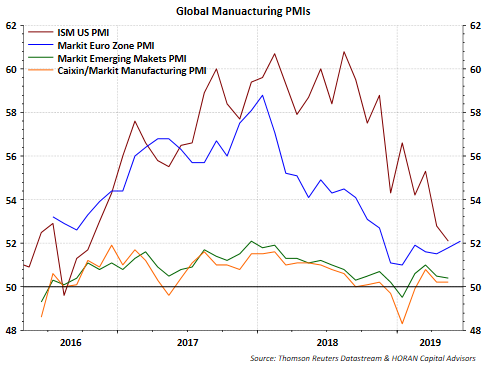

No one variable provides the key to the future direction of the economy or market. However, one economic data point that tends to get a lot of attention is the Purchasing Managers' Index for both manufacturing and non-manufacturing parts of the economy. In fact, in an article I wrote earlier this week, I highlighted the optimism being expressed by manufacturers and small businesses. Many of my articles get republished on Seeking Alpha, as did this one. One reader comment to the article stated I must not be "paying much attention to the manufacturing PMIs, which are showing a severe turn to pessimism." PMIs are important variables we do review; however, we believe many misinterpret the meaning behind the PMIs.

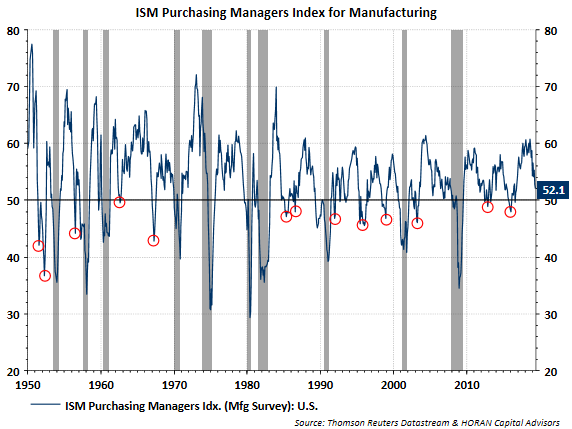

A key misinterpretation revolves around contracting manufacturing versus a recession-level PMI reading. PMI readings below 50 do indicate manufacturing is generally contracting, but it does not mean with certainty that the economy is headed for a recession. According to the Institute for Supply Management that reports PMI data, they note:

- "A reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally contracting."

As it relates to economic expansions though, ISM states:

- "PMI® above 42.9 percent, over a period of time, generally indicates an expansion of the overall economy [emphasis added]. Therefore, the May PMI® indicates growth for the 121st consecutive month in the overall economy and the 33rd straight month of growth in the manufacturing sector. 'The past relationship between the PMI® and the overall economy indicates that the PMI® for May (52.1 percent) corresponds to a 2.7-percent increase in real gross domestic product (GDP) on an annualized basis,' says Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey CommitteFiore."

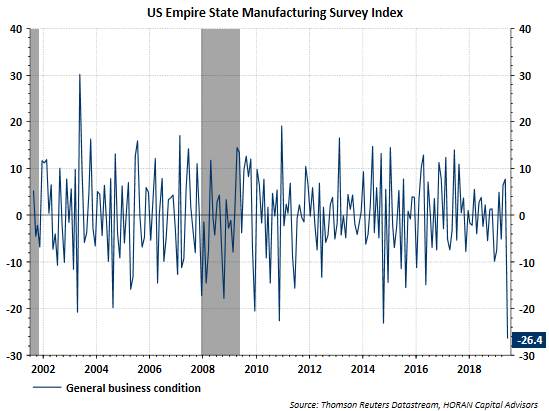

Thursday's Philadelphia Fed business Outlook Survey missed expectations at .3 versus consensus of 11.0. Econoday noted though:

"Yet outside of the headline which is not a composite but a general sentiment reading based on a single question, details in today's report are less alarming. New orders did slow but not very much and remain respectable and solid at 8.3. And unfilled orders are building nicely so far this month, at 10.2 for a more than 8 point gain which is very strong for this reading. Shipments continue to move out the door at 16.6 and hiring remains solid at 9.4."

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.