The S&P 500 is the benchmark US index for investors to compare their returns and track the market's fluctuations. Moreover, the S&P 500 and total market options that largely track it have become popular core investment options. There are many available options for investors seeking S&P 500 exposure, with nearly identical holdings and associated portfolio risk profiles, but other significant differences exist between the available options. This is an overview of the attributes of the main ETF options for direct S&P 500 as well as a review of their shared current market risk profile.

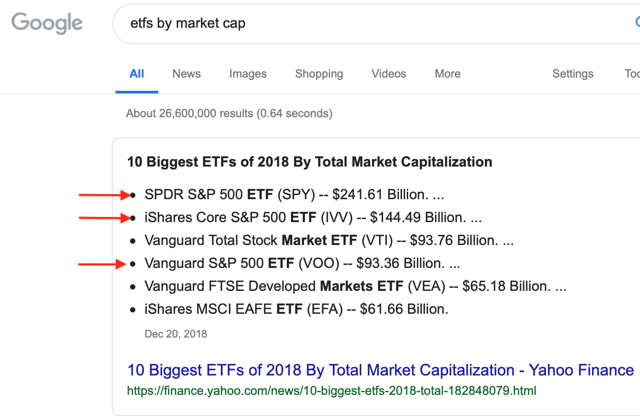

There are numerous ways to invest in the S&P 500 through ETFs, and even more through mutual funds, but the largest and most popular ETF options for individual investors are the SPDR S&P 500 ETF (SPY), the iShares Core S&P 500 ETF (IVV), and the Vanguard S&P 500 ETF (VOO). These ETFs are not merely the largest and most popular S&P 500 ETFs, but three of the four largest ETFs by assets under management.

Each of these options clearly resonates with a significant investor group, and the concept of general S&P 500 investing is a dominant theme for ETF investors. So, which of these three is right for you? The answer depends upon various factors, but primarily whether you are making a long-term investment or a short-term trade, and your brokerage's possible commission-free trading rules.

SPDR S&P 500 ETF

SPY is not just the largest S&P 500 ETF, but the largest ETF of any type. SPY also has the richest options market among the S&P 500 ETFs and the largest average trading volume (it and EEM are the highest volume ETFs). Of the three S&P 500 ETFs being discussed here, it has the highest fees. Despite being a low fee ETF, SPY's 0.0945% gross expense ratio is over double to triple that of the