In my last article I showed how the risk in buying CBL (NYSE:CBL) common stock gets a lot smaller if the dividends are paid consistently for a few more years.

One of the only things that threatens those dividends is the debt covenants. The new credit facility announced in January as well as all of the bonds are covered by the same covenants.

Breaching those could make all of CBL's debts payable immediately and cause management and the common shareholders to lose control.

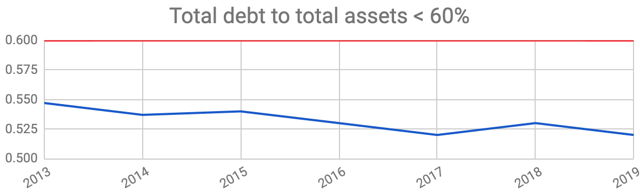

Is this likely to happen in the next few years? I've put together a historical view of how the debt metrics have changed so we can see this.

It includes data from 10-K filings going back to 2013 (prior to this there were different covenants applied based on the old credit facility) and up to Q1 2019.

According to CBL's investor relations, these metrics reported for the latest quarter include pro-forma adjustments for major changes such as disposing of a mall or paying off a loan, but may not fully account for further losses in income throughout the year.

Covenant Coverage

(Source: CBL 10-K filings, author's chart)

The first covenant shows how CBL has managed to consistently deleverage their balance sheet, and still stands in a good position. There may be some asset disposals later this year that affect this covenant, but there is also scheduled debt amortization that will continue to bring it down.

This is already at a healthy level and continuing the trend for another 5 years should see it improve more.

The total assets are the gross book value, not counting depreciation. Although the 52% debt level may sound close to the limit, CBL would have to lose around $900m in assets to hit the limit. This seems to be at a very safe level.