HCP, Inc. (HCP) is an attractive income vehicle for dividend investors, but only if the price and risk/reward are attractive. HCP benefits from an aging U.S. population and rising healthcare expenditures, and has a strong portfolio and moderately attractive dividend coverage stats. That being said, though, the valuation is stretched, which exposes new investors to downside risks. Investors may want to wait for a drop before gobbling up some shares for a high-yield income portfolio.

HCP - Portfolio Overview

HCP is a dominant player in the U.S. healthcare industry. The company has large investments in senior housing properties, medical office buildings, and life science facilities. At the end of the December quarter, the healthcare REIT's real estate portfolio was comprised of 744 properties (including joint venture facilities).

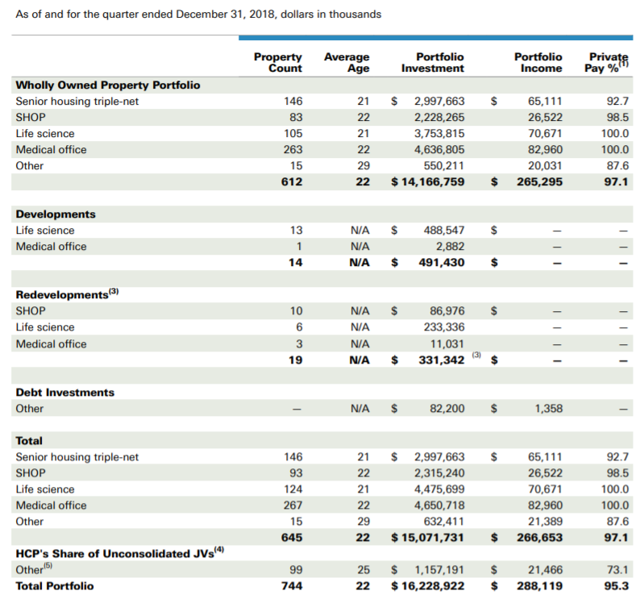

Here's a portfolio snapshot by asset type:

Source: Q4-2018 Earnings Supplement

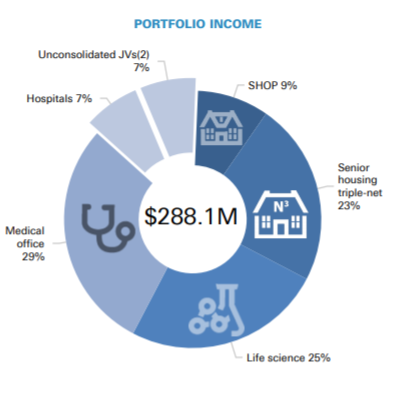

Medical office buildings represented 29 percent of the REIT's portfolio income in the fourth quarter, followed by life science buildings (25 percent), and senior-housing facilities (23 percent). HCP produces ~$288 million a year in portfolio income from its mix of senior-focused healthcare facilities.

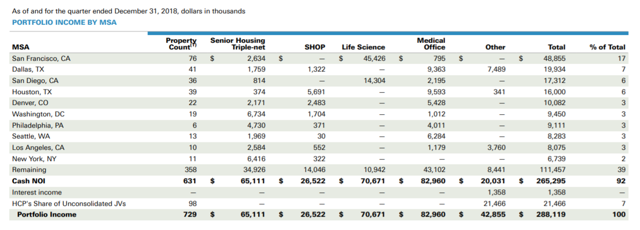

Here is a more detailed breakdown of the REIT's property portfolio:

Source: HCP

HCP's properties are spread out across the United States, but are nonetheless concentrated in major urban areas. San Francisco and Dallas are the two most important cities for HCP, consolidating 17 percent and 7 percent, respectively, of the REIT's real estate investments.

Source: HCP

Two major trends generally support the investment thesis in HCP:

1. The U.S. population is aging at a rapid clip. Elderly demographics (65+ age cohorts) are going to make up a larger share of the U.S. population going forward.

2. Patients are demanding more cost-efficient outpatient procedures than in the past.

HCP benefits from these long-term trends in the healthcare