HCP, Inc. (HCP) is a promising income play for dividend investors in the healthcare REIT sector, but only at the right price. The healthcare real estate investment trust faces favorable long-term industry trends, has a strong balance sheet, and covers its dividend with AFFO. That said, though, the REIT's shares do not make an attractive value proposition for long-term dividend investors based on today's stretched valuation. In addition, HCP is at the brink of being overbought, potentially exposing investors to a correction over the short term. An investment in HCP yields 4.7 percent.

HCP - Portfolio Overview

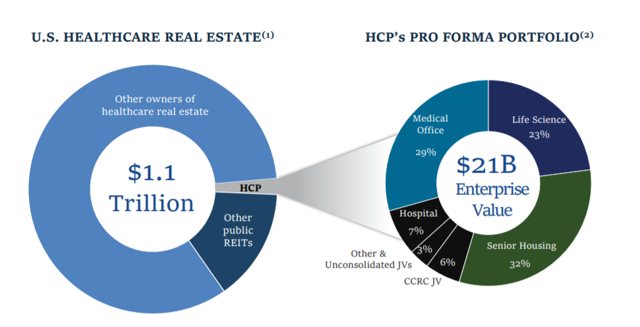

HCP is a healthcare real estate investment trust with large investments in senior housing properties, medical office buildings, life science buildings, hospitals, and other healthcare-related facilities. Senior housing and medical office buildings account for the lion share (61 percent) of HCP's property investments.

Here's a breakdown by property type.

Source: HCP Investor Presentation

Source: HCP Investor Presentation

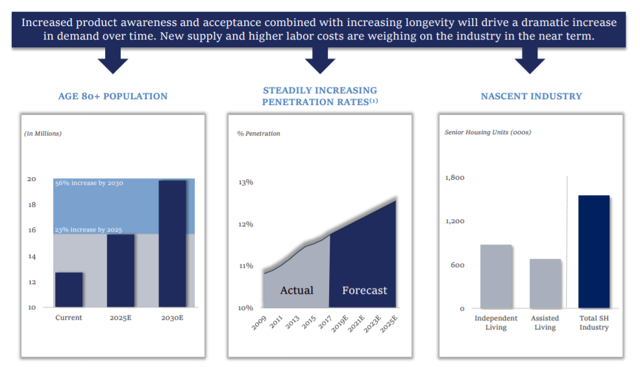

HCP benefits from an aging U.S. population and rising healthcare expenditures, especially as it relates to advanced age cohorts (80+). Strong projected growth in U.S. elderly demographics bodes well for HCP's senior housing part of the property portfolio going forward.

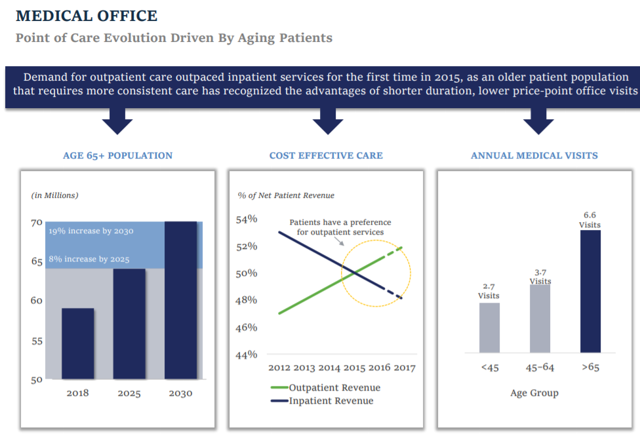

At the same time, HCP benefits from increasing demand for outpatient care. Patients require easy, cost-effective and efficient visits to healthcare professionals, which is why outpatient revenues (which are directly related to medical office buildings) have steadily risen over the last couple of years.

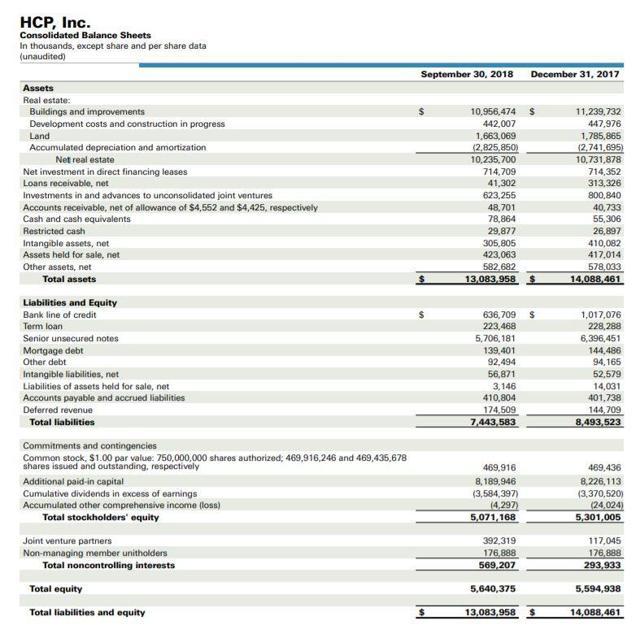

Balance Sheet Lends Some Downside Protection

HCP has an investment-grade rated balance sheet (BBB+ rating from Standard & Poor's, Baa2 rating from Moody's, and BBB rating from Fitch), which adds a layer of protection to the investment thesis in case the U.S. economy slides into a recession or the healthcare REIT industry heads for a downturn.

Source: HCP

Source: HCP

Solid Distribution Coverage

HCP