Investment Strategy

I am a follower and proponent of an investment strategy that belongs to the broad category of strategies called dividend growth investing. Broadly speaking this means that I seek to own a portfolio of stocks that over time pay me an increasing amount of dividends.

My specific implementation of the dividend growth strategy is tied to my goal of replacing the income I currently receive from working with the dividends from my portfolio when I retire. I intend to generate this income without being required to sell shares, although I will sell shares in order to increase the one or more of the following: the dividends generated by the portfolio, the predicted rate of growth of the dividends generated by the portfolio, or the safety of the dividends generated by the portfolio.

A primary goal for the portfolio is to generate a stream of dividends that increases each year. Now, while I am still in the accumulation phase, I aim for 12% growth in income each year. Later, once I retire and am using the dividends to pay for my expenses, I will target growth that is in excess of inflation. To meet those goals, I invest in companies that pay a dividend, but have a variety of yields and dividend growth rates.

Investment Process

My investment process starts by looking at the company. I want to buy stock in a company that is a good investment partner, so first I must find good partners. There are lots of places to find companies that have the potential to be a good partner. I tend to use Seeking Alpha a lot, but you can also find good companies in other investment publications, on the news, or even in goods you use. I typically find that it’s a bigger problem filtering all the potentially good companies down to a manageable list of companies worth the time for further investigation.

To me, dividend growth investing is about cash flow. I want the companies I own to pay me a reliable amount of cash on a regular basis. I then manage that cash flow to achieve my goals. Right now that means growing the dividends received. Once I retire that will mean that I use some of that cash flow to pay my living expenses, and use some of it to grow my cash flow, so I can cover the increased cash I will need over time because of inflation.

Looking at what a company needs to be doing so that it can pay me (and other shareholders) an increasing amount of dividends, I have developed what I call my Four Keys. The Four Keys are a set of actions (and the metrics that measure them) that a company needs in order to support a growing stream of dividend payments. I analyze a company on these Four Keys in order, because each Key is supported by the previous keys. The Four Keys are: growing revenues or sales, growing earnings, profits or cash flow, managing debt well, and a well-supported and potential growing dividend.

The First Key is growing revenues or sales. There is a reason why this is called the top line. Revenues or sales (which depends on the business model) is the ultimate source of the dividend payments I want. Sure, not all of this cash will or could end up in shareholder’s pockets, but it is from here that the cash that does originate. So while a company can continue to raise the dividend even if sales or revenues are flat, eventually without more revenue, the dividend increases will end. And sure, even with more revenue a company might have less cash to pay dividends, but for the most part, all other things being equal, more revenue means an improved ability to pay dividends. So I want companies that have long term trends of increasing sales or revenues. This can come from increasing the number of customers, increasing the number of items or services a customer purchases, or increasing the amount customers pay for items or services.

The Second Key is increasing earnings, profits, or cash flow. I describe it this way because different metrics measure the ability of companies to pay dividends based on their business model. For a lot of companies, GAAP earnings are a good metric for measuring the ability to pay dividends. But that isn’t true for every company. The primary example of this is REITs, where large non-cash deductions for depreciation of real estate distort how much cash they really generate. In the long run growth in this Key is what will determine growth in the dividend. Sure, over short periods of time the dividend can grow faster than the cash generated by the business, but sooner or later that will have to stop. And yes, for short periods of time cash generated by the business can shrink while the dividend grows, but this too will end at some not too distant point.

The Third Key is managing debt well. Every company needs to manage debt and select the correct amounts and sources for that debt. Too little debt can mean that good opportunities are missed or perform poorly because of a lack of funding. Too much debt can mean interest payments eat up all the money that could have paid dividends. Too much debt can also mean that opportunities are missed because the funding isn’t available because the company can borrow no more cash to take advantage of them. Interest rate coverage and credit ratings are 2 things I look at when judging whether or not a company and its management are doing a good job managing its debt. I particularly like the Moody’s website, as it gives out its rationale for the ratings it gives to companies for free.

The Fourth Key is a well-supported dividend with the potential for growth. Dividends are the last key because if a company isn’t performing based on the first 3 keys, the dividend payment isn’t going to be sustained long term. Without a good performance as measured by the first 3 keys, the company will eventually run out of the cash to pay, much less increase, the dividend. But the first 3 keys are also not enough, because plenty of companies perform well on the first 3 keys and never pay a dividend at all. So paying a dividend, and management’s recognition that paying a dividend is important to shareholder is the final key to identifying a company that is a good investment partner for a dividend growth investor.

Approach to Valuation

There are a lot of different methods to put a valuation on a company. There are various ratios, Like P/E (Price to Earnings) and even some that offer black boxes, like Morningstar. For me, I use a valuation method based on my goals. I want dividends and dividend growth and want to pay a reasonable amount for the current dividend and the growth I see. As it turns out a method called the Gordon Growth Model or more generally the Dividend Growth Model does exactly that.

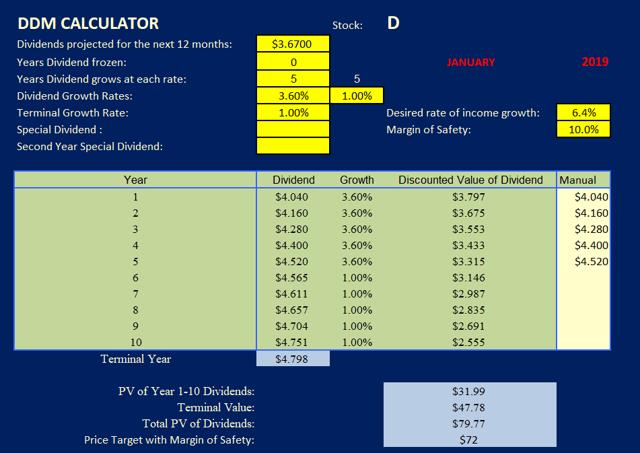

I have developed a calculator (in Excel®) that takes a set of parameters about the current dividend and expected dividend growth using DDM to determine an NPV (Net Present Value) of the predicted dividend stream.

Above is the output of the calculator I used in a recent article on Dominion Energy (D). The fields in yellow can be filled in when appropriate for making a projection. I have multiple fields that control the dividend, thus avoiding one of the issues with the Gordon Growth model (that is assumes only a single dividend growth rate). I can also set dividends manually for any of the first 10 years. I actually do that for Dominion, because management has made a commitment of 10% dividend growth to 2020 and analysts predict 3% growth after that. Using the manual field over-rides the dividend amount calculated using formulas. I have added features to the calculator to support predicting the dividend for companies I have covered. For instance, once I started covering Main Street (MAIN) I added fields to account for special dividends.

I have found that 6.4% as a discount rate or expected rate of return works well. First, since I want to have portfolio that grows its per share dividend by twice the rate of inflation (which gives me a nice cushion), and second because that discount rate strikes a balance between current dividend and dividend growth that has worked well for me. A higher discount rate or rate of income growth would give more weight to the current dividend payment and less weight to growth. While a lower discount rate would do the opposite.

Another tool I use is David Fish’s CCC List (which contains data on companies that have raised their dividend each year for 5 or more years). Originally created by David Fish (a long time SA contributor), since his passing it has been maintained by Justin Law.

Managing Portfolio Risk

One technique I use to limit portfolio risk is diversification. I own many different quality companies so that no one company cutting its dividend will have a large impact on the total dividends paid by the portfolio. This was of big help during 2015 and early 2016, when 4 companies I held cut their dividends. One company, Conoco Philips (COP), had enough issues that I was able to sell my shares well before the cut happened and put that money into other companies with safer dividends. However, in the case of the other 3 I was, for various reasons, caught by surprise and still held the shares when the dividend cut was announced. Even so, by owning some 40 companies, the cuts were more than offset by increases from other companies.

I also use position sizing to manage portfolio risk. This works hand in hand with diversification to limit the damage any one company can do to my dividend stream. For instance, one company I own is Ladder Capital (LADR). It is a commercial mortgage REIT. In the past I had some trouble with mortgage REITs, but Ladder was recommended by several folks I respected. So I bought some, but because of the risk that I saw I only purchased a small position. This allowed me to get the benefits of owning LADR while keeping the risk to my portfolio income small. As I continued to hold LADR and watched its performance my confidence that I understood its operations grew. That allowed me to increase the relative size of the portfolio as the risk declined.

I use my 4 keys to monitor the safety of the dividend. As my calculation of the dividend safety decreases I will trim or even eliminate a position. Take General Electric (GE) for instance, once I bought in, I carefully monitored its revenues, cash generation, debt levels and dividend payments. Between the deterioration in those metrics and the abrupt replacement of the CEO, I determined the dividend was in danger and sold before the share price decline more than a few cents below my buy price. I also sold Darden (DRI) when I felt its dividend was in danger. That took almost 18 months to actually happen, but I was still right that the dividend was in danger.

While price isn’t a significant factor in sell decisions, it does come into play indirectly. I do have limits on portfolio size (any but the safest of dividend growing companies are kept below 5% of the portfolio). So a big price increase can mean that I need to trim back the number of shares I own. When I do that, I try to buy stock that have a bigger yield, a faster growing dividend, a safer dividend, or some combination of more than one of those factors. Price declines, as long as the fundamentals don’t change, mostly don’t concern me and can at times represent an opportunity to buy more shares.

Portfolio Return Objectives

Because I am primarily an income investor, my goals are all income based. I need the portfolio I write about to generate $100,000 by the time I retire (at the end of the year I hit my full retirement age). My wife and I both enjoy our jobs and plan to work until we hit full retirement age. Since as a Realtor® and real estate broker my wife would pass up significant income if she stopped work at the end of June, we plan to continue to work till the end of the year.

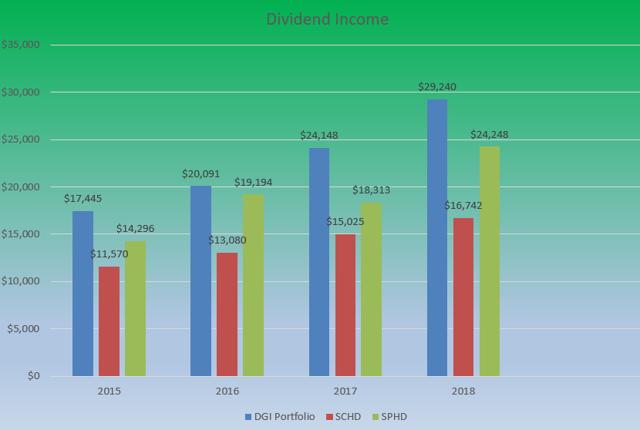

Given my eventual goal and the time remaining until I retire, that means I have to grow the income my portfolio produces by 12% each year from the previous year. Since I set up my Dividend Growth Portfolio in an IRA I have beaten that goal. For 2018, I increased my dividend income by more than 20%.

Figure 1 Source

About Me

I started investing in the stock market in 1988. The small company I was working for at the time made a big push to sign up the younger employees for their 401(k) plan. So I started with mutual funds. Early on my father and grandfather had taught me a lot about investing (Dad taught me things to do, my grandfather mostly taught me things not to do). Starting in 1998, using Sharebuilder.com I got into investing in ETFs and individual stocks. By 2009 I had discovered Seeking Alpha and dividend growth investing. In 2014, when switching jobs, I rolled several old 401(k) accounts into an IRA and my Dividend Growth Portfolio was born. I became a contributor to Seeking Alpha in October of 2016 which crystallized my investment thinking. I now cover many more stocks than I have the cash to invest in, but I approach each of them as though I would put my own money into them.

If you enjoyed this article and wish to receive updates on my latest research, click "Follow" next to my name at the top of this article.

Disclaimer: This article is intended to provide information to interested parties. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before purchasing any stocks mentioned or recommended. The price I call fair valued is not a prediction of future price but only the price at which I consider the stock to be of good value for its dividends.

At the end of last year, I joined the HDO team and now work with Rida Morwa.

About High Dividend Opportunities

We are the largest community of income investors and retirees with over 1600 members. We provide a comprehensive service, ranked #1, dedicated to high-yield securities trading at attractive valuations: Overall target yield of 9-10%. Subscription includes:

A managed portfolio of stocks currently yielding 10.3%. A "Dividend Tracker" to know exactly when to expect your next dividend. A "Portfolio Tracker" to track your holdings, income, and sector allocations. For video, click here.

If you are looking for the most profitable high-dividend ideas, you have come to the right place. For more info, please click Here.