell a completely different story. The latest National Association of Manufacturers survey found that the US economy is operating at “unprecedented levels of optimism, spurred by improvements in the global economy and, in particular, by pro-growth policies such as tax reform and regulatory relief.” While some are predicting a synchronized global slowdown, we forecast continued, steady growth. While there is no doubt that earnings in 2018 were boosted by the tax cuts, growth ought to continue this year. The rate of change may slow, from 3+ plus percent growth, but lifting a $20 trillion economy by over 2.5% is still healthy. In our opinion, bearish sentiment more than discounts the slowing domestic and global economy.

In fact, we believe this year will be quite positive. As we continue to say, the market hates uncertainty and the unknown. To quote Dave Donabedian, the chief investment officer at CIBC, “The stock market in 2019 is desperately seeking clarity.” Not if but when US and China resolve their trading issues, the equity market will rally higher. Just this week, US Commerce Secretary Wilbur Ross said there’s “a very good chance that we’ll get a reasonable settlement that China can live with, that we can live with, and that addresses all the key issues.” Whether you love or hate President Trump, his game plan for re-election is fairly simple. He will run on a strong economy. To quote James Carville, Bill Clinton’s successful campaign manager for re-election in 1992, “It’s the economy, stupid!” President Trump will need to resolve the current Chinese issue, be the “champion” of a robust economy (i.e. jobs), and maybe most importantly, be the leader in charge during a positive stock market. President Trump will need to change the market from its current “Trump Slump”, back to that post-election “Trump Bump.”

To be perfectly clear, we do NOT expect a recession in 2019. From a macro perspective, the inflation outlook remains subdued. This should give Fed Chairman Powell enough evidence to take a more dovish stance. The US Treasury 2-year versus 10-year yield curve remains positive and has not inverted. While EPS will slow, it should remain positive from solid, economic activity. We see great opportunity in our FINTECH portfolio, and we remain diligent to our strategy, philosophy and process. At this point in the market cycle, managers must be focused and disciplined. The recent market decline has presented us with some very attractive valuations (d) for our FINTECH companies. As we look forward to 2019, we absolutely expect one constant: more volatility.

Footnotes:

((a)) The VIX, known as the market’s fear gauge, measures the volatility of option on the S&P 500

((b)) With just 2 months until the UK is supposed to leave the EU, Britain has numerous issues. Prime Minister Theresa May continues to suffer defeats over legislation. In addition, the Labour Party is getting ignored when it calls for fresh elections. Brexit is debated, but no consensus is found.

((c)) The World Bank defines those consuming less than $2/day as living in “poverty”

((d)) According to FactSet data, the 2019 P/E multiple is 14.2x, a level not seen since 2013 and the technology sector saw its forward P/E contract from 18.3x (back in September) to only 15.2x now

Disclaimer:

Firm: Manole Capital Management LLC is a registered investment adviser. The firm is defined to include all accounts managed by Manole Capital Management LLC. In general: This disclaimer applies to this document and the verbal or written comments of any person representing it. The information presented is available for client or potential client use only. This summary, which has been furnished on a confidential basis to the recipient, does not constitute an offer of any securities or investment advisory services, which may be made only by means of a private placement memorandum or similar materials which contain a description of material terms and risks. This summary is intended exclusively for the use of the person it has been delivered to by Warren Fisher and it is not to be reproduced or redistributed to any other person without the prior consent of Warren Fisher. Past Performance: Past performance generally is not, and should not be construed as, an indication of future results. The information provided should not be relied upon as the basis for making any investment decisions or for selecting The Firm. Past portfolio characteristics are not necessarily indicative of future portfolio characteristics and can be changed. Past strategy allocations are not necessarily indicative of future allocations. Strategy allocations are based on the capital used for the strategy mentioned. This document may contain forward-looking statements and projections that are based on current beliefs and assumptions and on information currently available. Risk of Loss: An investment involves a high degree of risk, including the possibility of a total loss thereof. Any investment or strategy managed by The Firm is speculative in nature and there can be no assurance that the investment objective(s) will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. Distribution: Manole Capital expressly prohibits any reproduction, in hard copy, electronic or any other form, or any re-distribution of this presentation to any third party without the prior written consent of Manole. This presentation is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use is contrary to local law or regulation. Additional information: Prospective investors are urged to carefully read the applicable memorandums in its entirety. All information is believed to be reasonable, but involve risks, uncertainties and assumptions and prospective investors may not put undue reliance on any of these statements. Information provided herein is presented as of December 2015 (unless otherwise noted) and is derived from sources Warren Fisher considers reliable, but it cannot guarantee its complete accuracy. Any information may be changed or updated without notice to the recipient. Tax, legal or accounting advice: This presentation is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any statements of the US federal tax consequences contained in this presentation were not intended to be used and cannot be used to avoid penalties under the US Internal Revenue Code or to promote, market or recommend to another party any tax related matters addressed herein.