From a pricing standpoint, many commodities remain pretty depressed since the complex in general bottomed back at the start of 2016. At present, we have some small positions in both gold and natural gas. We are eyeing up a long play in silver once the pending intermediate decline plays itself out in the precious metals complex.

Some subscribers though may feel a tad perplexed about how small our current weighting is in commodities in general in our portfolio. After all, a strong case could be made that many commodities at present look far more undervalued than high-flying US equities.

In saying this, a long play in silver (SLV), for example, over the past decade would have barely struck even from a return standpoint. In fact, any purchase after 2009 would actually be down money in this ETF at present. Precious metals investors who bought into the whole "perma-bear" commentary over the past decade are most probably in the red on their investments from either holding physical or being long an ETF like SLV.

Growing deficits and coming inflation have been the main arguments the perma-bears have used in recent times and gold-bugs and even bitcoin investors have bought into this premise in a big way. Could the doom's day scenario be true? Who knows, but with US equity markets once again approaching their all-time highs, equity investors may feel enticed to start re-balancing their portfolios towards the metals or bitcoin, especially if we see a sustained rally.

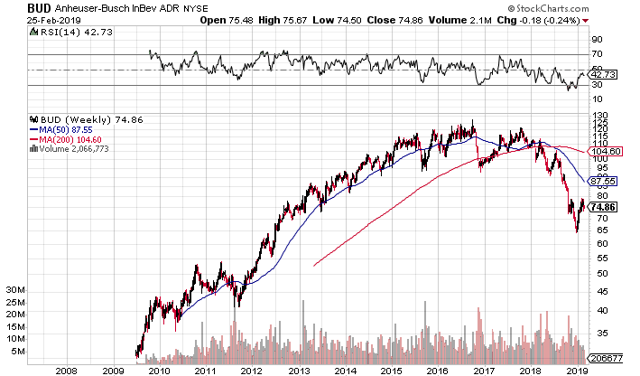

We advise against this though. Let's use Anheuser-Busch InBev SA/NV (BUD) as our stereotype as why we remain overweight equities. Our recent lot of shares actually got "called away" recently but the share price has come back down to an attractive level at present.