We are issuing an initial equity report of iQIYI (NASDAQ:IQ) with a Buy recommendation and price target of $30, implying 25% upside from the current ~$24/share level. Because of superior content creation ability, we expect IQ to continue its rapid growth in subscription number and advertisement revenue, we see IQ’s bottom line improving substantially with operating leverage.

Company Highlights: Content Creation focus

IQ is a Chinese online video platform launched by Baidu in 2010. It is currently one of the largest online video sites in the world, with nearly 6 billion hours spent on its service each month, and over 500 million monthly active users. The company issued its IPO in the U.S. on 3/29/18 and raised $2.25B.

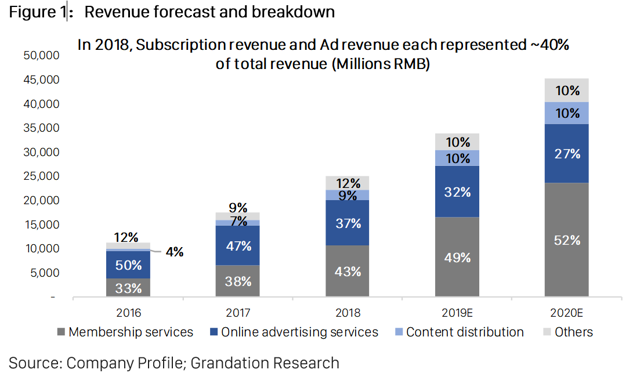

IQ has three main revenue streams. First is subscription fee which provides users rights to view the newest exclusive contents, and newer blockbusters. Paying users can also skip the pre-content ads. Second is the advertising fee. For the non-paying audience, a 90-second advertisement would be played before any content. IQ also integrates product placement and corner ads within its videos. Third is content distribution fee, which IQ gets from licensing its original content.

Among China’s video streaming big 3 (IQ, Tencent Video (OTCPK:TCEHY) and Youku (BABA)), we think IQ has been focused on creating original content the most.

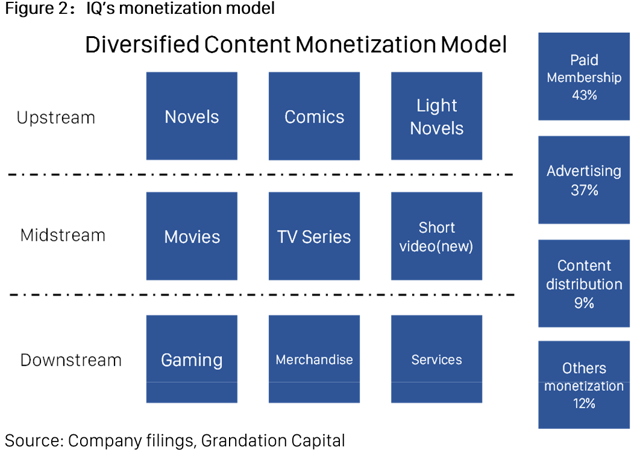

IQ has a comprehensive ecosystem, with eight integrated business lines complementing each other. IQ has been deriving video content from the "upstream" IP industry chain, such as novels, comics, and light novels, and then maximizing the commercial value of IP through the "downstream" of gaming, goods, and services. IQ has also developed nine major IP monetization methods, including advertising, paid membership, publishing, distribution, and derivative business licensing, to maximize its IP value.