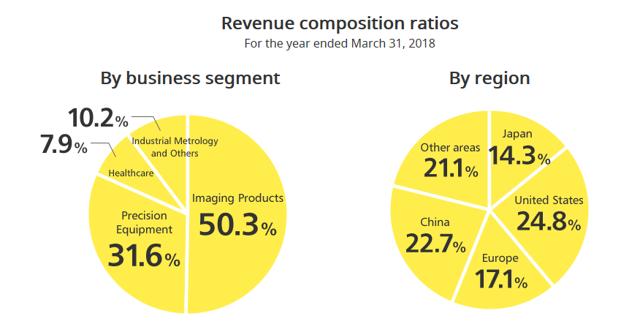

I reiterate my sell rating for Nikon (OTCPK:NINOY). I went long on Canon (CAJ) because it has a robust printing business. Nikon, sadly, is still overly-reliant on its Imaging Products (cameras, lenses, and accessories) business segment. The chart below explains why Nikon is very vulnerable to the waning camera business.

(Source: Nikon)

More than 50% of Nikon’s annual revenue still comes from its Imaging Products segment. In comparison, Canon’s Imaging system division only accounts for 25% of Canon's total annual revenue of 3,951.9 billion yen ($38.83 billion).

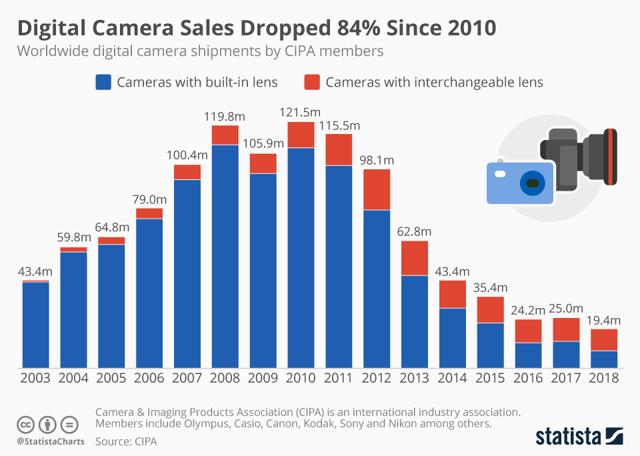

NINOY is really a sell based on the latest digital camera sales chart from Statista. Nikon’s over-exposure to digital cameras (and lenses) makes it unattractive to investors because last year’s global digital camera unit sales were only 19.4 million. This is a suicide drop from 2010’s sales volume of 121.5 million.

(Source: Statista)

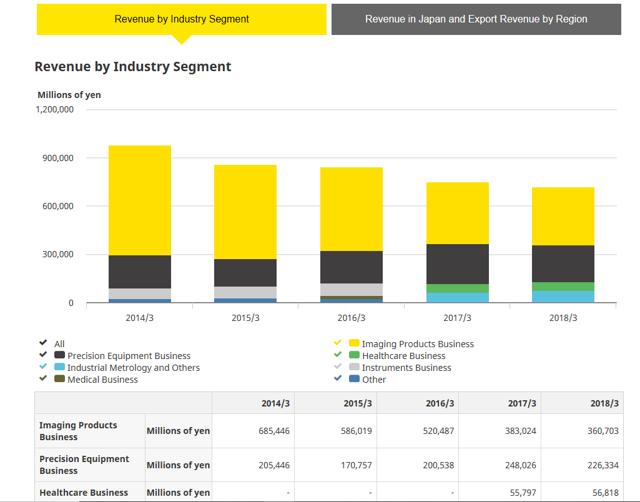

The continuing decline of the digital camera industry is why Nikon’s annual revenue notably dipped since 2014. Nikon’s Precision Equipment business is not growing fast enough to compensate for Imaging Products segment’s quick decline over the last five years.

(Source: Nikon)

Nikon is not a safe long-term investment because of its huge exposure to the declining digital camera industry. The reality is that other business segments of the Nikon Group are not growing fast enough to compensate for the decline in Nikon’s Imaging Products segment.

This scenario is why NINOY has a poor 1-year return performance of -17.76%. Investors are avoiding NINOY.

(Source: Seeking Alpha)

How Nikon Can Decelerate Imaging Products’ Decline

I like it that Nikon has released mirrorless cameras and lenses for them. It helps Nikon retain the loyalty of its most valuable customers – professional photographers. However, I insist that tardiness on the part of Nikon in addressing the threat from Chinese-made DSLR and mirrorless lenses can