Introduction

We first wrote about Meet Group (MEET) in August 2016, stating our belief that the company's ad business (at the time 90%+ of revenues) was likely to implode due to company's highly suspect content. Our forecast appears to have played out. While it is hard to pinpoint the extent of the decline in MEET advertising revenues since our story due to the company's aggressive M&A binge, we note that in 3Q17 (one year after our story), MEET disclosed that mobile CPMs at MeetMe and Skout were down more than 40% year over year in a conference call. The stock remains ~40% below levels prior to our first story and advertising revenues continue to rapidly decline - 1Q19 advertising revenue was down almost 40% y/y.

Source: NJ.gov - boxed apps are owned/controlled by MEET

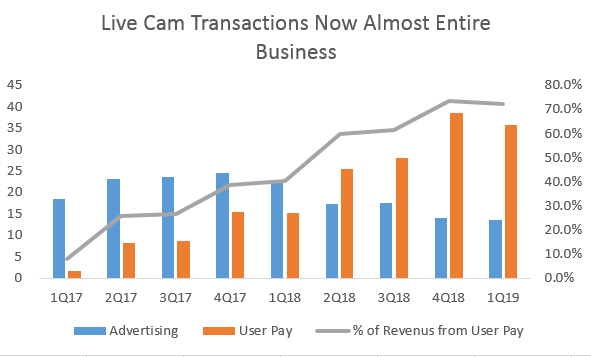

Despite this, MEET has continued to see strong top-line growth. How have overall revenues at MEET continued to climb despite the advertising business falling off a cliff over the past few years (see below)?

Source: Our analysis of public filings

Simple…since our first report, MEET materially restructured its business model and entered the "live stream" business, which, for the unacquainted, involves MEET monetizing user purchases of virtual currencies that are used to "tip" MEET performers who provide live video shows. Essentially, MEET operates and monetizes a marketplace for live cam streams. Today, MEET generates ~75% of total company revenues from the user pay segment, though growth largely driven by "virtual gifts associated with MEET's live video product" (p7).

Here is a quick primer on the "live video" business. MeetMe users can opt into live stream themselves over a webcam (henceforth "Cam Person"). The Cam Person just needs to download the MeetMe app and hit the live stream button which immediately broadcasts a "selfie" live video feed that is available to all MeetMe users via