On January 31, 2019, GE (NYSE:GE) announced its fourth quarter 2018 results and reported a revenue of $33.27 billion compared to $31.6 billion in 2017. Although this looks promising, there is more to this than meets the eye! When we look at the company 's core sector- Power, the business still continues to struggle. If there is one thing that GE needs to get right, it is strengthening its power business. After the latest financial results were announced, GE went up by almost 12% and closed above $10 for the very first time since November 2018.

GE’s Power business continues to struggle

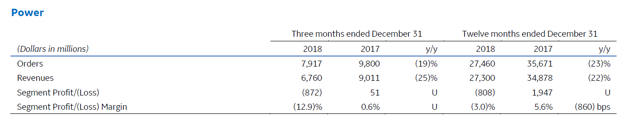

Image Source: GE Press release

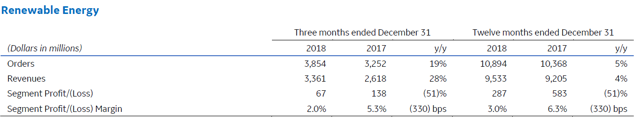

Image Source: GE Press release

It’s a known fact that growing demand for renewable energy is affecting GE Power’s core business of selling turbines to power plants. It then comes as little surprise that GE’s Power segment had another dismal year. With revenues of $27.3 billion in 2018, the power segment witnessed a massive drop of 22% when compared to 2017 and reported a loss of $808 million (refer the above table for more details).

In my opinion, GE needs to effectively tap the complete potential of South Asian markets like India where thermal power still represents more than 70% of the total installed capacity. In fact, GE power has been doing fairly well in India as it has recently secured some key orders from NTPC, which is India’s largest energy conglomerate. But, this is simply not enough for GE Power.

Because of its declining annual revenues and order intake, the overall annual outlook for GE’s Power business seems to be largely on the negative side. This is something that new investors must take note of.

Renewable energy business does well (as expected)

Image Source: GE Press release

With an order booking of 10.9 billion, GE’s Renewable energy business