The InfraCap MLP ETF (NYSEARCA:AMZA) holds some of the top midstream companies in North America in its portfolio, three of which were analyzed in my previous coverage on AMZA.

In this article, we will go further in-depth on AMZA's holdings, particularly as it pertains to Plains All American Pipeline (PAA) and Enterprise Products (EPD) since they are still some of the larger holdings of the fund. Next time, we will dig into AMZA's smaller holdings, so stay tuned for that.

PAA and EPD are helping to alleviate takeaway issues in North America for E&Ps, and both have numerous projects to drive future earnings and sustain dividend payouts. As a result, I continue to believe in PAA and EPD and am staying long AMZA for the added diversification and leverage that the fund provides.

AMZA Description

As I mentioned above, AMZA owns some of the top midstream companies in the world and seeks to:

Provide a high level of current income, a growing income stream, and long-term capital appreciation. The fund is an actively managed portfolio of high-quality, midstream energy master limited partnerships (MLPS) and related general partners, utilizing options strategies and modest leverage.

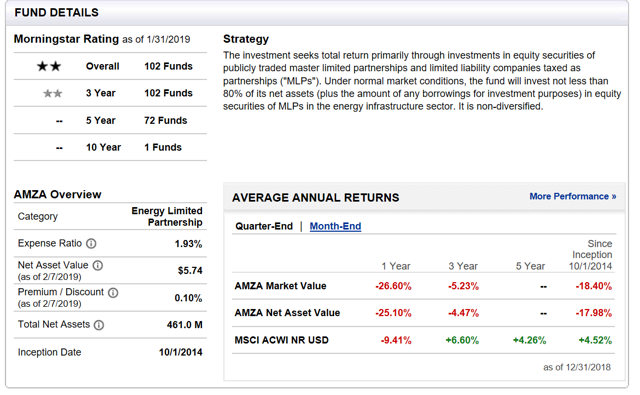

Source: E*TRADE

The fund also has an expense ratio of 1.93%, which is considered higher than average. However, the dividend is still one of the largest in the sector, so a larger expense ratio is not unusual here. Plus, I expect capital gains from stock appreciation in AMZA to offset its expense ratio over time.

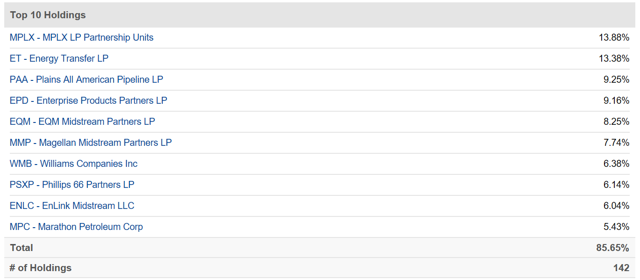

Here are the fund's top holdings:

Source: Seeking Alpha

As investors can see, the top 5 holdings of AMZA represent more than half of the fund. We already did a breakdown of the AMZA's top three holdings, which are EQT Midstream (EQM), MPLX LP (MPLX), and Energy Transfer LP (