By Jeff Weniger, CFA

There is a chance that, come this autumn, many fund managers will have zero exposure to the eighth-largest country in the MSCI Emerging Markets Index. It's one thing to avoid a country because of a bearish thesis; it's quite another to be caught flat-footed when a "frontier" market gets upgraded to "emerging."

While our industry has been focused on the inclusion of mainland-listed Chinese A-shares in the MSCI EM Index, there are two frontier markets that MSCI is graduating to emerging market status this year that have been scarcely mentioned.

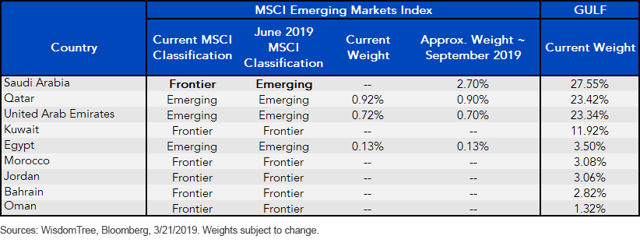

Consider this nugget from the Financial Times in March: a country that I'll keep under my hat for a few paragraphs will this year be included and comprise about 2.7% of the MSCI EM.1 For comparison, others with similar weights are Mexico (2.7%), Thailand (2.3%), Indonesia (2.2%) and Malaysia (2.2%).

Now digest this, and I mean really digest this bit from the same article:

Emerging market funds have an average exposure of just 0.08 per cent to the country's stocks, according to analysis of 180 funds with $350bn of assets by Copley Fund Research, and more than 90 per cent have no exposure at all.

Hold the phone. MSCI announced this last summer, not yesterday. FTSE Russell and Standard & Poor's are following suit. Everyone knows the index providers are the big gorillas. What, pray tell, have those 180 managers been doing all day?

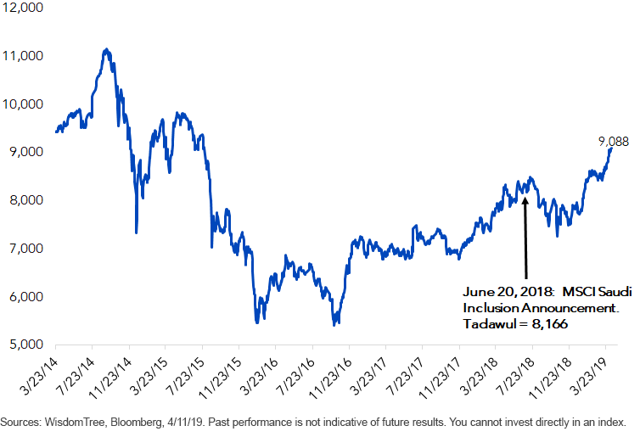

The mystery country is Saudi Arabia (the other graduate is Argentina). Only now is the Tadawul All Share Index of Saudi stocks breaking out. June's MSCI index inclusion won't be wished away.

Figure 1: Tadawul All Share Index

Here's a way in which WisdomTree is unique: we have a pure play ETF for the Middle East. GULF, the WisdomTree Middle East Dividend Fund, has been around for over a decade. It has been our top performer over the last year, and readers of last spring's GULF: The Global Power Chess Game's Critical Piece, know my positive structural thesis for the region. Saudi Arabia is currently GULF's largest component nation, at approximately 28%. June inclusion, complete by September. The procrastinators need to get busy if they want to avoid awkward diligence meetings.

Figure 2: Weights Comparison

1Steve Johnson and Simeon Kerr, "Landmark for Saudi Stocks as Index Providers Become Kingmakers," Financial Times, 3/21/19, https://www.ft.com/content/69f5a8ec-4a3a-11e9-bbc9-6917dce3dc62.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. This Fund focuses its investments in the Middle East, thereby increasing the impact of events and developments associated with the region which can adversely affect performance. Investments in emerging, offshore or frontier markets such as the Middle East are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. As this Fund has a high concentration in some sectors, the Fund can be adversely affected by changes in those sectors. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund's prospectus for specific details regarding the Fund's risk profile.

Jeff Weniger, CFA

Director, Asset Allocation

Jeff Weniger, CFA serves as Director, Asset Allocation at WisdomTree. Jeff has a background in fundamental, economic and behavioral analysis for strategic and tactical asset allocation. Prior to joining WisdomTree, he was Director, Senior Strategist with BMO from 2006 to 2017, serving on the Asset Allocation Committee and co-managing the firm’s ETF model portfolios. Jeff has a B.S. in Finance from the University of Florida and an MBA from Notre Dame. He is a CFA charter holder and an active member of the CFA Society of Chicago and the CFA Institute since 2006. He has appeared in various financial publications such as Barron’s and the Wall Street Journal and makes regular appearances on Canada’s Business News Network (BNN) and Wharton Business Radio.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.