For the Canadian cannabis companies, the biggest regret is not making an early move into the U.S. markets. For this reason, Canopy Growth Corp. (NASDAQ:CGC) has desperately attempted to position the company for a future in the world's largest cannabis market. The latest FDA news could be another blow to their attempt to enter the U.S. market and a prime reason why the stock dipped below $40.

Image Source: Canopy Growth website

U.S. Entry

Canopy Growth already has a large and vibrant business in Canada, so the company doesn't need U.S operations to be amongst the leaders in the North American cannabis sector. The company does, however, need the U.S cannabis market to justify its market-leading $14 billion market valuation.

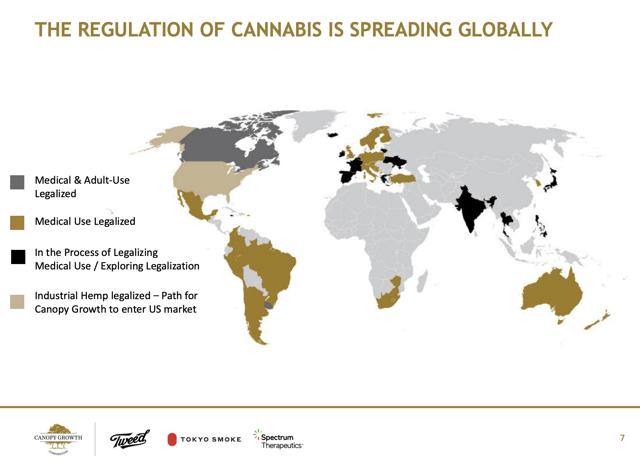

This handy slide from Canopy Growth acknowledges that very little outside of medical legalization has occurred outside of Canada and certain states in the U.S. The company has rapidly expanded globally, but the market really isn't ready outside of limited medical use.

Source: Canopy Growth presentation

The recent introduction of Spectrum Therapeutics provided a lot of hype surrounding global medical cannabis, but the company has limited revenues outside Canada. Spectrum was introduced as the commercial medical arm of Canopy Growth operating in 12 countries, but amazingly, the company failed to release any financial specifics surrounding such a large global endeavor.

Canopy Growth has recently focused expansion on the U.S. market. The company can't enter anything related to adult use due to federal restrictions that would jeopardize its stock listing on major exchanges. For this reason, it entered into a right to purchase Acreage Holdings (ACRGF) and invested in a hemp industrial park in New York to produce hemp-derived CBD.

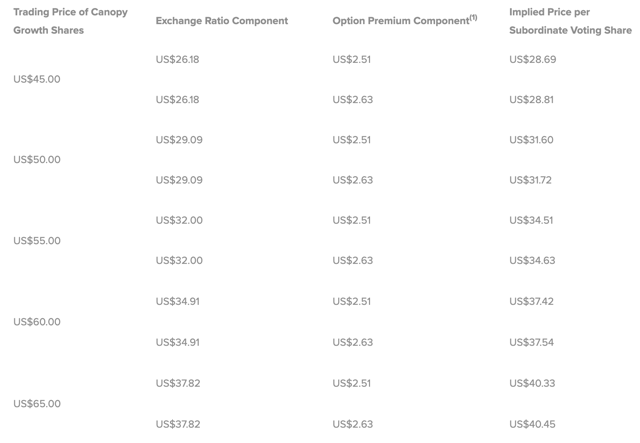

Both options to enter the U.S. face major roadblocks. The Acreage Holdings deal apparently has ~91% shareholder support, but the market isn't that convinced the deal gets done with the stock trading at $18, while the deal has an implied value of close to $26.

Source: Canopy Growth press release

Noteworthy is that Canopy Growth fails to include the actual trading price of the stock at $40 in the implied price guide for shareholders - another sign that management teams in the cannabis sector fail to have a rational expectation that stocks can go up and down when $65 is listed but the current price and downside to $35 and even $30 is not.

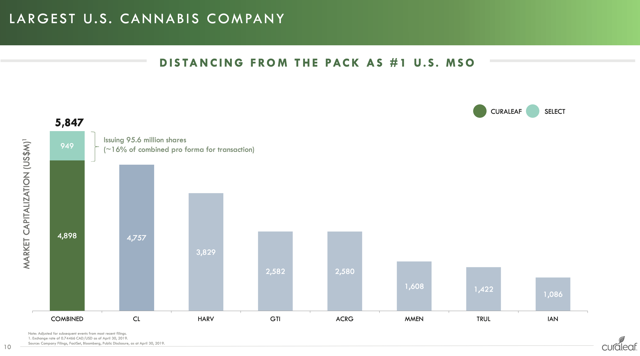

Despite arguments that the deal will accelerate Acreage Holdings' move into a market leadership position, the company is actually falling far behind the other multi-state operators (MSOs) in the U.S. The other domestic leaders have all expanded via aggressive deals to leave Acreage in the rearview mirror as the company focused on the Canopy Growth transaction.

Source: Curaleaf May presentation

Though this chart from Curaleaf (OTCPK:CURLF) represents stock prices as of April 30, the majority of the listed stocks have seen valuations depressed in the general 25% range. In addition, Acreage Holdings recently reported a far smaller revenue base and pro forma revenues when including pending mergers in comparison to Curaleaf, Harvest Health & Recreation (HRVSF) and Cresco Labs (OTCQX:CRLBF):

- Acreage - Q1 actual = $12.9 million, Q1 pro forma = $33.1 million

- Curaleaf - Q1 actual = $35.3 million, Q1 pro forma = $75.1 million

- Harvest Health - Q1 actual = $19.2 million, Q1 pro forma = $51.0 million

- Cresco Labs - Q1 actual = $21.1 million, Q1 pro forma = $33.9 million

So, even with the federal waiver of laws that will permit general cultivation, distribution and possession of marijuana being a triggering event to allow the closure of the merger, Canopy Growth would still be far behind some of its competitors. Acreage is likely to face even more competitive threats, as nimble U.S. management teams from Curaleaf, Harvest, Cresco Labs and other MSOs aren't restricted by a corporate overhang from another country.

CBD Headaches

The other U.S. headache involves a quick move to invest in hemp-derived CBD production in the U.S., while the FDA might implement regulations that stall growth in the CBD market. At a public hearing last week, new FDA commissioner Ned Sharpless made these damaging statements (via CNBC) regarding CBD product approvals:

There are real risks associated with [THC and CBD] and critical questions remain about the safety of their widespread use in foods and dietary supplements, as well as other consumer products - including cosmetics, which are subject to a separate regulatory framework.

Previously, the federal government deemed both cannabis plants to be controlled substances despite the general perception that hemp wasn't an addictive substance. The 2018 Farm Bill removed hemp and derivatives like CBD from the controlled substance list, as long as products containing them didn’t have more than 0.3 percent THC. The law preserved the FDA’s authority to regulate cannabis compounds.

The commissioner went on to make it clear that CBD in regulated products like food and beverages could be problematic without further research on the subject.

When hemp was removed as a controlled substance, this lack of research, and therefore evidence, to support CBD’s broader use in FDA-regulated products, including in foods and dietary supplements, has resulted in unique complexities for its regulation, including many unanswered questions related to its safety

The NY Times has an enlightening summary of the hearing with lots of questions about the safety of CBD. At the very least, the industry is likely headed to substantially more regulation regarding dosing levels. At the worst, the FDA could clamp down on CBD sales for years, while studying the benefits and side effects of CBD-infused products.

For its part, Canopy Growth has already decided to invest up to $150 million in a hemp industrial park in New York. As well, the company bought This Works for its CBD-infused products sold in Europe with an intent of making the brand a global beauty and wellness product line for countries like the U.S.

Source: Canopy Growth presentation

The FDA appeared generally set to look the other way until this public hearing unless future research provided evidence that CBD causes health problems outside of false claims. Of course, the problem is shared by all in the industry, but it is a further reminder that Canopy Growth faces major problems entering the U.S. market.

Former commissioner Dr. Scott Gottlieb probably provided the largest warning shot back in April on the free-for-all CBD market that currently exists:

I don’t think that CBD is doing anything approximating what people are purporting is its magic quality. It’s a real safety issue here. There are risks of accumulated effects. It’s not a completely benign compound.

Takeaway

The key investor takeaway is that Canopy Growth still faces a major problem entering the U.S. cannabis market. The company's major push into the U.S. MSO space is falling far behind competitors with a focus on the Canopy Growth transaction, and the CBD-focused plans face potential major roadblocks.

The issue for Canopy Growth is that the stock needs an entry into the largest global market to justify the $14 billion valuation. CEO Bruce Linton predicted revenues to reach C$1 billion in the next 12 months, which isn't enough to justify the current stock price. Any hiccups in the company's entry to the U.S market, whether via CBD products or the purchase of Acreage Holdings, would leave the stock further behind the revenue surge needed to maintain the current price, much less rally from here for shareholders.