Assets are the lifeblood of the economy. They enable us to store, transfer, and create wealth. Historically, investors have put most of their wealth into traditional financial assets such as stocks, bonds and cash.

I have never been a fan of this approach because:

(1) Stocks are generally risky and efficiently priced.

(2) Bonds provide mediocre returns.

(3) Cash does not protect against inflation.

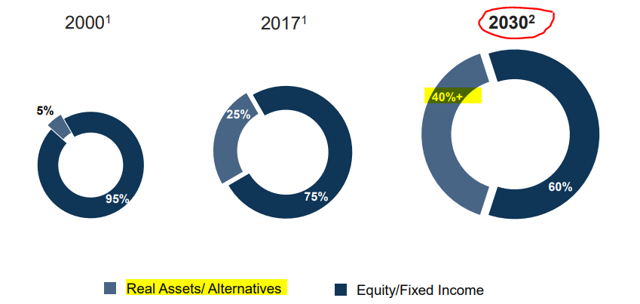

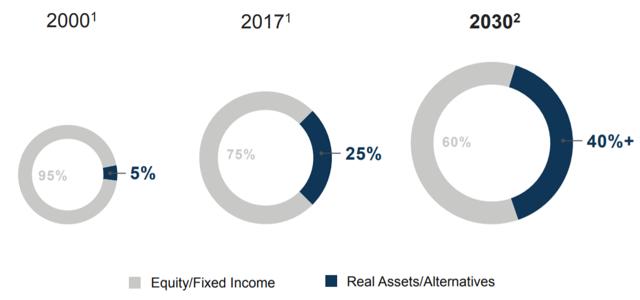

With these drawbacks in mind, it's rather surprising to learn that still in year 2000 – about 95% of portfolios were allocated to traditional financial assets. It's only over the past 20 years that the investment community started to wake up to other alternatives including “real assets” to boost returns and diversify portfolios.

What are Real Assets?

Real assets are value-generating physical assets that a business and/or investor owns. These include:

- Real estate

- Energy pipelines

- Timberland

- Farmland

- Airports

- Railroads

- Windmills

- Solar farms

- Goldmines

- Ships

- And many other…

Real assets are similar to traditional stock and bond investments in that their valuations are generally tied to their cash flow generation potential. However, the key difference is that a real asset also has intrinsic value in and of itself and does not rely on monetization and/or exchange in order to provide value for its owner.

Why Is This Relevant to Your Investment Strategy?

The current investment environment favors real asset investments and institutions are taking note.

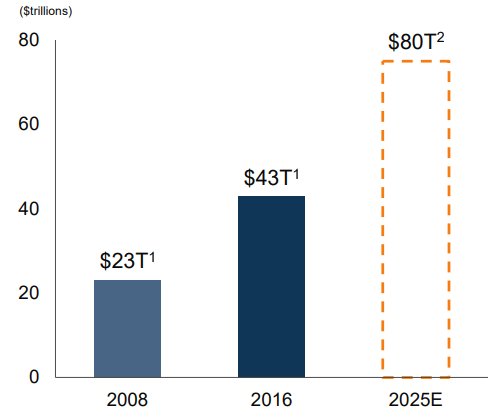

In less than 10 years, institutional capital in this space has grown by $20 trillion and another ~$40 trillion is expected in the decade ahead.

Allocations to real assets were only 5% in 2000. Today, it's closer to 25%. And in 10 years, this figure is expected to exceed 40%:

At High Yield Landlord, we are ahead of the crowd with the majority of our Core Portfolio already invested in high cash flowing real assets. My personal net worth is also allocated at over 50% into real assets.

What are the reasons behind this rush to real assets?

Below we discuss the five key reasons why professional investors are rushing into real assets and how you can mimic these strategies with publicly traded alternatives.

Reason #1 – Stock valuations are high... Interest rates are low…

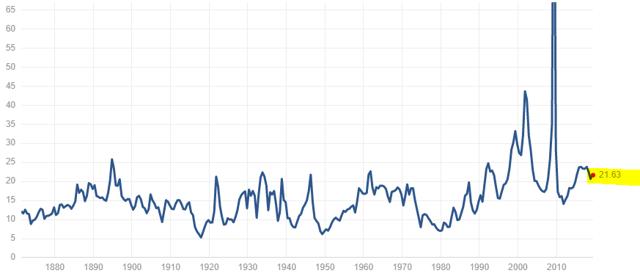

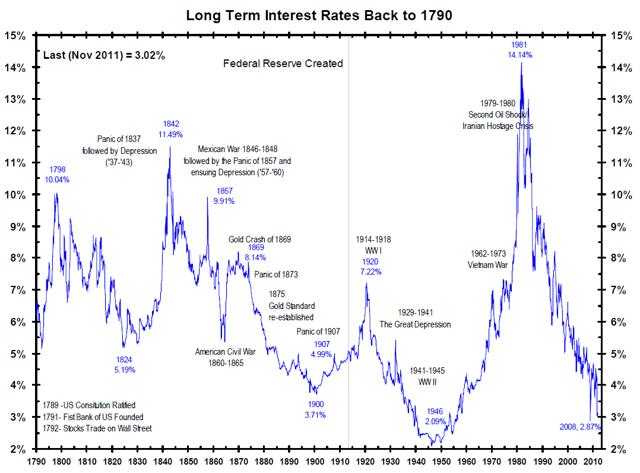

Historically when the goal was to earn high income, investors would turn to bonds (LQD, VCLT, IEF). While this may have worked well in the past and allowed investors to earn a satisfying yield, today's environment is much less favorable to bond investors. After a multi decade-long decline in interest rates, the yields are today at historically low levels:

The same applies more or less to broader market equities. Historically when the goal was to earn high returns, investors would turn to stocks. But with elevated valuations in a late cycle economy, the future rewards are expected to be quite mediocre on a risk-adjusted basis.

Reason #2 - Higher Total Returns

Over the past 30 years, the Yale Endowment Fund returned an unparalleled 13% per year.

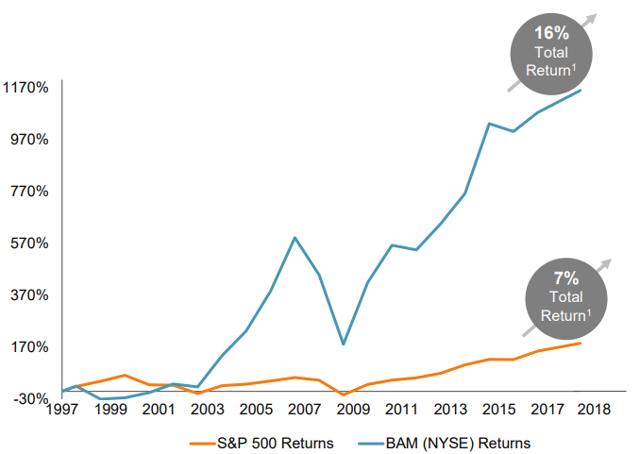

Similarly, Brookfield (BAM) earned a 16% annual return over the same time frame – compared to just 7% for the S&P 500 (SPY):

How you asked? They were early to recognize the value of “real asset” investments such as real estate, infrastructure, natural resources, and other alternatives.

Real assets generate high income, but they also appreciate in value and grow cash flow. A well-located office tower may yield 6% and grow in value by 3% per year. Add to that a bit of leverage and you can reasonably expect double-digit total returns even in 2019.

Reason #3 – Greater Income

The 10-year treasury may yield only 2%, but real assets will often trade at yields in the 6%-10% range – and can be leveraged to generate even greater cash-on-cash returns.

This income can then be used to reinvest, live or save. With higher income coming in, investors are also less dependent on stock market appreciation which is much more uncertain.

Reason #4 – Diversification and Inflation Protection

Traditional assets (stocks and bonds) are highly volatile and adding real assets to a portfolio has proven to lower volatility. As such, investors can profit from diversification benefits while boosting total returns and income.

Real assets also have different risk exposures and can serve as good hedges against certain risk factors that are important to traditional assets. As an example, when you invest in low yielding bonds, you are at big risk of accelerating inflation. Real assets, on the other hand, are well-protected as their income and values tend to grow along with inflation.

Reason #5 - Profit from the Rush to Real Asset

You can profit from the rush to real assets. Institutional capital is expected to nearly double by 2025. Some investments will benefit from this capital shift, while others will suffer from it. And it does not take a genius to realize that with more money chasing real assets than ever before, valuations are likely to be pushed higher and higher.

Twenty years ago, we were buying office building at 8% cap rates. Today, these same properties commonly change hands at 6-7% cap rates due to increased investor appetite. And in another 20 years, it is very possible that similar offices trade at 5-6% cap rates – leading to further appreciation to today’s investors.

In certain parts of Europe, the demand for real assets is so high that cap rates have already dropped below 3%. The US market still has a long way to go.

How can Individual Investors Profit from Real Assets?

OK, so real assets should be a vital part of your portfolio. How is the average do-it-yourself retirement investor supposed to put this into practice to profit from the rush to real assets?

Fortunately, you do not need to be a multi-billion-dollar institution to invest in real assets. At High Yield Landlord, we specialize in liquid alternatives to gain exposure to high yielding real assets. Here are five examples in which we are investing today:

- (1) Commercial Real Estate: There exists over 200 REITs today with each investing in different property sectors. A few popular examples include Realty Income (O), Simon Property Group (SPG) and STAG Industrial (STAG).

- (2) Airports and Railroads: Today, there exists many listed airport companies in which you can invest by simply buying their shares. Examples include Grupo Aeroportuario del Pacifico (PAC), Auckland International Airport (OTCPK:AUKNY), and Sydney Airport Ltd. (OTC:SYDDF).

- (3) Timberland and Farmland: You can invest in both asset classes with listed partnerships and REITs such as Farmland Partners (FPI) and Weyerhaeuser (WY) among many others.

- (4) Energy pipelines: Investors can get exposure to high yielding energy pipelines through the purchase of MLP units. Popular examples include Energy Transfer (ET) and Magellan Midstream Partners (MMP).

- (5) Windmills: Similarly, investors can invest in renewable energy assets through listed partnerships such as Brookfield Renewable Partners (BEP) and specialty REITs such as Hannon Armstrong (HASI).

Closing Thoughts on Our Real Asset Strategy

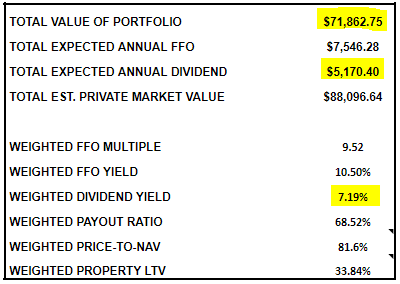

REITs and MLPs – along with several other real asset backed financial asset investments – are all high yielding assets that allow us to generate over $5,000 in annual passive income from a small $70,000 Real Asset Portfolio.

Source: High Yield Landlord Real Money Portfolio

Compared to traditional equities, our real asset portfolio also enjoys much more reasonable valuation metrics trading at:

- 9.5x cash flow on average.

- 18% discount to estimated NAV.

- 7.2% dividend yield (with safe 68% payout ratio).

With interest rates expected to remain lower for longer, and stocks trading at all-time highs, we believe that these attractive attributes will continue to attract more and more capital toward real assets. This will result in bidding up of prices, compressing yields, higher valuations, and strong total returns to investors who position themselves early enough.

Still, 20 years ago, most investors would ignore these assets. Today, they are becoming one of the biggest components of institutions’ portfolios:

Are you Positioned to Profit from the Rush to Real Assets by Yield-starved Investors?

At High Yield Landlord, we have positioned our portfolio to thrive in today’s rapidly evolving environment. We are the #1 Ranked Service for Real Asset Investors on Seeking Alpha with over 600 members on board.

We spend 1000s of hours and well over $20,000 per year researching the Real Asset market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Join us Before the Price Hike!

SIGN UP HERE FOR 2-WEEK FREE TRIAL